Are academic independent directors punished more severely when they engage in violations?☆

Yi Quan,Sihai Li

School of Accounting,Zhongnan University of Economics and Law,China

Are academic independent directors punished more severely when they engage in violations?☆

Yi Quan*,Sihai Li

School of Accounting,Zhongnan University of Economics and Law,China

A R TiClE I NfO

Article history:

Received 29 September 2015

Accepted 14 October 2016

Available online 30 November 2016

Academic independent directors

We use a sample of Chinese A-share listed companies from 2003 to 2013 to explore the reputation damage and over flow effect of academic independent directors who have received supervisory punishment.We find that when companies violate information disclosure rules,the market punishes academic independent directors more severely than nonacademic independent directors for these violations.Furthermore,companies employing punished academic directors face greater declines in their stock price than companies employing punished nonacademic independent directors during a relatively short window before or after the punishment is announced.The punishment of academic independent directors in fluences the employment of other scholars in the same field and results in a negative over flow effect.This study provides evidence of the market’s differential reactions to independent directors with different backgrounds;the findings re flect the double-edged sword of one individual’s reputation on organizations.

?2016 Sun Yat-sen University.Production and hosting by Elsevier B.V.This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

1.Introduction

Independent directors play an important role in modern corporate governance,helping balance power within firms and providing supervision.In China,43.51%of independent directors are scholars from universities,party schools,research institutes or other public institutions.Mastery of professional knowledge and concern for their reputation are two important ways in which academic independent directors differ fromother independent directors.With respect to professional background,86.93%of academic independent directors are professors and 2.52%of them are members of either the Chinese Academy of Sciences or the Chinese Academy of Engineering.Generally,there is a tradition of respecting teachers and valuing education in China. Because of their broad recognition as intellectuals,academic independent directors have a positive social image and wide acceptance.When prominent scholars become involved in management,development is promoted and decision making is facilitated.They are also important invisible assets for corporations.That is, when these famous inde1Quoted from‘Professors have become main power of independent directors,while reputation is a double-edged sword”(In Chinese) http://news.ifeng.com/gundong/detail_2011_05/05/6171735_0.shtml?_from_ralated.pendent directors serve as image spokespersons for corporations,investors trust these listed companies more. As a consequence,academic independent directors will care more than nonacademic independent directors about the possible negative effects on their careers of any negative behavior.

One important way in which an academic independent director’s reputation may be damaged is when they receive supervisory punishment due to their companies’misconduct.Some reports suggest that between 2003 and 2013,458 independent directors were punished by the China Securities Regulatory Commission(CSRC) or stock exchanges because of violations of information disclosure rules;36.03%of these were academics.Xin et al.(2013) find that the number of academic directorships declined after these directors were punished.The decline in numbers is perhaps not symbolic of reputation punishment;it may simply be a consequence of risk aversion.Studies show that during the relatively short window after a punishment is announced,the stock prices of other companies that the independent directors who are being punished had worked for do not fall sharply.When the market punishes independent directors,academic independent directors may be treated differently because of their high reputation and the market’s greater expectations.Such differences may occur in several ways;for example,the market may react more negatively,the stock price of other companies that employ academic directors may fall more sharply,or the punishment of academic directors may generate overflow effects to other scholars at the same universities.

Our analysis of a sample of Chinese A-share listed companies from 2003 to 2013 has two important conclusions.(1)The market punishes academic independent directors more severely for their violations.Specif ically,when companies violate information disclosure rules and independent directors are punished by the China Securities Regulatory Commission or stock exchanges for failing to fulfill their executive duties,the market often reacts more negatively to those companies which have academic independent directors.Furthermore,companies that employ punished academic directors face greater declines in their stock price than companies that employ punished nonacademic independent directors,during a relatively short window just before or after the punishment is announced.(2)To some extent,the punishment of academic independent directors influences the employment of other scholars in the same field and results in a negative overflow effect.These conclusions are practically significant for both participants in the capital market and for corporate management.This research helps capital market participants identify companies with severe reputation punishment so that they can adjust their portfolios and properly reduce investment losses.With this knowledge,management can both enjoy the benefit of employing well-known scholars as independent directors and avoid the possible negative effects of these directors’improper behavior.

This study makes the following contributions.First,the existing research on independent directors’backgrounds focuses on resource support.For example,independent directors with commercial bank backgrounds may dramatically increase the total debt of a company(Booth and Deli,1999;Burak et al.,2008;Liu et al., 2012),whereas independent directors with investment bank backgrounds help companies issue more bonds (Burak et al.,2008).Independent directors with academic backgrounds promote the entrance and absorption of external knowledge spillover(Audretsch and Lehmann,2006).However,few studies have explored the‘reputation punishment”associated with independent directors with different backgrounds.Therefore,we explore the concept of reputation punishment and the overflow effect on academic independent directors caused by information disclosure violations by academic independent directors.Our aim was to deepen the knowledge of the economic consequences of hiring independent directors with different backgrounds.Second, previous studies suggest that the extent of the market’s reaction to corporate violations is significantly related to the type of violation(Wu and Gao,2002)and to the transparency and severity of the punishment(Hu andChen,2004).Extending these findings,we find that the extent of the market’s reaction to corporate violations also depends on whether academic independent directors are simultaneously punished.The result reflects the‘double-edged effect”of an individual reputation on organizations.Whereas scholarly independent directors increase a corporation’s public credibility,any improper behavior by these scholars may result in severe consequences for their employers.Our research provides new evidence for the variability of market reaction to corporate violations.Finally,our research enriches the related literature on corporate violations.The existing literature focuses on violations by companies or management.Our study considers the different backgrounds of punished independent directors and explores the overflow effect of their punishments.

The remainder of this paper is organized as follows.Section 2 develops the hypotheses based on the theoretical analysis,Section 3 presents the research design,Section 4 reports the empirical analysis and Section 5 concludes the paper.

2.Theoretical analysis and hypothesis development

To improve the corporate governmental structure and promote the standardized operation of companies, the CSRC published Guidelines for the Establishment of Independent Directors of Listed Companies(hereafter,Guidelines)on 16 August 2001.The Guidelines state that every listed company in China should modify its articles of incorporation according to the Guidelines and employ appropriate personnel as independent directors.In China,the main incentive for independent directors to perform their supervisory duties is to avoid legal and reputation risks.Existing academic research on the backgrounds of independent directors has focused on the so-called resource support.It is believed that independent directors provide important resource support,enabling successful corporate governance(Pfeffer,1972;Zahra and Pearce,1989;Pfeffer and Salancik,2003).Many scholars have demonstrated that independent directors with different backgrounds contribute different resources to their employers.For example,independent directors with management backgrounds may provide low-cost financing resources(Johnson et al.,1996);outside directors with backgrounds in politics may help companies lobby for policy changes,enhancing the ability to gain related profits (Agrawal and Knoeber,2001);independent directors with commercial bank backgrounds could obviously increase the total debt of their companies(Booth and Deli,1999;Burak et al.,2008;Liu et al.,2012);independent directors with academic backgrounds help companies gain and absorb external knowledge,thereby sharpening their competitive edge(Audretsch and Lehmann,2006);the financial expert background of audit committee members can improve the quality of financial reports(DeFond et al.,2005;Krishnan and Visvanathan,2008;Dhaliwal et al.,2010,etc.);directors with legal backgrounds play important roles in supervising management,lowering litigation risks and increasing corporation valuation(Litov et al.,2013); and the inclusion of investment bankers in a board results in the company issuing more bonds(Burak et al.,2008).Outside directors use their abundant commercial experience to help managers solve operational problems;they provide new techniques and market knowledge and participate in the construction of important strategies(Weisbach,1988).

