Economic policy uncertainty,credit risks and banks’lending decisions:Evidence from Chinese commercial banks

Qinwei Chi,Wenjing Li

Management School,Jinan University,China

Economic policy uncertainty,credit risks and banks’lending decisions:Evidence from Chinese commercial banks

Qinwei Chi*,Wenjing Li

Management School,Jinan University,China

A R TiClE I NfO

Article history:

Received 8 September 2015

Accepted 6 December 2016

Available online 18 January 2017

JEL Classi fication:

G21

O17

D21

Economic policy uncertainty

Using data for Chinese commercial banks from 2000 to 2014,this paper examines the effects of economic policy uncertainty(EPU)on banks’credit risks and lending decisions.The results reveal significantly positive connections among EPU and non-performing loan ratios,loan concentrations and the normal loan migration rate.This indicates that EPU increases banks’credit risks and negatively influences loan size,especially for joint-equity banks.Given the increasing credit risks generated by EPU,banks can improve operational performance by reducing loan sizes.Further research indicates that the effects of EPU on banks’credit risks and lending decisions are moderated by the marketization level,with financial depth moderating the effect on banks’credit risks and strengthening it on lending decisions.

?2016 Production and hosting by Elsevier B.V.on behalf of Sun Yat-sen

University.This is an open access article under the CC BY-NC-ND license

(http://creativecommons.org/licenses/by-nc-nd/4.0/).

Contents

1. Introduction......................................................................34

2. Literature and hypotheses.............................................................35

2.1. Institutional background........................................................35

2.2. Literature review..............................................................36

2.2.1. Effects of EPU.........................................................36

2.2.2. Credit risks and lending decisions of commercial banks............................37

2.2.3. Brief summary of related literature...........................................37

2.3. Theoretical analysis and hypotheses development.......................................38

3. Research design....................................................................40

3.1. Sample.....................................................................40

3.2. Key variables................................................................40

3.2.1. Credit risks............................................................40

3.2.2. Loan sizes............................................................41

3.2.3. EPU................................................................41

3.3. Model.....................................................................42

3.4. Descriptive statistics...........................................................43

4. Empirical results...................................................................44

4.1. EPU and credit risks...........................................................44

4.2. EPU and adjustment of loan sizes.................................................45

4.3. EPU,adjustment of loan sizes and performance........................................46

5. Additional analyses.................................................................47

6. Conclusion and implications...........................................................49

Acknowledgment...................................................................49

........................................................................49

1.Introduction

As an emerging and transforming economic power,China’s government plays an important role in business activities.To realize the goal of social governance,governments use economic policies(e.g.,fiscal,monetary, industrial and administrative)to adjust and control the economic operation and behavioral patterns of market participants.Following the 2008 financial crisis,the Chinese government proposed and implemented a set of intensive policies to stimulate the economy and alleviate the pressure generated by the economic downturn. These policies efficiently addressed the economic decline,but they also objectively aroused tremendous economic policy uncertainty(hereinafter referred to as EPU).Fan and Xu(2015)survey 1041 CEOs in domestic and foreign enterprises operating in China,and find that 57%and 66%of CEOs in domestic and foreign enterprises,respectively,explicitly treat the condition that laws and regulations are ambiguous,changeful and selectively executed as their biggest concern.Facing a high level of EPU in China,market participants must dynamically rectify their operational strategies and actions.

As important participants in the Chinese market,commercial banks possess the same essential attributes as general corporations,but one of their special functions is channeling the effects of governmental macroeconomic control.Specifically,given advancing marketization,commercial banks are becoming more similar to general enterprises,exhibiting more market-orientated behavioral modes and operating goals.Governments also intensively adjust deposit rates and reserve requirement ratios to indirectly achieve economic regulation and control.This suggests that commercial banks are a key loop in the transmission mechanism of official macroeconomic policies.The operating businesses of commercial banks are at enormous risk and inherently possess great influence.Given these characteristics,we assume that the effects of EPU on commercial banks are particularly complex.Therefore,there is an urgent need to investigate whether EPU affects commercial banks.In particular,it is important to uncover the mechanism by which EPU operates,and the solutions for mitigating its effect on commercial banks.To answer these issues,we pursue an understanding of commercial banks’behavioral patterns in dealing with the shock generated by EPU within emerging economies.

Using unbalanced panel data for Chinese commercial banks between 2000 and 2014,we investigate how EPU influences commercial banks’credit risks and lending decisions,and how commercial banks respond to these effects.We find that an increase in EPU increases bank non-performing loans,single borrower concentration and the normal loan migration rate.That is,EPU increases the credit risks of Chinese commercial banks.We also reveal that the level of EPU significantly and negatively correlates with the loan-to-deposit ratio and the loan growth rate,and this negative relationship is more pronounced in joint-equity commercialbanks with fewer state-owned shares.This empirical finding indicates that commercial banks,particularly joint-equity commercial banks,reduce their loan sizes.In addition,commercial banks can improve their operating performance by decreasing loan size in response to greater EPU.Further analysis shows that the effect of EPU on credit risks and loan sizes can be weakened by marketization level development.Meanwhile,following in-depth financial development,the effect of EPU on credit risks can be weakened,whereas that on loan size can be strengthened.

Our study makes three contributions.First,we extend the literature on the mechanisms and consequences of EPU.The extant research in this field focuses on EPU’s effect on macro-economic growth and micro-enterprise investment(Baker et al.,2013;Li and Yang,2015)by simply emphasizing its economic consequences.As bridges linking state macro-economic adjustments and controlling policies,and microenterprise operation and investment behavior,commercial banks can be affected by EPU.Moreover,due to the frequent adjustment and vague orientation of economic policies,commercial banks more or less mingle at their own discretion when they understand and execute their policies,effectively amplifying the shock of EPU on macro-economic growth and micro-enterprise operation.Hence,our study enriches the related literature by shedding light on the mechanism through which macro-economic policies influence micro-enterprise behavior.

Second,we deepen the comprehension of what causes commercial banks’credit risks.Research mainly focuses on the effects that legal institutions,diversification and internal governance mechanisms have on credit risks,whereas our study provides a new perspective on macro-economic policies that reveal the following points:EPU can increase credit risks for commercial banks through enterprise and bank balance sheets, and it has a crowd-out effect on loan size.

Third,our study contributes to the evaluation of the enforcement,efficiency and effectiveness of macroeconomic policies issued by the government to alleviate economic volatility and achieve economic governance. Frequent changes to economic policies can produce uncertainty shock,which is harmful to commercial banks’operations because it disorders the direction and strength of monetary policies.Therefore,our findings can explain why the enforcement outcomes of economic policies do not always achieve the expectations of regulators.Our findings are particularly beneficial for understanding contra-cycle loan adjustments in Chinese commercial banks(Pan and Zhang,2013).

The remainder of this paper is organized as follows.Section 2 discusses the literature and develops three hypotheses.Section 3 explains the research design and introduces the sample.Section 4 presents the main results and Section 5 reports supplementary analyses.Section 6 concludes by discussing the study’s policy implications.

2.Literature and hypotheses

2.1.Institutional background

Following the financial crisis of 2008,to prevent a severe recession,the major economies(China,the US, the European Union,etc.)implemented a series of economic policies designed to adjust and control the inevitable economic deterioration.These policies worked in part,but they also generated tremendous EPU.The International Monetary Fund repeatedly mentions EPU in the 2012 World Economic Outlook Report.They insist that the level of EPU in the US and European Union hit a record high after 2008.They also point out that increasing EPU suppresses investment,employment and consumption in enterprises and families,slowing global economic recovery.Fortune Magazine once reported that extraordinary uncertainty was a major part,maybe the largest part,of why the US economy was barely moving or why millions of workers could not find jobs.The same article identified the hyperpolarized US Congress as an uncertaintygenerating machine.