The existing literature rarely discusses the variations in reputation punishment that the market imposes on independent directors from different backgrounds,when these directors have been punished for corporate violations.Although Wu and Gao(2002),Hu and Chen(2004)and some other scholars have tested the different reactions of the market to violations,they limit their research to corporations.Xin et al.(2013),focusing on the independent directors themselves,demonstrate that independent directors suffer supervisory punishment if they provide false statements.They find that after punishment,the number of directorships held by these independent directors declines sharply,but the stock price of other companies in which these directors have held a post does not fall sharply in a relatively short window before or after the punishment announcement.The premise of their research is that the market will impose the same reputation punishment on all of the independent directors who are given supervisory punishment.However,it is possible that the market may be less willing to tolerate negative behavior and will impose stricter punishment on groups for whom they have higher expectations.

Theoretically,the supervisory effect of independent directors is a joint function of their ability to execute their duties and their willingness to do so.Executive ability is dependent on their professional knowledge and energy,whereas willingness depends on the independence of independent directors and the maintenanceof their reputation.In our dataset,86.93%of academic independent directors have the rank of professor,and 2.52%are members of the Chinese Academy of Sciences or the Chinese Academy of Engineering.Academic independent directors are not only experts,and they also constitute a group with strong professional in fluence in their fields.The government consults some of these scholars directly on policy issues,and they in fluence important policy changes.The academic work schedule,with its flexible hours,gives university educators more freedom to arrange their time,compared with the fixed 9–5 h worked in government and public institutions. This freedom and flexibility help academic independent directors put more energy into their directorships. Furthermore,Jiang and Murphy(2007)believe that compared with other independent directors,academic independent directors are less likely to have relationships with corporate insiders and more likely to share their own thoughts and judgments because of their higher reputation.This guarantees independence to some extent. However,when1scholars agree to be independent directors,it seems that they mortgage their reputation to their employer. If the company encounters severe problems with the law or in its operations,the social reputation of the independent director will also be severely damaged(Ye et al.,2011).In China,mottos such as‘A teacher is to transfer knowledge and solve puzzles,”‘Teach by example”and‘Be a model of virtue for others”embody the social expectations for educators.Traditionally,therefore,Chinese scholars care about maintaining their reputation.

According to the above analysis,due to both their executive ability and willingness,academic independent directors may be better at executing their duties than nonacademic directors.At the same time,when an academic independent director is punished for failing in his executive duty for his employer,the violation behavior of the company may be more stealthy.However,when additional negative information is publicized,the stock price will fall more sharply.Thus,the market will react more negatively to companies with academic independent directors who have been punished.Furthermore,university educators are recognized as a group with moral integrity and cultural value in Chinese society.University educators,who exert a major social in fluence and who are held to high standards by society,are sought after as high-level personnel.As society has higher expectations about the behavior of this group,academic independent directors may confront stronger market punishment when they commit supervisory violations.The punishment may be imposed upon not only the companies in which the violation occurred,but also other companies in which the director has held a post,leading to the over flow effect.Based on this analysis,we propose two hypotheses.

H1.When companies violate rules and their independent directors are punished because of failures in executive duties,the market will react more negatively to those companies with academic independent directors.

H2.The stock prices of listed companies with academic independent directors will fall more sharply than the stock prices of companies with nonacademic independent directors during a relatively short window before or after a punishment is announced.

3.Research design

3.1.Sample selection and data sources

The sample for H1 is Chinese A-share listed companies with recorded information disclosure violations leading to punishment of independent directors by the CSRC or stock exchanges in the 2003–2013 period. The sample for H2 is Chinese A-share listed companies that did not commit any violations,but in which the punished independent directors held posts in the 2003–2013 period.Independent directors’personal information was collected manually.Other data were collected from the GTA CSMAR database,with some manual supplementation.From the initial sample,we excluded(1)financial and insurance firms and(2) observations with missing variables.Our final sample included 112 firm-year observations of companies with independent directors who were punished by a regulatory authority and 103 firm-year observations of other companies in which the punished independent directors held posts.To avoid the effects of extreme values,all of the continuous variables were winsorized at both the top and bottom 1%levels.

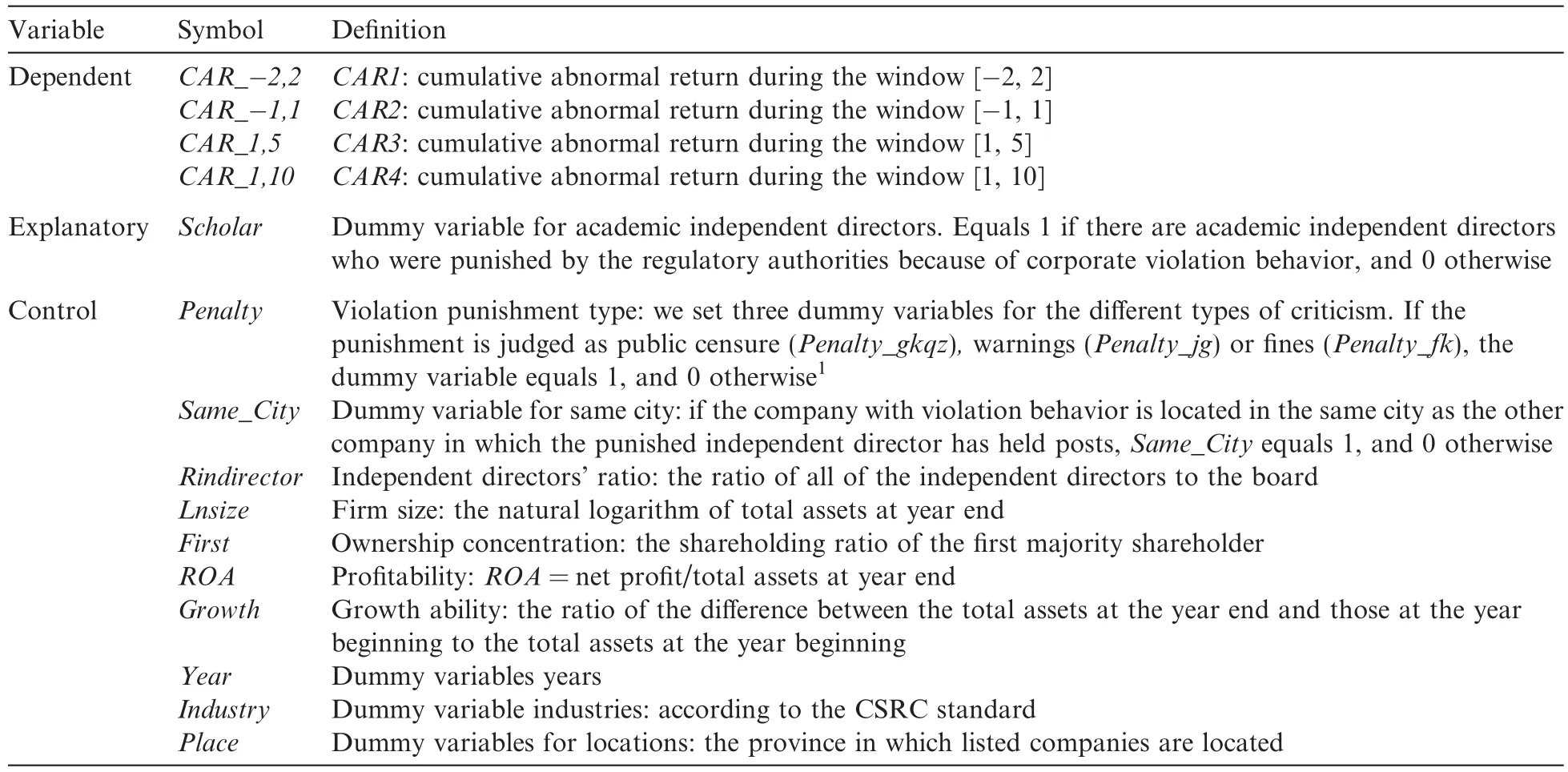

Table 1 Definitions of variables.

3.2.Model specification and variable definitions

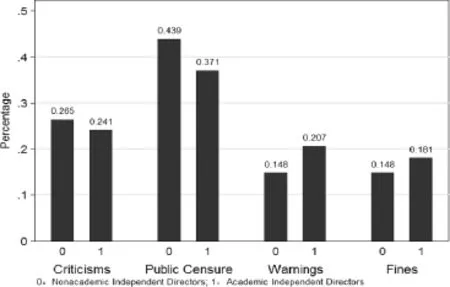

We use model(1)to test H1.If H1 is supported,thenb1in model(1)should be significantly negative.

We use model(2)to test H2.If H2 is supported,b1in model(2)should be significantly negative.

The dependent variable isCARin both models.In this study,we stipulate the punishment announcement as the Event Date and consider[-251,-11]as the Estimation Period.Then we use the market model to estimate the abnormal return(AR)in a single day and the cumulative abnormal return(CAR)of every window period.Scholaris a dummy variable for academic independent directors(1 if there are academic independent directors punished by regulatory authorities because of corporate violations,and 0 otherwise).Following previous studies,we addPenalty,Same_City,Rindirector,Lnsize,First,Return on Assets,Growth,Year,IndustryandPlaceas control variables.Table 1 summarizes our variables.

4.Empirical results and analysis

4.1.Descriptive statistics of the sample

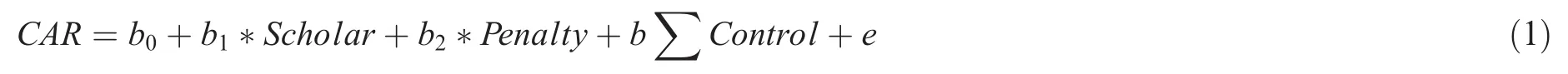

Panel A of Table 2 presents the annual distribution of the sample.One hundred and twelve listed companies in the sample have information disclosure violations leading to the punishment of 299 independent directors.2Practically,during the period of 2003 and 2013,there were 165 listed companies with information disclosure violations,and 458 independent directors suffered punishment because of these violations.Because 53 companies’CARs could not be calculated due to delisting,long-term suspension or missing data,we finally used 112 companies with violation behavior in our regression.One hundred and fifteen of the punished directors are academic independent directors,comprising 38.46%of all of the punished directors,whereas 43.51%of the independent directors in our sample are academics.One hundred and eighty-four of the punished independent directors are not academic,comprising 61.54%of all of the punished independent directors.Panel B reports the types of punishment carried out by year.We find that public censure is the most common type of punishment,carried out in 36.13%of the cases.Most often,warnings and fines are used simultaneously.During the sample period,the fines for the independent directors are between RMB 30,000 and 50,000.About 93.62%of the independent directors(44 directors)are fined RMB 30,000.

Table 2 Annual distribution of sample and types of punishment.

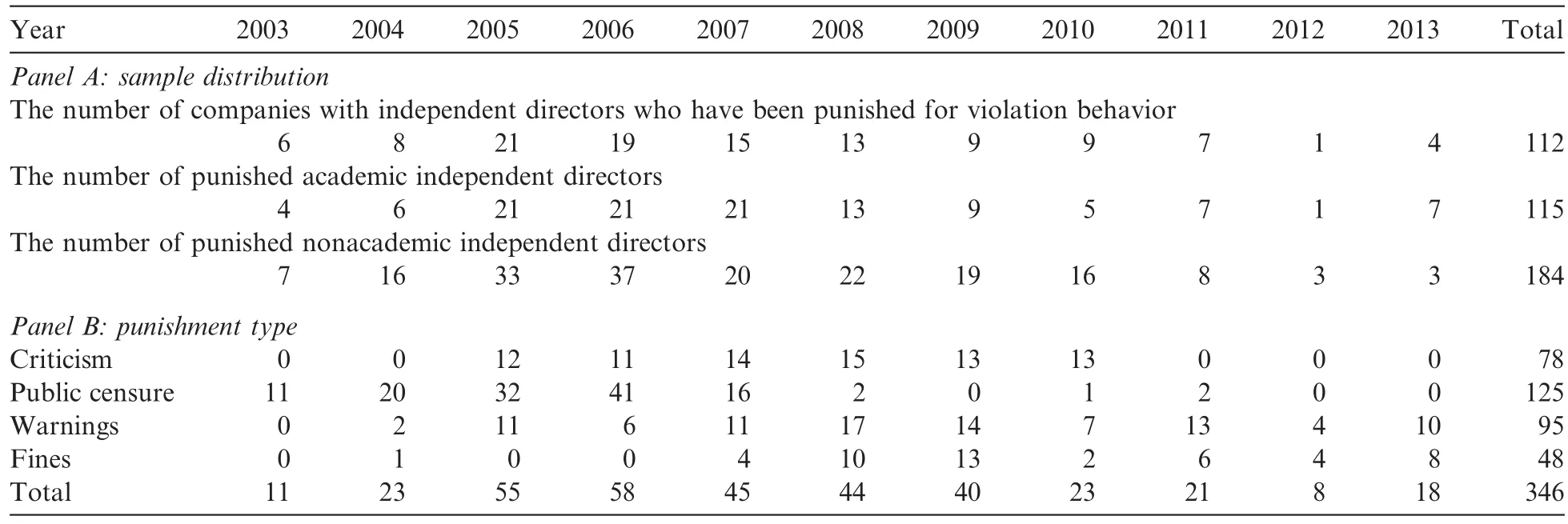

Fig.1 presents the sample distribution of the types of punishment by category(academic independent directors versus nonacademic independent directors).The most common punishment for both categories is public censure.However,the proportion of academic independent directors who are criticized or publicly censured is slightly lower than that of nonacademic independent directors,whereas the proportion of academic directors who receive warnings or fines is slightly higher than that of nonacademic directors.In terms of the severity of punishment,academic independent directors face more severe punishment than nonacademic independent directors.According to the earlier analysis,due to their executive ability and willingness,academic independent directors are usually better at executing their duties than nonacademic independent directors.3We establish that the percentage of academic independent directors committing violations is lower than that of nonacademic independent directors by comparing the proportion of academic independent directors to that of those who commit violations.Correspondingly,when academic independent directors are punished by regulatory authorities because of failures in their duties,the actual violations may be more stealthy and severe.However,with respect to severity of punishment,there is no statistically significant difference between the punishments for academic independent directors and nonacademic independent directors(mean test results:t=1.379,p=0.177;median test results:z=1.368,p=0.174).Wu and Gao(2002)and Hu and Chen(2004)report that market reactions to corporate violations are significantly correlated with the type of violation,transparency of punishment and severity of punishment.To avoid having the type of violation and severity of punishment skew the results,we control for the severity of punishment of independent directors in our multiple regression.