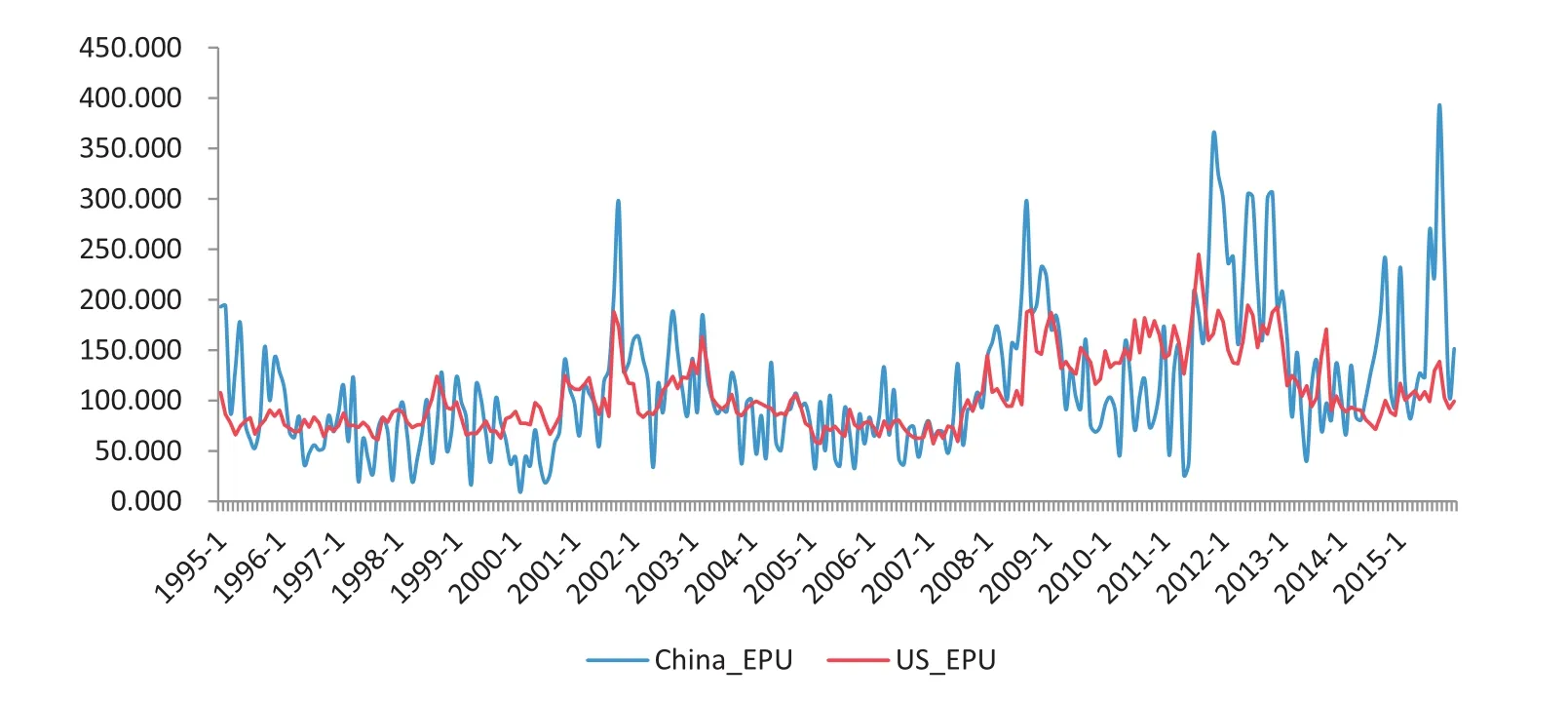

Figure 1.Comparison of EPU indices in the US and China.

Due to market-oriented reform,the formation terms and consequences of EPU in China differ from those in the US.China’s political system can guarantee sequential consistency for blueprints of state-level economic development,but the government lacks adequate transparency and scientificity in drawing up specific economic policies.This leads to regulators testing the short-term objectives of economic development by subjecting the use of specific economic policies to a trial and error process.Moreover,individuals in economic businesses tend to feel ambiguous about the orientation,effect size and persistence of the economic policies due to the aforementioned lack of transparency and scientificity in the policy-making process.Launching the circuit breaker in the China stock market is a vivid example of how to depict EPU.On 4 December, 2015,the Shanghai Stock Exchange,Shenzhen Stock Exchange and China Financial Futures Exchange formally announced circuit breaker-related regulations,which were then enforced as of 1 January,2016.However,only two trading days later,the China Securities Regulatory Commission(CSRC)claimed that the circuit breaker had been suspended.The CSRC had implemented the circuit breaker to stabilize the stock market,but the enforcement outcomes went against the initial intention.This hurried implementation and withdrawal of the circuit breaker revealed that the government still has a long way to go in improving scientificity in policy making.

In contrast,China is an emerging transition economy,and its visible ties to central and local governments and invisible ties to the market interactively affect economic operation and resource allocation.The government can influence enterprise through industrial entry,administrative license and price regulation.For instance,the government directly intervenes in the hiring of top managers and rank-and-file workers in state-owned enterprises,restricts private firms from entering specific domains and industries and intervenes in the lending decisions of commercial banks.This level of government intervention and the extensive and profound effects of the economic policies they issue on participants in business activities indicate that slight changes in economic policies could produce significant uncertainty shock.Therefore,compared with the US,EPU is more significant in China.To achieve a better understanding of the differences in EPU in the US and China,we compare the two countries’EPU indices from January 1995 to December 2015.As Fig.1 shows,the EPU indices in the US and China are highly correlated,whereas the China index is of greater mean value and volatility.As a result,to correctly estimate the institutional efficiencies of various economic policies introduced by the government,we must investigate EPU’s influence on enterprises,commercial banks and individuals in China.

2.2.Literature review

2.2.1.Effects of EPU

Due to their opacity,ambiguity and unpredictability,the economic policies issued by the government often confuse participants in business activities,or prompt governments to take a position opposing a policy’s original intention when they are enforced,ultimately generating uncertainty shocks.We treat this type of uncertainty as EPU.For example,China’s government introduced intensive regulation and control policies to adjust supply and demand for real estate and its related prices from 2005 to 2014.However,the policy targets swung chaotically among stabilizing economic growth,controlling real estate prices,guaranteeing people’slivelihoods,etc.Related policy instruments include public finances,taxation regulation,administrative restriction of real estate buying and credit limitations.Co-movement and consistency are absent among these policy instruments,which in turn produce greater EPU in the real estate market.