4.2.Descriptive statistics of variables

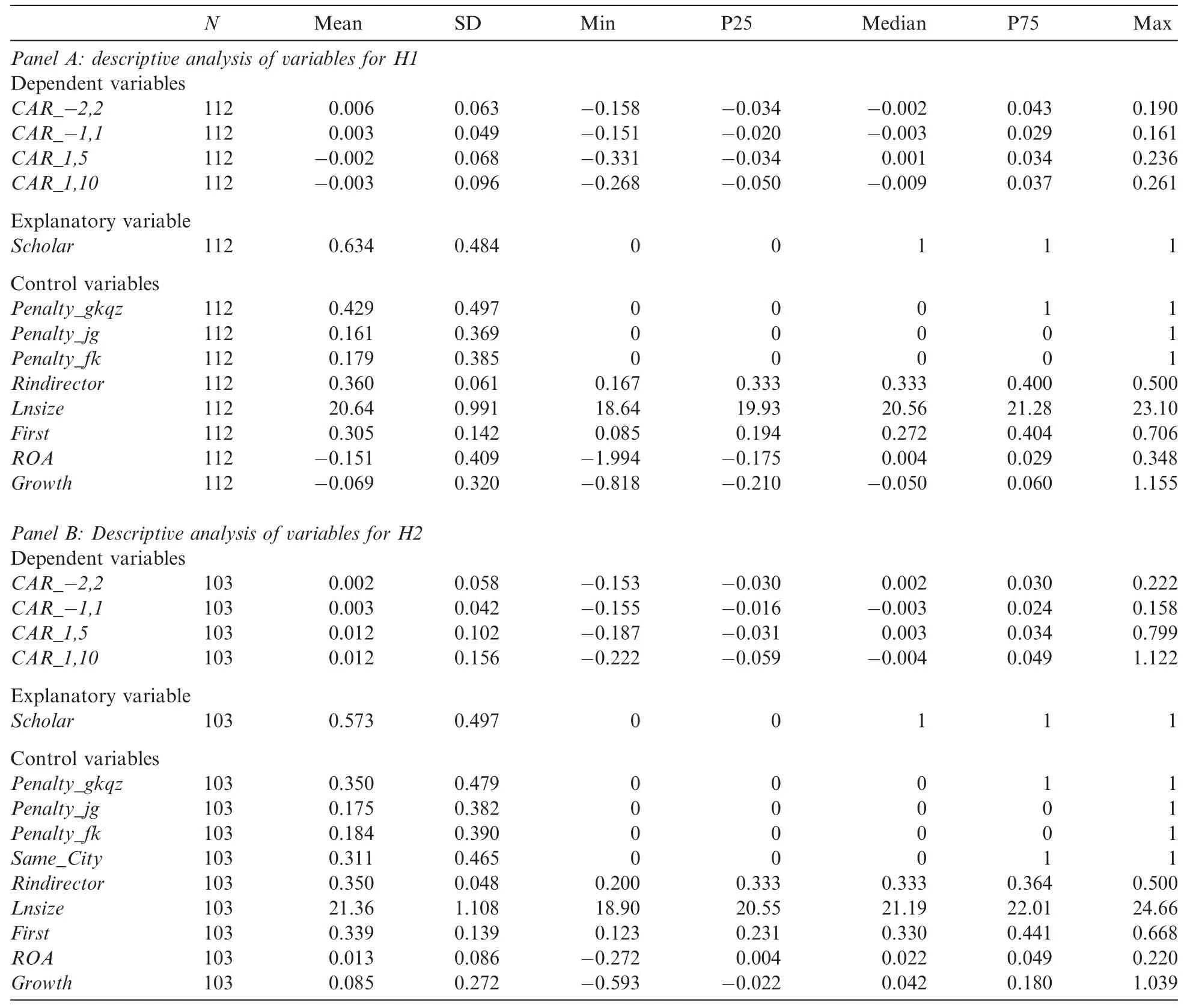

Panels A and B of Table 3 report the descriptive statistics of the main variables in H1 and H2,respectively. The results show that during the four short windows before or after a punishment is announced,theCARin Panel A is slightly lower than that in Panel B,which is consistent with the findings of Yang et al.(2008).In the violation sample,63.4%of the listed companies punish at least one academic independent director.Among the other companies in which the punished independent directors have held a post,57.3%hire at least one punished academic independent director.The most common type of punishment for independent directors is pub-lic censure.In addition,31.1%of the companies with violation behavior are located in the same city as other companies in which the punished independent directors held posts.In addition,the asset size,profitability and growth ability of companies committing violations are all lower than those of other companies in which the punished independent directors held posts.

Figure 1.Types of punishment,characterized by type of independent director.

Table 3 Descriptive analysis of variables.

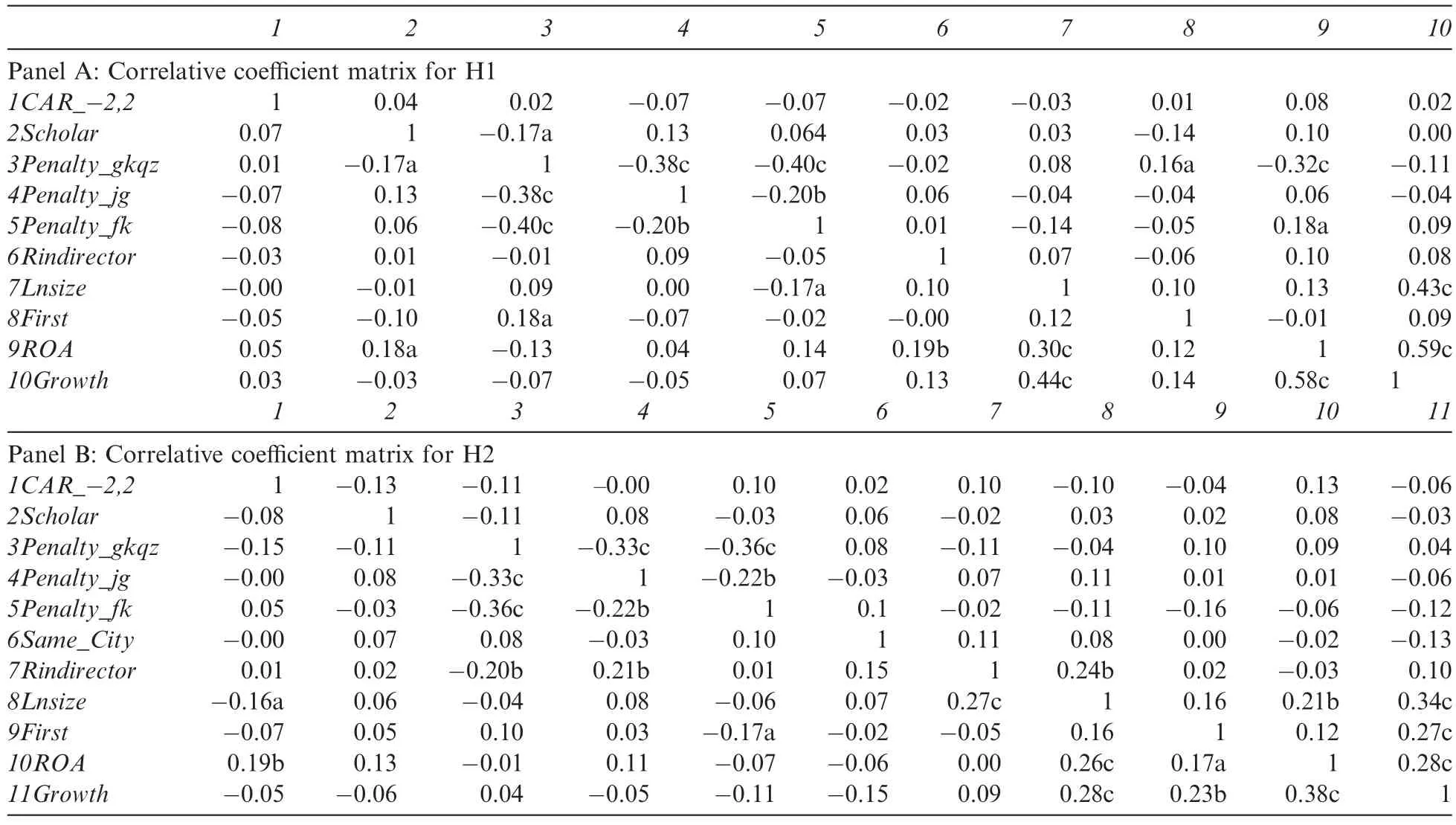

4.3.Correlation analysis

Panels A and B of Table 4 report the Pearson and Spearman correlative coefficient matrices of the main variables in H1 and H2,respectively.The results show thatScholaris negatively but not significantly correlated withCAR_-2,2.The result of the correlation coefficient test does not strongly support our hypotheses; therefore,we need to control for other variables using multiple regression analysis.The Pearson(Spearman) correlation coefficients betweenROAandGrowthand betweenLnsizeandGrowthin Panel A are 0.58(0.59) and 0.44(0.43),respectively4The results do not change if one variable is removed from the robustness test.;the other absolute values for the correlation coefficients are all under 0.4.These data demonstrate that there is not a strong relationship between the independent variables and the control variables.We thus control for other variables using multiple regression analysis.

4.4.Basic regression analysis

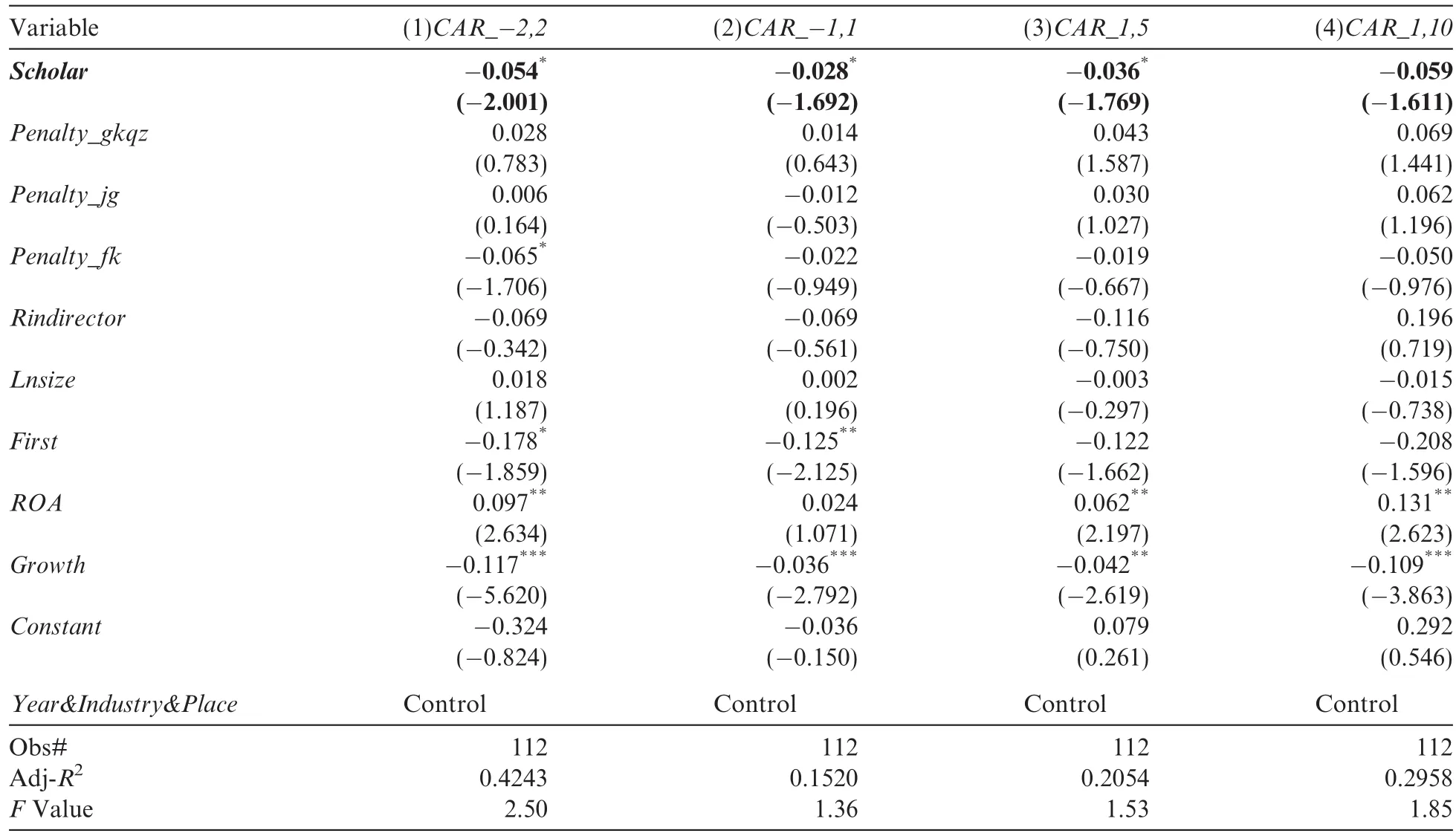

4.4.1.Testing H1:punished academic independent directors versus punished nonacademic independent directors

Table 5 reports the regression results of H1.To control for the fixed effects of year,industry and area,we add dummy variables for year,industry and area into every model.To render our results comparable with those of Xin et al.(2013),we addCAR_-1,1,CAR_-2,2,CAR_1,5andCAR_1,10.The results(shown in Table 5)reveal that all of theCARsare significantly negatively correlated with the dummy variableScholarat no less than the 10%level,except forCAR_1,10.These results demonstrate that the market reacts more negatively to companies that have punished academic independent directors during a relatively short window of time before or after the punishment is announced,than to companies that have punished nonacademic independent directors.Therefore,H1 is supported.Furthermore,the regression coefficients forScholarare-0.054, -0.028,-0.036 and-0.059,respectively,which mean that the maximum negative effect on shareholders exerted by punished academic independent directors relative to nonacademic independent directors is -0.054.5It is obvious from the comparison of the regression coefficients in every time window that the market reaction in a relatively short window before or after the violation is punished is more negative than that in a long-term window of ten days.In other words,the rate for a window of five days is 5.4%,which represents more than 1%per day on average.This fall in share prices is sufficient to be taken seriously by investors.

The regression results for the control variables show that for all types of punishment,only fines(Penalty_fk)are significantly negatively correlated withCARin the five-day window before or after the announcement of the violation.It is weakly evident that a more severe punishment of independent directors results in a more negative market reaction.Ownership concentration(First)is significantly negatively correlated withCAR,illustrating the greater the stake of the largest shareholder,the more negative the market reaction. Profitability(ROA)is significantly positively correlated withCAR,implying that stronger profitability is associated with a more positive market reaction.Growth ability(Growth)is significantly negatively correlated withCAR,at no less than the 5%level,denoting that faster growth ability is related to a more negative market reaction.