EPU can be driven by the following circumstances:the indeterminate expectations created by frequent policy changes introduced by governments(Feng,2001);the possibility that governments might take a position opposing policies in enforcement(Le and Zak,2006);and new policies enforced by private sector profits (Pastor and Veronesi,2013).EPU has also had extensive influence on economic development.Baker et al. (2013)show that increases in EPU foreshadow decline in output,employment and investment.Moreover,high levels of policy uncertainty are associated with weaker growth prospects.Specifically,an increase in EPU steepens the yield curve and increases the volatility in asset and option markets(Ulrich,2012).Increasing EPU also boosts the volatility of share pricing(Pastor and Veronesi,2013),which can affect enterprises extensively.Panousi and Papanikolaou(2012)document that high EPU can increase financing costs and risk aversion among top managers,which then depresses the investment size.In addition,the depressing effect of EPU on investments is more significant in firms with higher irreversibility in investing that are more dependent on government public expenditure(Gulen and Ion,2013).Li and Yang(2015)show that an increase in EPU reduces Chinese listing firms’investments,with the depressing effect more pronounced in firms with greater irreversibility in investment,lower learning capability,lower institutional shareholding and higher ownership concentration.Wang et al.(2014)examine Chinese listing firms’data and find evidence that firms tend to hold more cash when faced with increasing EPU.

2.2.2.Credit risks and lending decisions of commercial banks

The credit risks and lending decisions of commercial banks are jointly determined by various internal and external factors.For the internal factors,the share proportions held by heterogeneous shareholders can significantly affect the risk management,lending decisions and operating performance of commercial banks(La Porta et al.,2002;Barry et al.,2011;Zuzana et al.,2011).Specifically,for Chinese commercial banks,the ratio of state-owned shareholding significantly affects their risk taking in different stages of the business cycle(Pan and Zhang,2012).Related party loans weaken the effectiveness of compensation incentives within commercial banks(Zhang et al.,2012)and diversification can lower the credit risk,but makes no contribution to improving performance(Liu et al.,2012).For external factors,in countries with better legal protection for creditors,loan sizes increase(La Porta et al.,1998),credit spreads decrease(Laeven and Majnoni,2005),financial crises are less frequent(Johnson et al.,2000),loan concentrations are higher and loan maturity is longer(Qian and Strahan,2007).Using data from Chinese commercial banks, Zhang and Wang(2012)find evidence that the level of legal protection is beneficial for raising the loan size. Qian and Cao(2015)document that trusts,as a type of informal institution,can help commercial banks simplify the loan pricing and approval processes related to lending decisions.This,in turn,contributes to controlling non-performing loans and improving operating performance for commercial banks. Moreover,the promotion of local officials significantly influences the length of maturity and size of a non-performing loan(Qian et al.,2011).

2.2.3.Brief summary of related literature

The research on EPU is primarily based on developed economies,particularly that of the US,and empirical evidence from emerging economies remains scarce.The few studies on China’s EPU simply focus on its effect on the investing behavior and cash holdings of enterprises.Commercial banks occupy an important position in a country’s economic development.Unfortunately,few studies pay attention to the mechanism through which EPU affects such banks,or the economic consequences of those effects.The literature on commercial banks tends to focus on firms’demand for or commercial banks’ability to supply loans.Theoretically,supply and demand are interdependent and interactive.EPU can shock a firm’s investments and cash holdings, shocking its demand for loans and simultaneously driving commercial banks to adjust their supply.Hence, this study contributes to the literature by incorporating the work on EPU and commercial banks into a logic consistent analysis framework.

2.3.Theoretical analysis and hypotheses development

To ensure that economic policies remain consistent with the demands of economic development,governments adjust and change economic policies contingently.Nevertheless,the policy-making process is always accompanied by unpredictability,opaqueness and ambiguity—all of which can prompt EPU.Existing research shows that EPU influences macro-economic,capital market and enterprise behavior in varying degrees,and it has a multi-aspect,multi-layer effect on business participants.As an important component of any economic system,commercial banks are affected by economic policies,and they transfer those effects. Hence,as a variable that affects participants in economic activities,EPU is expected to influence the behavior of commercial banks.

EPU can directly influence commercial banks in that their behavior can be shocked by macro-policy,not only because banks are important participants in economic activities but also because they often adjust the strategies for lending decisions.Enterprises cannot develop completely without the support of credit resources from banks,but the latter’s supply of credit resources cannot always meet enterprises’funding demands due to scarcity.As such,banks need to screen customers to find those with the best potential growth and value to allocate credit resources.Macro-economic policies are beneficial for commercial banks to select customer enterprises.Compared with banks,the regulators who introduce the economic policies possess more farsighted cognition for economic development and industrial planning.Different industries make diverse contributions to economic growth.To increase the pace of macro-economic development,regulators use various economic policies to induct industrial progress and introduce and adjust other economic policies to gather resources into supported industries or enterprises more efficiently and intensively.Commercial banks have the most capital resources for economic growth,to the extent that the allocation of credit resources is inevitably affected by macro-economic policies.Theoretically,the guiding role of economic policies increases the efficiency of credit resource allocation.However,if changes to economic policies are frequent and excessive,EPU arises,forcing commercial banks to deal with ambiguity regarding which regulators want to support which industries or enterprises.It then becomes difficult to accurately identify which industries or enterprises are valuable for allocating credit resources.In this case,economic policies can mislead banks to allocate scarce credit loans to industries or enterprises with poor prospects for future gains.The regulation policies in China’s real estate industry are the most typical examples of this.China’s central and local governments have introduced a series of policies to adjust and control real estate prices since 2005,but commercial banks find it difficult to accurately evaluate their industrial prospects because the policies change so frequently and local governments often take a stand against the original goals of regulation policies during the enforcement process.Consequently, commercial banks encounter greater information asymmetry when deciding how to allocate their credit resources.This eventually creates an increase in non-performing loans.Thus,an increase in EPU can directly increase credit risks.

EPU can also indirectly affect banks through its effect on enterprises.Banks are the most common financing source for enterprises,so a deterioration of a firm’s financial condition or bankruptcy affects the sizes of nonperforming loans and in fluences the operating performance of commercial banks.Speci fically,if a customer enterprise is in severe financial distress,banks can subsequently fall into loss or insolvency(Zhu,2002).As such,the operational risks taken by enterprises have a spillover effect on banks’credit risks.An increase in operational risk can cause firms’operations to fluctuate,making their financial situations more unstable.This in turn shocks the debt-paying abilities of customer firms.The literature shows that enterprises decrease investments or increase cash holdings to cope with an increase in EPU.However,if EPU increases continuously, firms’conservative behavior is not always enough to counter the adverse effects of extraneous risks,and firms’operations do deteriorate as EPU increases,inevitably spilling over to create a surge in banks’credit risks.

According to the above analysis,EPU can escalate banks’credit risks through direct and indirect channels. Formally stated,our first hypothesis is as follows:

H1.The level of economic policy uncertainty positively affects the credit risks of commercial banks.

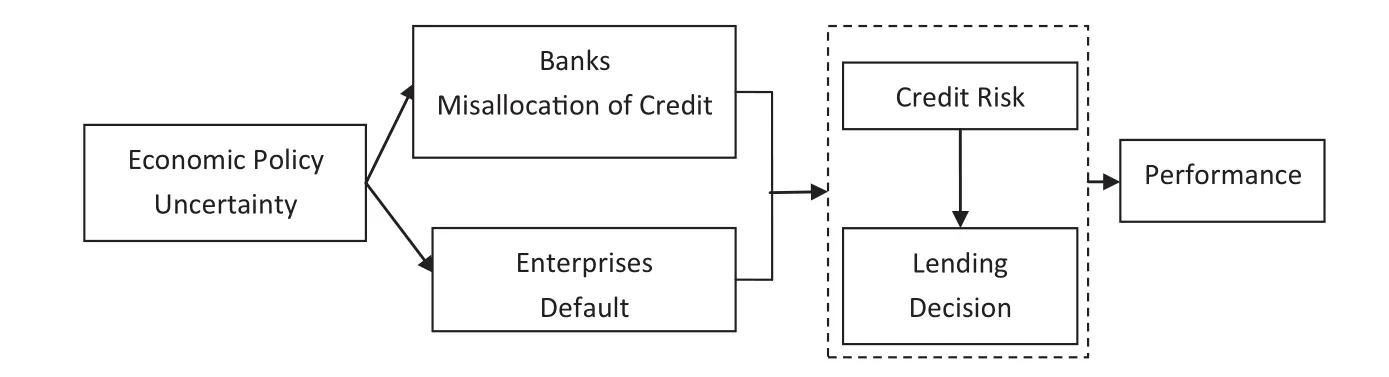

Figure 2.The theoretical framework of our research.