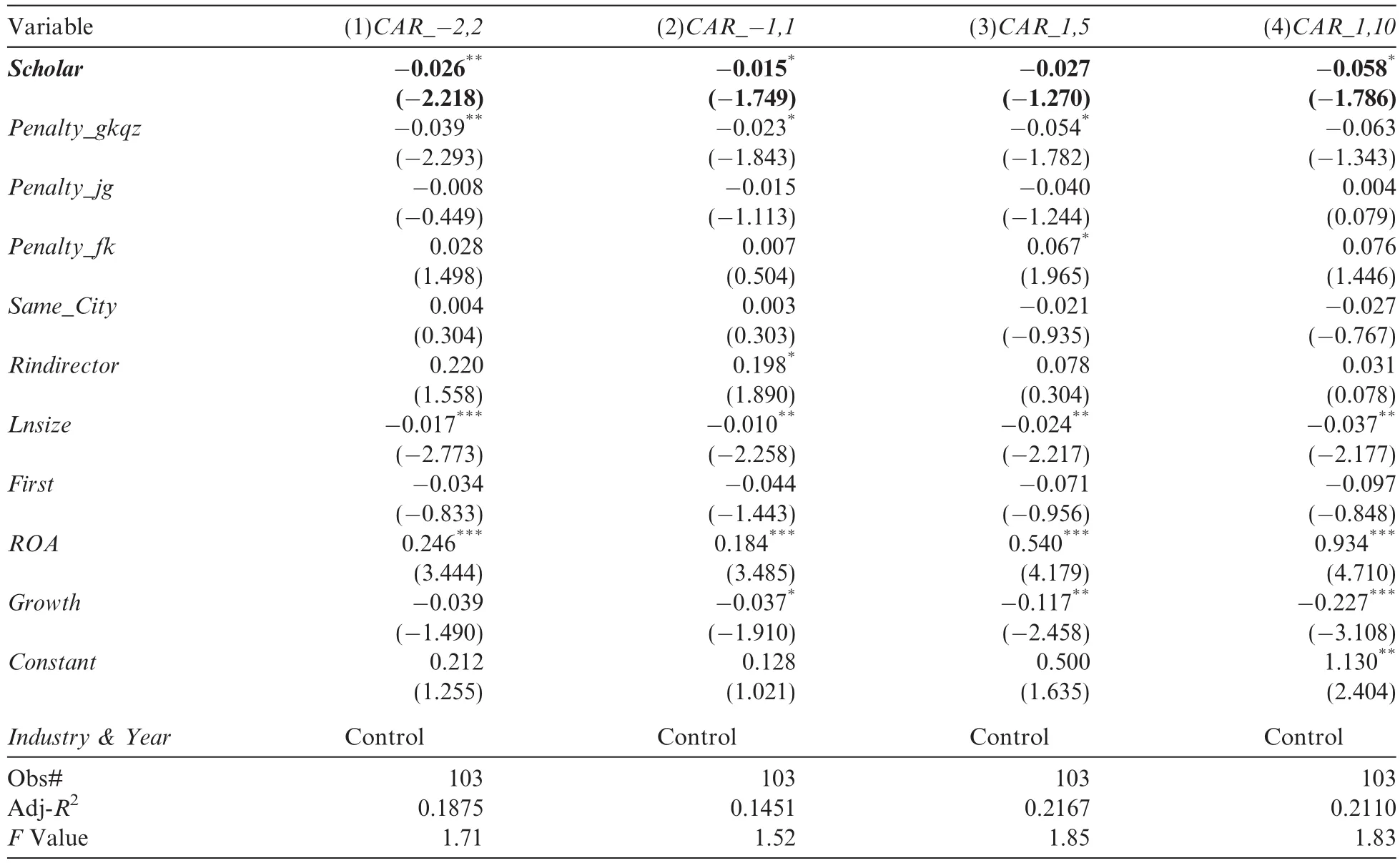

4.4.2.Testing H2:companies in which punished academic independent directors have held a post versus companies in which punished nonacademic independent directors have held a post

Table 6 reports the regression results of H2.To control for the fixed effects of year and industry,we include dummy variables for year and industry in every model.6As the companies in which punished independent directors have held a post and companies that engage in violations are concentrated in Shanghai,Shanxi,Shandong and so on,we did not control for area variables in H2.The results denote that everyCARvalue in every window is significantly negatively correlated with the dummy variableScholarat no less than the 10%level,exceptforCAR_1,5.This illustrates that during the short window before or after a punishment is announced companies in which academic independent directors have held a post have a larger decline in share price than companies in which nonacademic independent directors have held a post.Thus,H2 is supported.The regression results of the control variables show that the dummy variableSame_Cityis not significantly correlated withCAR,illustrating that the market reaction to companies in which punished academic independent directors have held a post is not affected by whether these companies are based in the same city as the companies with violation behavior.The size of the companies in which punished independent directors have held a post (Lnsize)is significantly negatively correlated withCAR,meaning that larger companies are associated with a more negative market reaction,perhaps because large companies attract more public attention.ROAis significantly positively correlated with CAR at no less than a 5%level,denoting that the stronger the profitability of companies in which independent directors have held a post,the more positive the market reaction,which correlates with the regression results used to test H1.

Table 4 Correlative coefficient matrix.

4.5.Further analysis

4.5.1.Reputation punishment of academic independent directors with accounting backgrounds

The Guidelines state that every listed company in China must modify its articles of incorporation to meet the requirements of the Guidelines and employ appropriate personnel as independent directors,including at least one professional with an accounting background.In this study,accounting professionals are defined as those people who have senior titles in accounting or certified public accountant qualifications.Listed companies can hire university scholars with accounting specializations,personnel in accounting firms or financial stafffrom other companies to meet the supervision by accounting professionals requirements.According to Defond et al.(2005),Krishnan and Visvanathan(2008)and Dhaliwal et al.(2010),the presence of members with professional accounting backgrounds in audit committees can enhance the quality of financial reports. The quality of the earnings information from listed companies improves when the board includes some independent directors with finance or accounting backgrounds(Wu and Wang,2007;Hu and Tang,2008).Com-panies with independent directors with financial backgrounds on their boards or audit committees have a lower probability of financial restatements(Agrawal and Chadha,2005).

Table 5 Market reaction test by type of independent directors.

If independent directors with financial backgrounds are known to lower the probability of restatement,and the market has higher moral expectations of academic independent directors,then it is possible that the market will impose stricter punishments for information disclosure violations involving academic independent directors with financial backgrounds.To test this,we construct a dummy variableScholar_Accountingfor academic independent directors with financial backgrounds.Scholar_Accountingequals 1 when there are academic independent directors with financial backgrounds who are punished because of corporate information disclosure violations,and 0 otherwise.Table 7 reports the regression results.It is obvious thatScholar_Accountingis not significantly correlated withCARduring the relatively short windows before or after the violation is announced.That is,the market does not react more negatively to the information disclosure violations when financial academic independent directors are punished.The regression results of the control variables are generally consistent with the results in Table 5.

4.5.2.Overflow effect of punished academic independent directors on the employment of other scholars at the same university

In H1 and H2,we examine the reputation punishment of academic independent directors in companies that have committed violations,and in the other companies in which these directors have held a post.Yu et al. (2011)find that violations at the Wuliangye Company resulted in a‘contagion effect”throughout the liquor industry,leading to a fall in the share prices of competitors.Liu et al.(2014)also find that the Bai Peizhong corruption case not only caused a drop in share prices in the company itself,but also prompted a contagion effect in other companies in the same industry due to information transfer.Chiu et al.(2013)believe that earnings management can be communicated between directors and that those directors who engage in earningsmanagement in one company are more likely to conduct earnings management in other companies.Chen and Chen(2013)also find that financial restatements can spread to other companies via the relationships between top managers.

Table 6 Test of market reaction to other companies based on whether they hire punished academic independent directors.

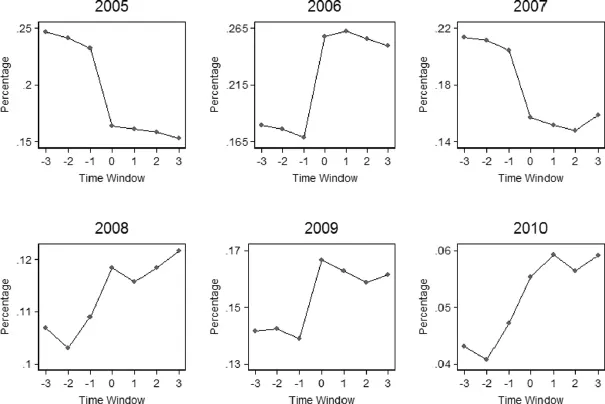

Because of the homogeneity of academic independent directors from the same university,when one independent director is punished,other independent directors at the same university will lose the confidence of listed companies and investors,leading,eventually,to a negative overflow effect on the employment of scholars from the same university.To test this design,we compute the three-year employment of scholars at universities with punished academic independent directors.As Fig.2 shows,the horizontal axis reflects the year in which the violation occurs(0 year)and the three-year period before or after the violation.7Because we wish to reflect three-year data before and after the violation,we limit the period to 2005–2010.The vertical axis reflects the proportion of academic independent directors at universities that employed punished independent directors that year.Notably,in the two or three years after academic independent directors from a certain university are punished,the proportion of independent directors from that university declines,to various extents,in most years(2005,2007,2008 and 2009)or increases in a smaller degree than usual(2006 and 2010).The results demonstrate that punished academic independent directors bring some degree of negative overflow effects to the employment of other scholars at the same institutions.

4.5.3.Influence of independent directors’violations on later employment of independent directors at the same companies

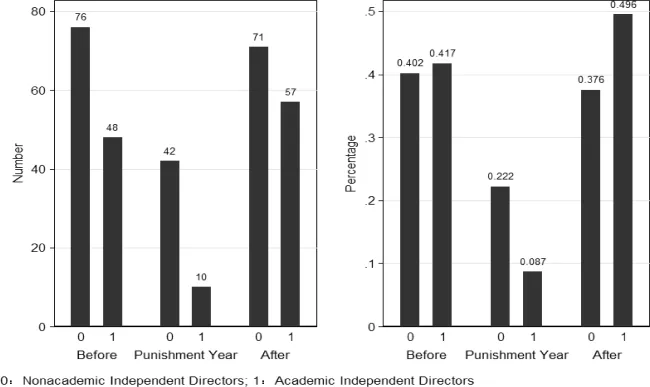

Xin et al.(2013)report that 49%of punished independent directors leave the companies in question before the end of the year they are punished.In other words,most companies with a punished director must hire newindependent directors.We ask whether punished independent directors influence the later choice of independent directors in the companies in question.To solve this problem,we investigate the punished independent directors who leave and the subsequent employment decisions of the involved companies.Fig.3 shows the time distribution of the departure of punished academic independent directors and punished nonacademic independent directors by distinguishing between‘before punishment,”‘during punishment”and‘a(chǎn)fter punishment.”Fig.3 shows that of 304 punished independent directors,124(40.79%)leave the companies prior to punishment,52(17.11%)leave the companies during the year they are punished and 128(42.11%)continue to work at the same company after punishment.8Among the 128 directors,57 independent directors leave companies one year after punishment,and 39 directors leave two years later after punishment.Academic independent directors are more likely to continue their employment.