After long-term financial marketization reform,commercial banks in China exhibit market-oriented behavioral patterns and operational objectives(Cai and Zeng,2012),and their risk management capabilities have shown considerable progress.As the main source of capital for enterprises,commercial banks adopt various measures to reduce their credit and overall operational risks when their credit risks increase.Zhang and Wang (2012)document that the non-performing loan ratio is an important determinant of loan size.Li and Yang (2015)find evidence that as EPU increases,enterprises encounter difficulties in evaluating future trends and project profitability,which results in reduced investments.Enterprises generate the uppermost demand for bank credits,and that demand decreases if the level of investment in customer firms decreases,shrinking the size of bank credits.This is the indirect mechanism based on corporate balance sheets.Moreover,commercial banks assess the economic and industrial development prospects in which the applicants for credit resources are located,and EPU can disturb those judgments when the banks forecast their economic development prospects.Banks can also reduce loan sizes to manage risk.This is the direct mechanism based on bank balance sheets.For instance,statistical data issued by the People’s Bank of China on 16 November,2015, showed that the total loans supplied by Bank of China,Agriculture Bank of China,China Construction Bank and Industrial and Commercial Bank of China were 35.69 trillion,aggregately,by the end of October 2015–656 billion less than in September 2015.Some specialists affiliated with financial medium analysis indicate that loan size decreases sharply because commercial banks are cautious of the economic prospects and asset quality.This practical case is evidence of the direct mechanism based on bank balance sheets.1Source:http://news.hexun.com/2015-11-17/180616640.html.

Commercial banks play a vital role in stabilizing economic development and insuring that governments achieve their regulation goals.The adjustment of credit quotas can immediately shock the market liquidity and credit resource availability of enterprises.China’s banking system is fairly complex.According to the ownership structure,we can group commercial banks into two categories:state-owned and joint-stock.In state-owned banks(Bank of China,Agriculture Bank of China,China Construction Bank,Industrial and Commercial Bank of China,city commercial banks),state-owned shares are enormous,lending decisions are subject to governmental intervention and there is limited space to make decisions autonomously.In joint-stock banks,the ownership structure is dispersed,with little state ownership,and there is more freedom to adjust lending decisions.Compared with state-owned banks,joint-stock banks reduce more credit loans when facing a similar level of EPU.Thus,we hypothesize:

H2a.Greater economic policy uncertainty results in smaller credit quotas,and

H2b.Compared with state-owned banks,the adverse effect of economic policy uncertainty on credit quotas in joint-stock banks is more signi ficant.

Security,liquidity and pro fitability—three fundamental principles of commercial banks(Liu et al.,2012)—are dynamic and interactive,and banks seek to achieve a dynamic equilibrium among them.Asset liability management theory indicates that banks manage assets and liabilities simultaneously and achieve a balance point between risk and pro fit to control risk.Loans are a bank’s greatest assets;thus,asset management mainly refers to loan management.Assets and liabilities have a U-shaped relationship;that is,when credit loans rise to a certain level,a further increase generates greater risk(Calem and Rob,1999).When EPUincreases,banks encounter greater credit risk and deterioration of asset quality.According to asset liability management theory,a moderate decrease in credit quotas can prevent risk from rising unceasingly and push banks to achieve a new equilibrium between security and profitability.Song and Zheng(2011)find that conservative and rational developing strategies often bring about greater returns in Chinese commercial banks. This leads to the third hypothesis:

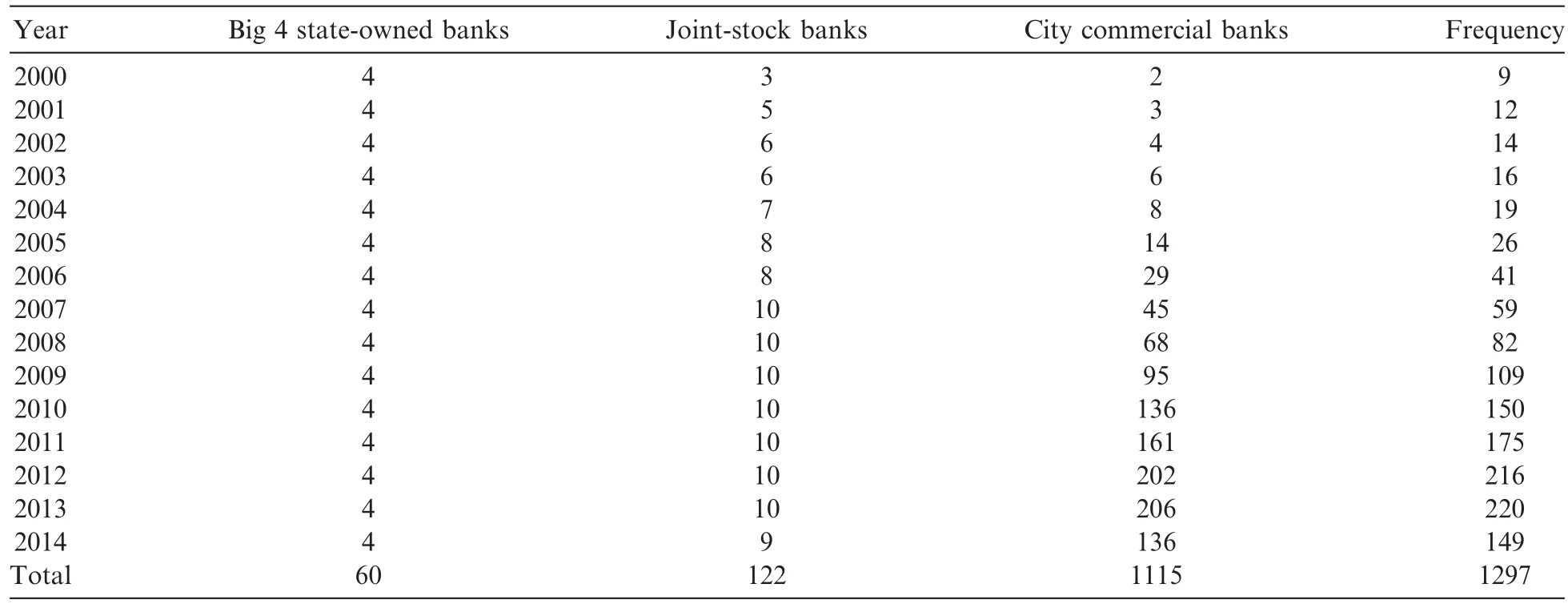

Table 1 Sample distribution by year.

H3.When economic policy uncertainty arises,banks can improve operational performance by decreasing the total supply of credit.

Our theoretical framework is illustrated in Fig.2.

3.Research design

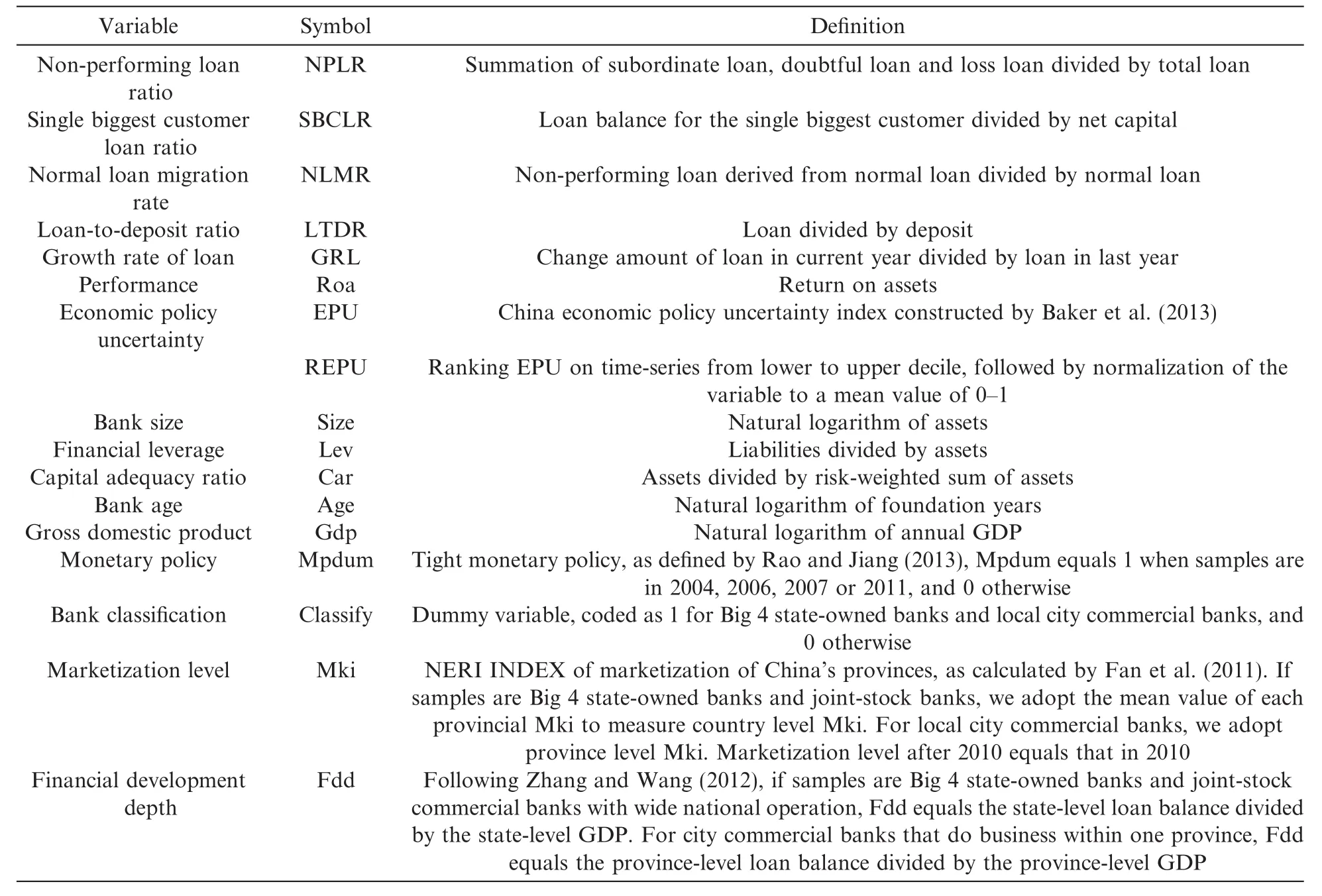

3.1.Sample

Our sample consists of Chinese commercial banks and the sample period is 2000–2014.We manually collect and sort the data on commercial banks from the CSMAR database,the BANKSCOPE database and each bank’s official website.Overall,we obtain 1297 observations,the composition and distribution of which are shown in Table 1.To remove outliers,all continuous variables are winsorized at 1%and 99%.

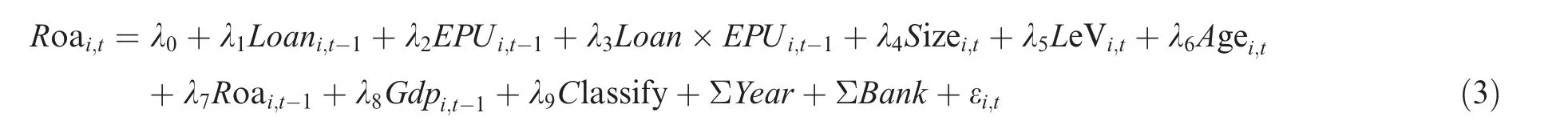

3.2.Key variables

3.2.1.Credit risks

Considering the commercial bank risk regulation core index issued by China’s bank regulatory commission, our research topic and data availability,we use three proxies to measure the credit risks of commercial banks. The first indicator is the non-performing loan ratio(NPLR),which equals the summation of subordinate, doubtful and loss loans divided by total loans.The second indicator is the single biggest customer loan ratio (SBCLR),which equals the loan balance for the single biggest customer,divided by net capital.This proxy reflects the degree of concentration for credit loans in commercial banks.The third indicator is the normal loan migration rate(NLMR),which equals the non-performing loans derived from normal loans,divided by normal loans.This measure depicts the dynamic changes in credit risk.

3.2.2.Loan sizes

In accordance with Qian et al.(2011),we design two indicators to measure loan size for commercial banks. The first proxy is the loan-to-deposit ratio(LTDR),which equals the loans divided by deposits.This indicator measures the static stock of loan sizes.The second proxy is the growth rate of loans(GRL),which equals the changes in loan amounts in the current year,divided by loans in last year.This proxy measures the dynamic changes in loan size.

3.2.3.EPU

To measure EPU for China,Baker et al.(2013)construct a scaled frequency count of articles about policyrelated economic uncertainty in the South China Morning Post(SCMP),Hong Kong’s leading Englishlanguage newspaper.The method follows their news-based indices of EPU for the US,Russia,Canada and other countries.

First,Baker et al.identify SCMP articles about economic uncertainty pertaining to China byflagging those that contain at least one term from each of the China EU term sets:{China,Chinese},{economy,economic} and{uncertain,uncertainty}.Second,they identify the subset of the China EU articles that also discuss policy matters.For this purpose,the articles must satisfy the following text filter:{{policy OR spending OR budget OR political OR‘interest rates”O(jiān)R reform}AND{government OR Beijing OR authorities}}OR tax OR regulation OR regulatory OR‘central bank”O(jiān)R‘People’s Bank of China”O(jiān)R PBOC OR deficit OR WTO.They use this compound filter because it outperforms simpler alternatives in their audit study.Third, they apply these requirements in an automated search of every SCMP article published since 1995,yielding a monthly frequency count of those about policy-related economic uncertainty.Fourth,they divide the monthly frequency count by the number of all SCMP articles in the same month.They then normalize the resulting series to a mean value of 100 from January 1995 to December 2011 by applying a multiplicative factor.

The methodology for constructing an economic policy index is analogous to that for used in creating a questionnaire survey,which is prevalently used in social science research.By measuring how concerned a news medium is about EPU,researchers can infer the extent to which participants in business activities perceive it when new economic policies are introduced.Baker et al.(2013)provide abundant evidence justifying the methodology for constructing this index and confirming its effectiveness.This index is also widely used in academic research and government decision making.