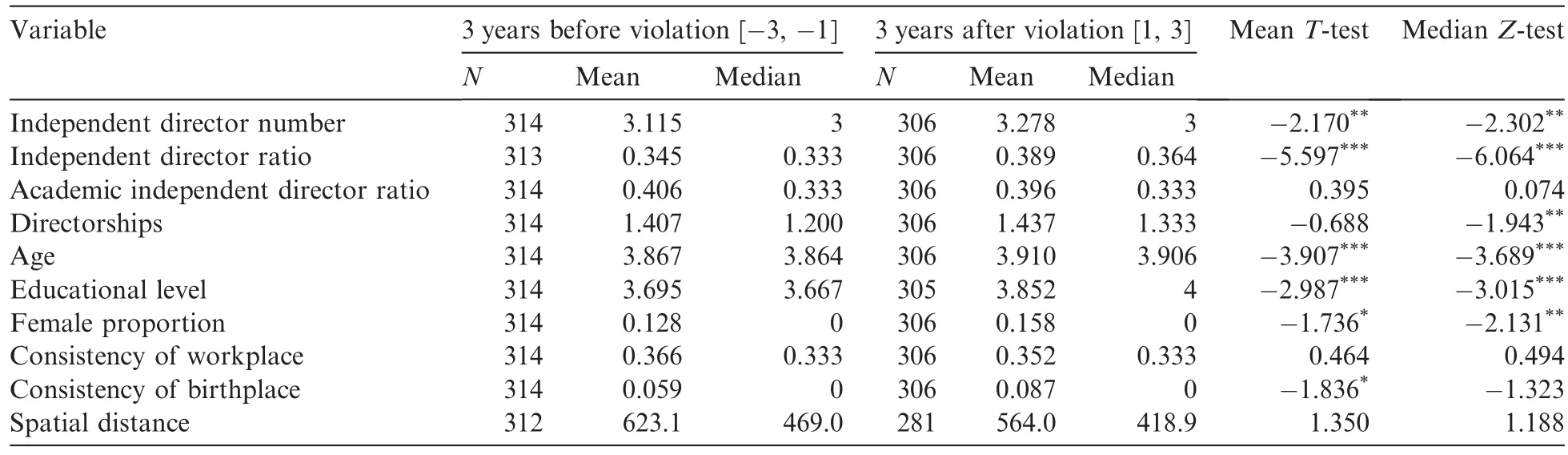

Next,we compare the individual characteristics of the punished independent directors for three years before and after the punishment.We explore the differences within several dimensions,such as the number of independent directors,the proportion of independent directors,the proportion of academic independent directors, the average directorships of independent directors,average age,average education level,ratio of female independent directors,consistency between their stated full-time workplace and the listed company,consistency between their birthplace and the location of the listed company,and spatial distance from their full-time workplace to the headquarter of the listed company.The results of the univariate tests are provided in Table 8;they show that after violation punishments,companies employ more independent directors.9Because of continuous improvements in the independent director system,the number of independent directors employed by listed companies generally increases over the sample period.To avoid the effect of this tendency,we match the violation samples according to the most current rules of that year,industry and firm size.The above conclusions are con firmed.Furthermore,theseindependent directors have,on average,more directorships,are older and are more educated.The proportion of female independent directors is higher,and local independent directors make up a large proportion of independent directors.After punishment,the average independent directors’supervision distance decreases from 623.1 km to 564 km for those companies,representing a decrease(although not significant).These results are consistent with the idea that companies with violations go on to employ more experienced,stable independent directors to encourage a positive image.

Figure 2.Employment of other scholars at the universities that employ punished academic independent directors.

Figure 3.Time distribution of the departure of punished independent directors.

Table 8 Tests of individual characteristics of independent directors before and after violations.

4.5.4.Ruling out competing hypotheses

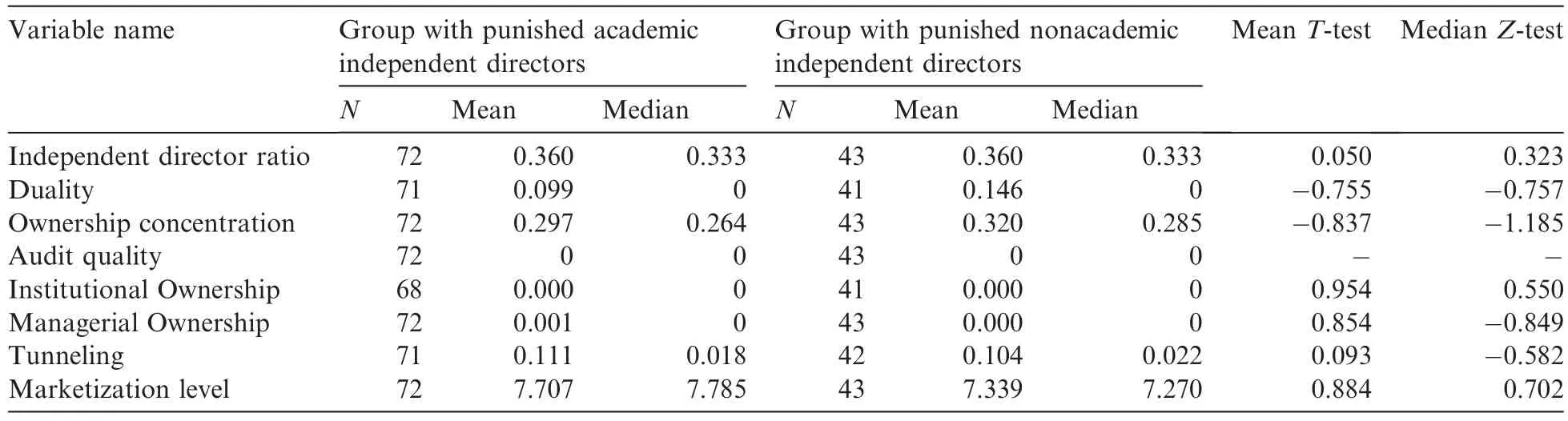

In our tests of the basic hypotheses,we find that the market reacts more severely to violations committed by academic independent directors.When companies have a low level of corporate governance and a low degree of investor protection,they can communicate a positive image to the market through the reputation and social status of the academic independent directors.It is possible that the positive relationship we observe between the presence of academic independent directors and more severe market punishment of violations is a spurious association.To exclude this competing hypothesis,we divide the violation sample into two subsamples:those with academic independent directors who are punished and those with nonacademic independent directors who are punished.We then conduct an univariate test of the corporate governance level of the two groups. If the results reveal that the governance level of the group with academic independent directors is poorer, we cannot rule out the competing hypothesis;if not,the competing hypothesis does not make sense.

Table 9 reports the results of the univariate test.We test the corporate governance level of the two groups along eight dimensions:the independent director ratio,duality,ownership concentration,audit quality (whether the Big Four were invited),level of institutional ownership,level of managerial ownership,tunneling (the difference between receivables and payables from related transactions after adjustment for scale)and marketization level(the average marketization index of every province given in Fan et al.(2011)).None of the eight dimensions show significant differences between the subsamples.In addition,none of the companies use international Big Four auditors.The results of the univariate test illustrate that there are no significant differences in governance between the two subsamples.In other words,the competing hypothesis is not supported.

4.6.Robustness test10Due to space limitations,the results are not included.If needed,please contact authors.