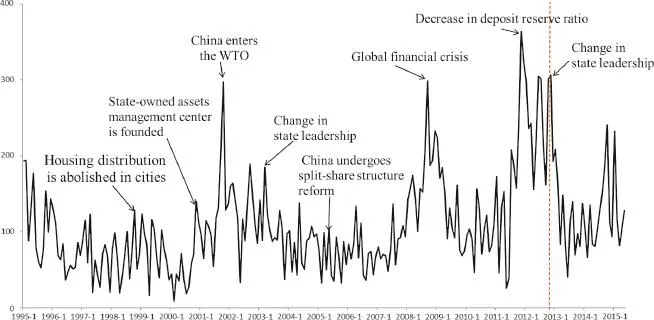

Figure 3.Timing of significant economic policies and index trends in China.

The reasonability of selecting the SCMP is reflected in the following aspects.First,Baker et al.(2013)construct an EPU index of the US based on 10 mainstream English newspapers,and the news reports in theSCMP are also English articles.As such,the effectiveness of the methodology for constructing the index cannot decline within the same language.Second,the SCMP cannot be affected by the media regulation in mainland China,which confirms the neutrality and timeliness of the news reports published in the SCMP.Third, the SCMP has a long and established history as the most credible and authoritative newspaper in Hong Kong, and even in Asia,over the last hundred years.The news published in the SCMP often includes in-depth reports and special analyses that possess great social influence and credibility.

To verify whether it is accurate to use this index to depict EPU in China,we collect and sort the significant economic policies or related events that occurred from January 1995 to January 2015,based on index construction.We then mark the timing of these significant policies or events and note the peak of the index curve. The corresponding relationship between timing and peak is illustrated in Fig.3.We find that the timing of significant policies or events and the peak of the index curve match to a great extent,indicating that the index constructed by Baker et al.(2013)can indeed depict EPU in China.

3.3.Model

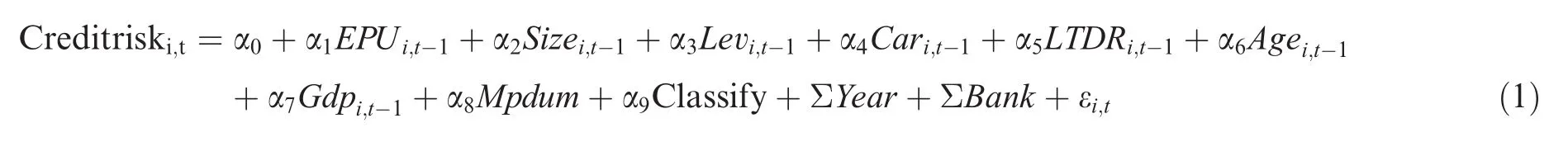

We use the following regression model to test H1:

The dependence variable is credit risk and consists of three variables:NPLR,SBCLR and NLMR—all of which measure the credit risks of commercial banks in different dimensions.The greater these variables are, the higher the credit risk is.The independent variable is EPU,and we use lagged EPU to alleviate the endogeneity problem.We control for bank size(Size),capital structure(Lev),capital adequacy ratio(Car),loan-todeposit ratio(LTDR),bank age(Age)and annual GDP(Gdp).We also control for monetary policy(Mpdum) because banks’lending decisions are inevitably affected by monetary policy,which changes many times during our sample period.The literature documents that the ratio of state-owned shares seriously influences lending decisions,but we cannot control for share structure directly due to data unavailability.Considering the features of Chinese banking systems,and knowing that the ratio of state-owned shares is greater in state-owned and city banks than in joint-stock banks,we design a dummy variable named‘Classify”to control for share structure.When the sample banks are state-owned and city banks,Classify equals 1,and 0 otherwise.We also control for year and bank dummies in the regression model.According to the theoretical analysis of H1,we predict that the coefficient of EPU should be significantly positive.

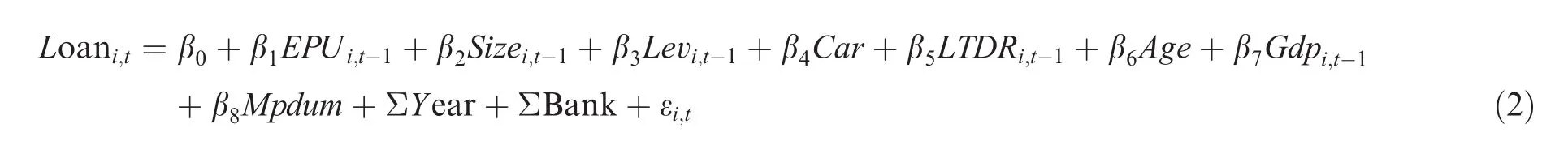

We adopt the following regression model to test H2a and H2b:

The dependence variable is loan size(Loan)and consists of two variables:LTDR and GRL.The independent variable is lagged EPU.According to the theoretical analyses of H2a and H2b,we predict that the coefficient of EPU should be signi ficantly negative.To test H2b,we partition the full sample into two subsamples based on the dummy variable Classify,and predict the coefficient of EPU in the subsample where Classify equals 0 to be more pronounced.The control variables are the same as in the first regression model,and thus are not explained here.

We design the following regression model to test H3:

Table 2 Variable definitions.

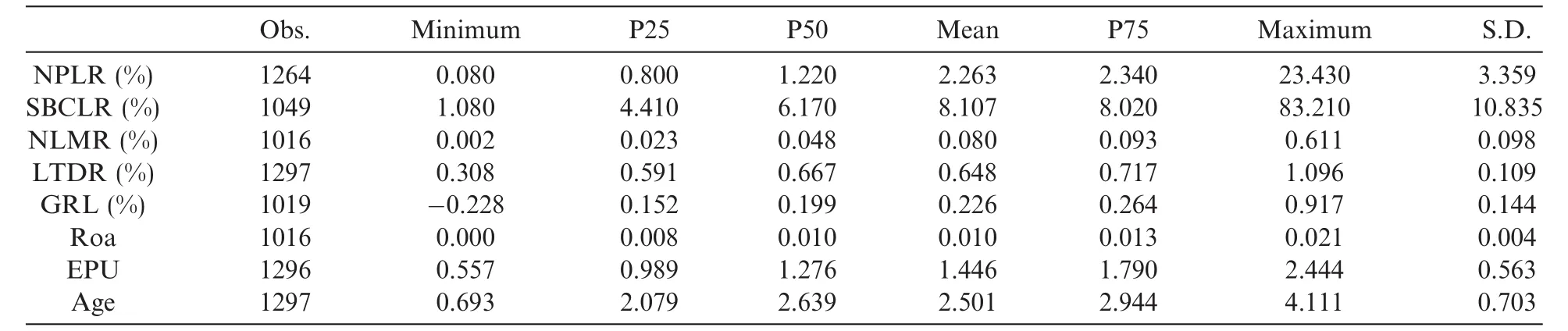

Table 3 Descriptive statistics.

The dependent variable is ROA,which measures bank performance.We mainly focus on the interaction term of Loan and EPU,such that if the coefficient of interaction is significantly negative,then H3 is confirmed. The control variables are the same as in the first and second regression models,and we control for lagged ROA to remove the time-series change of performance.Table 2 presents the variable definitions used in all of the regression models.

3.4.Descriptive statistics

Table 3 provides descriptive statistics about key variables used in the three regression models.The mean (maximum)NPLR for the sample banks is 2.27%(23.43%).The minimum(maximum)SBCLR is 8.11%(83.21%).According to the commercial bank risk regulation core index issued by China’s bank regulatory commission,NPLR should be less than 5%and SBCLR should be less than 10%.This means that core risk indices meet requirements on average,but some commercial banks do not manage credit risk in accordance with regulations.The mean(maximum)value of EPU is 1.45(2.44),with a standard deviation of 0.56,suggesting that EPU in China is rather high on average,with significantfluctuation.LTDR has a minimum(maximum)value of 0.308(1.096);ROA is 0.01 on average and has a maximum value of 0.021;and Bank age has a minimum(maximum)value of 0.693(4.111).These statistics are consistent with the stratified and incremental development features of China’s banking systems.

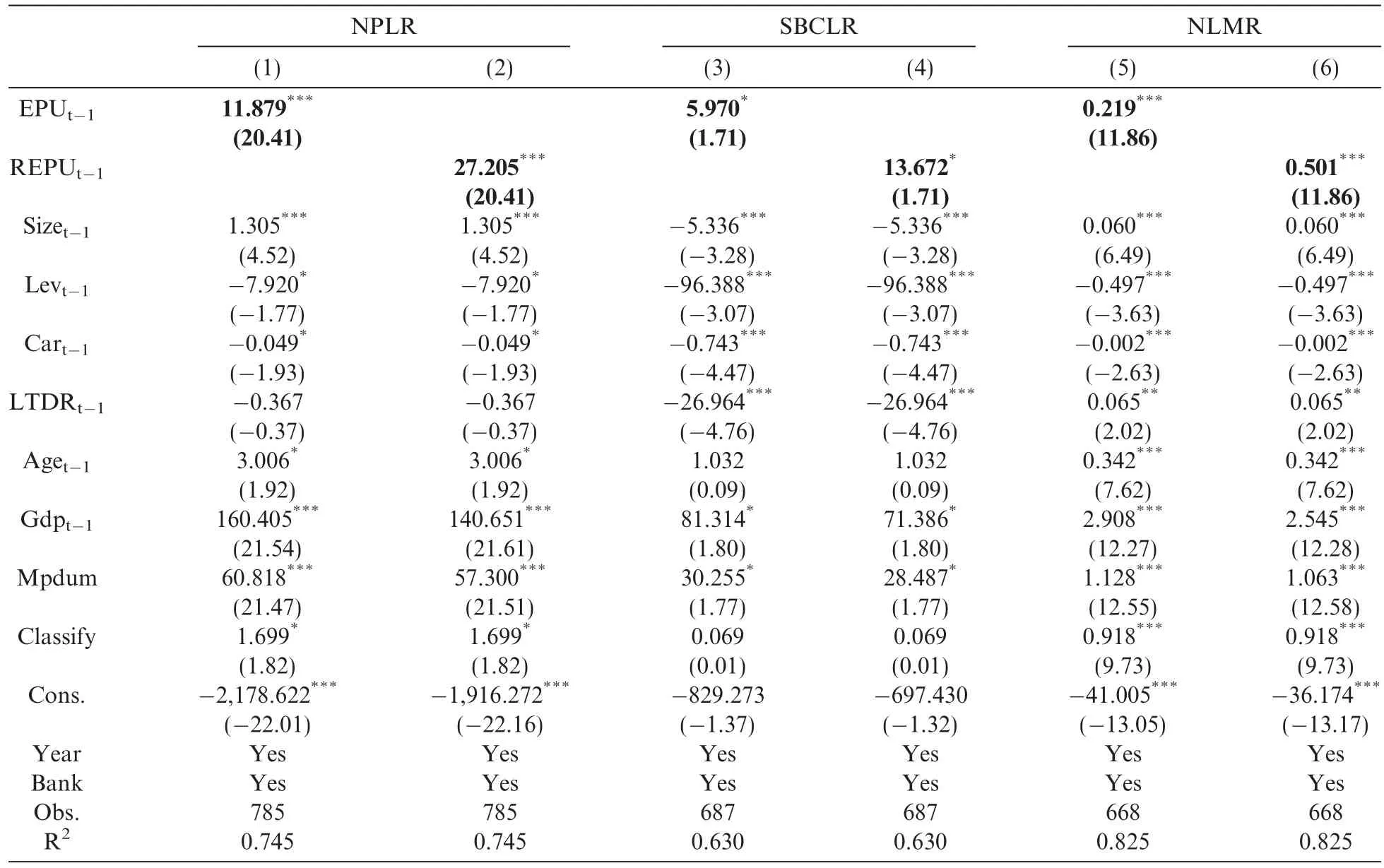

Table 4 The effect of EPU on credit risks.

4.Empirical results

4.1.EPU and credit risks

Table 4 presents the regression results for the first model with Credit risk as the dependent variable.Columns 1 and 2 report the results for the model with NPLR as the dependent variable,and they show that the coefficient of EPU(REPU)is 11.879(27.205)and statistically significant at the 1%level.These results document that greater EPU results in higher NPLR.Columns 3 and 4 report the results for the model with SBCLR as the dependent variable.We find that the coefficient of EPU(REPU)is 5.97(13.672)and statistically significant at the 10%level.This means that EPU significantly affects SBCLR.Columns 5 and 6 report the results for the model with NLMR as the dependent variable.The coefficient of EPU(REPU)is 0.219 (0.501)and statistically significant at the 1%level,suggesting that the increase in EPU can result in morenon-performing loans.Additionally,the coefficients of EPU in Table 4 are 11.978,5.97 and 0.219,and the corresponding economic implications are that a unit increase in EPU can generate a 12%increase in NPLR, a 6%increase in SBCLR and a 0.2%increase in NLMR,respectively.All of these results support our H1 in different dimensions.