To enhance the reliability of our conclusions,we conduct the following robustness tests.First,we use the number of academic independent directors who violated rules,instead of the dummy variable,to retest H1. Second,we retest our hypothesis after excluding from the sample companies with multiple violations in the same year,as when multiple violations occur during the same year,the use of a market model to estimateCARwill lead to the overlapping of time windows.Third,we change the measurement of punishment force(Penalty)to retest the hypotheses.In our study,we use three dummy variables to distinguish the strength of the punishment.In our robustness test,we use the assignment method to measure the strength of the punishments.We value fines,warnings,public censure and criticisms as 4,3,2 and 1,respectively,according to the degree of punishment from heavy to light,and use the maximum value for each incident.The results of the robustness test are not substantially different from the previous tests,leading us to believe that our conclusions are quite robust.

Table 9 Univariate test to rule out the competing hypothesis.

5.Conclusions

Most previous studies of the backgrounds of independent directors are based on the resource support theory.According to this theory,independent directors provide important resources for corporate development. Our study adds to our knowledge of the economic consequences of independent directors’backgrounds.We explore reputation punishment and the overflow effect of supervisory punishment of academic independent directors following violations of information disclosure rules in their companies.Our findings are as follows. The market punishes academic independent directors more severely than nonacademic directors for their violations.Specifically,when companies violate information disclosure rules and the independent directors are punished by the China Securities Regulatory Commission or stock exchanges for failing to fulfill their executive duties,the market often reacts more negatively to companies that have academic independent directors on the board.Furthermore,compared with companies that employ nonacademic independent directors who have been punished,companies that employ academic directors who have been punished face greater declines in their stock price during a relatively short window just before or after the punishment is announced.To some extent,the punishment of academic independent directors influences the employment of other scholars in the same field and results in a negative overflow effect.Our research provides experimental evidence that there are differences in how the market treats violations of independent directors with various backgrounds and reflects the double-edged sword that an individual reputation can bring to an organization.The conclusions provide support for the supervision of Chinese capital markets and corporate decision making.Certainly,this study has some deficiencies.For instance,differences in scholars’social reputations will result in different market reactions to their behavior.In future studies,we plan to extend our analysis by refining the categories of universities that employ scholars as academic independent directors:for example,the universities of the‘985 Project”and‘211 Project.”

Agrawal,A.,Chadha,S.,2005.Corporate governance and accounting scandals.J.Law Econ.48(2),371–406.

Agrawal,A.,Knoeber,C.R.,2001.Do some outside directors play a political role?J.Law Econ.44(1),179–198.

Audretsch,D.B.,Lehmann,E.,2006.Entrepreneurial access and absorption of knowledge spillovers:strategic board and managerial composition for competitive advantage.J.Small Bus.Manage.44(2),155–166.

Booth,J.R.,Deli,D.N.,1999.On executives of financial institutions as outside directors.J.Corp.Finan.5(3),227–250.

Burak,G.A.,Malmendier,U.,Tate,G.,2008.Financial expertise of directors.J.Financ.Econ.88(2),323–354.

Chen,S.H.,Chen,G.,2013.Inter-corporate top managers’ties and the diffusion of financial restatement.Econ.Manage.35(8),134–143 (in Chinese).

Chiu,P.C.,Teoh,S.H.,Tian,F.,2013.Board interlocks and earnings management contagion.Account.Rev.88(3),915–944.

DeFond,M.L.,Hann,R.N.,Hu,X.,2005.Does the market value financial expertise on audit committees of boards of directors?J. Account.Res.43(2),153–193.

Dhaliwal,D.,Naiker,V.,Navissi,F.,2010.The association between accruals quality and the characteristics of accounting experts and mix of expertise on audit committees.Contemp.Account.Res.27(3),787–827.

Fan,G.,Wang,X.L.,Zhu,H.P.,2011.Chinese Marketization Index:The Relative Process of Marketization in Different Regions in 2011. Economic Science Press,Beijing(in Chinese).

Hu,Y.P.,Chen,C.,2004.Analysis of the listed company information disclosure violations.South China Finan.,41–42(in Chinese)

Hu,Y.M.,Tang,S.L.,2008.The independent director and the earnings information quality of listed companies.Manage.World 9,149–160(in Chinese).

Jiang,B.,Murphy,P.J.,2007.Do business school professors make good executive managers?Acad.Manage.Perspect.21(3),29–50.

Johnson,J.L.,Daily,C.M.,Ellstrand,A.E.,1996.Boards of directors:a review and research agenda.J.Manage.22(3),409–438.

Krishnan,G.V.,Visvanathan,G.,2008.Does the SOX definition of an accounting expert matter?The association between audit committee directors’accounting expertise and accounting conservatism.Contemp.Account.Res.25(3),827–858.

Litov,L.P.,Sepe,S.M.,Whitehead,C.K.,2013.Lawyers and fools:lawyer-directors in public corporations.Georgetown Law J.102(2), 413–480.

Liu,H.,Tang,S.,Lou,J.,2012.Independent directors:supervision or consulting?The study of impact of independent directors with bank backgrounds on the enterprise credit financing.Manage.World 1,141–156(in Chinese).

Liu,Q.L.,Chen,D.,Luo,L.,et al.,2014.Executive corruption,contagion effect,and investor protection—empirical evidence from the Bai Peizhong case.China Account.Finan.Rev.3,63–120(in Chinese).

Pfeffer,J.,Salancik,G.R.,2003.The External Control of Organizations:A Resource Dependence Perspective.Stanford University Press, California.

Pfeffer,J.,1972.Size and composition of corporate boards of directors:the organization and its environment.Adm.Sci.Quart.2,218–228.

Weisbach,M.S.,1988.Outside directors and CEO turnover.J.Financ.Econ.20(88),431–460.

Wu,L.N.,Gao,Q.,2002.Punishment announcement reaction research.Econ.Sci.3,62–73(in Chinese).

Wu,Q.H.,Wang,P.X.,2007.Quality of company earnings:an investigation into micro-governance effect of board—evidence from the forced change for independent director institution.Appl.Stat.Manage.26(1),30–40(in Chinese).

Xin,Q.Q.,Huang,M.L.,Yi,H.R.,2013.False statements of listed companies and the independent director supervision punishmentbased on analysis of the independent directors of individual perspective.Manage.World 5,131–143(in Chinese).

Yang,Y.F.,Cao,Q.,Wu,X.M.,2008.Market reaction differences research on listed companies’information disclosure violation-an empirical analysis from 2002 to 2006.Audit.Res.5,68–73(in Chinese).

Ye,K.T.,Zhu,J.G.,Lu,Z.F.,Zhang,R.,2011.The independence of independent directors:evidence from board voting behavior.Econ. Res.J.1,126–139(in Chinese).

Yu,X.,Zheng,Y.,Zhang,P.,2011.Intra-industry effects of corporate scandals-a case study on Wuliangye.J.Shanxi Finan.Econ.Univ. 3,80–87(in Chinese).

Zahra,S.A.,Pearce,J.A.,1989.Boards of directors and corporate financial performance:a review and integrative model.J.Manage.15 (2),291–334.

*Corresponding author at:182#Nanhu Avenue,East Lake High-tech Development Zone,Wuhan 430073,China.

E-mail address:quanyi88888@163.com(Y.Quan).

☆We acknowledge financial support from the National Natural Science Foundation of China(Project Nos.71602191;71502174),the Special Funds for the Fundamental Scientific Research of Central Universities of Zhongnan University of Economics and Law.We appreciate the helpful comments from the anonymous reviewers.

http://dx.doi.org/10.1016/j.cjar.2016.10.002

1755-3091/?2016 Sun Yat-sen University.Production and hosting by Elsevier B.V.

This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

Violation behavior

Reputation punishment

Over flow effect

China Journal of Accounting Research2017年1期

China Journal of Accounting Research2017年1期

- China Journal of Accounting Research的其它文章

- Employee quality,monitoring environment and internal control

- Economic policy uncertainty,credit risks and banks’lending decisions:Evidence from Chinese commercial banks

- Regulatory pressure and income smoothing by banks in response to anticipated changes to the Basel II Accord☆

- Accounting research in banking–A review