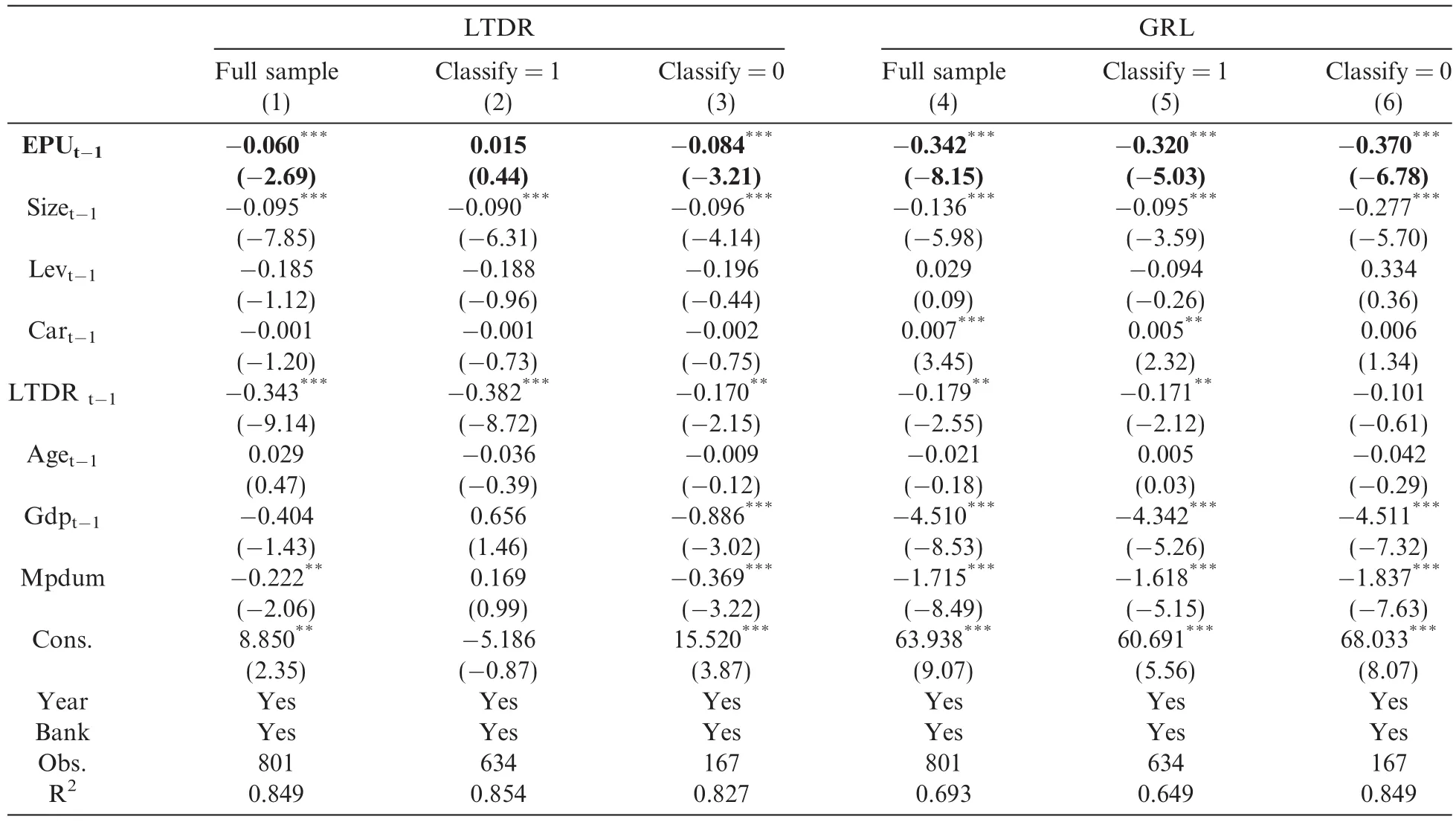

Table 5 Effect of EPU on loan size.

4.2.EPU and adjustment of loan sizes

Table 5 presents the regression results for the second model with Loan size as the dependent variable.2The results remain the same for the regression model with REPU as the independent variable.We do not report these results due to space limitations.In Columns 1,2 and 3,the dependent variable is LTDR,whereas in Columns 4,5 and 6,it is GRL.Column 1 reports the results for the regression model with the full sample,and the coefficient of EPU is–0.06 and statistically significant at the 1%level.Then,we split the sample into two groups based on the dummy variable Classify,and the results are represented in Columns 2 and 3.Comparing Columns 2 and 3,the coefficient of EPU in the former is not significant,but in the latter it is–0.084 and statistically significant at the 1%level. These results confirm that EPU can adversely affect LTDR,particularly among joint-stock banks.The fullsample regression results in Column 4 of Table 5 show that the coefficient of EPU is-0.342 and statistically significant at the 1%level.The split-sample regression results in Column 5(6),where Classify equals 1(0), show that the coefficient of EPU is-0.342(-0.37)and thetvalue is-5.03(-6.78).Taken together,the regression results in Table 5 reveal that EPU adversely affects loan size,and that this effect is more pronounced in joint-stock banks,confirming H2a and H2b.

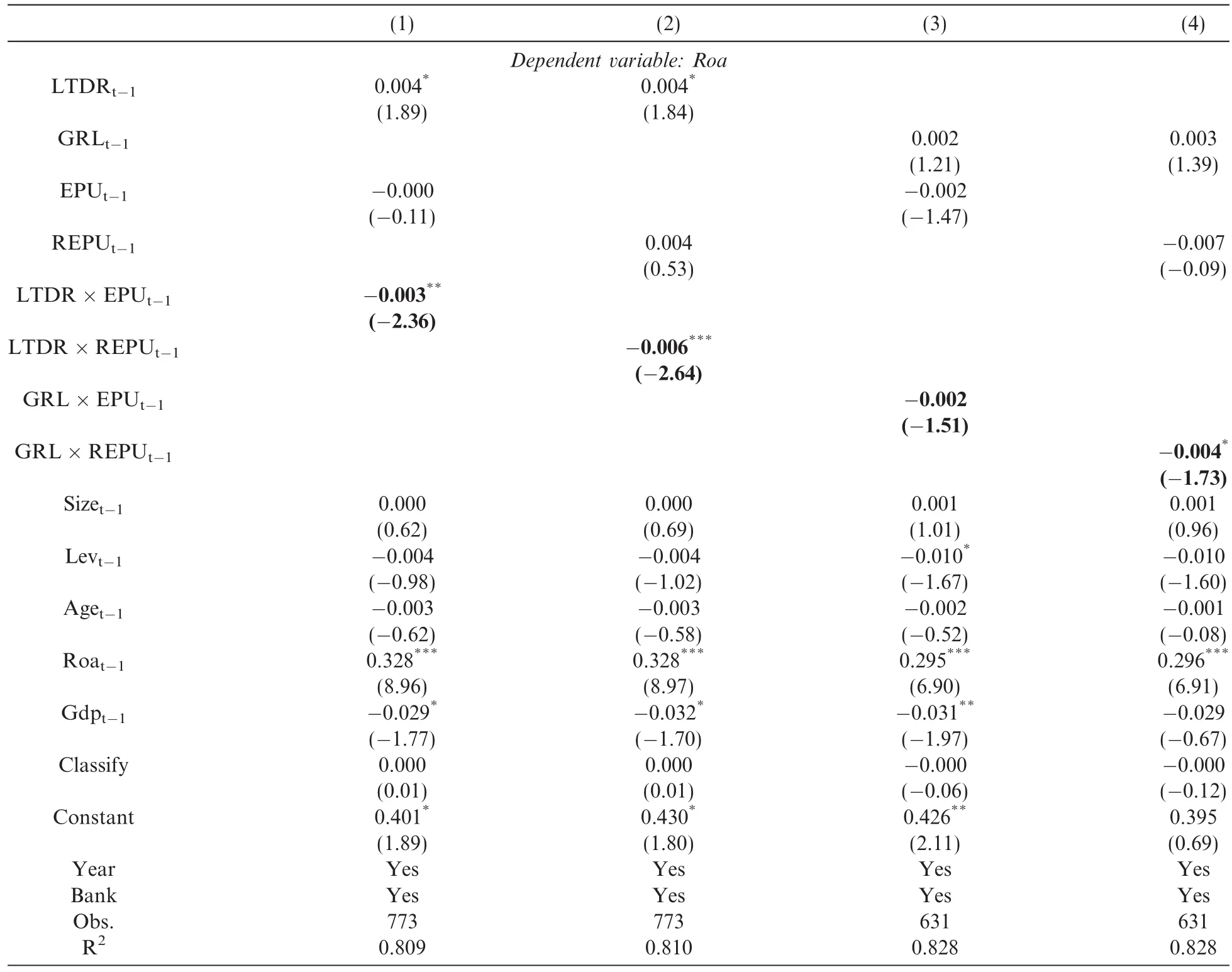

Table 6 EPU,lending decisions and performance.

For the control variables,the coefficient of Size is significantly negative,which shows that loan size is relatively low in large-scale banks,perhaps because the latter are more capable of deposit taking,exhibit higher market share stability and boast better customer relationships—all of which generate smaller loan sizes.The coefficient of MP is significantly negative,which shows that loan sizes decline when governments implement tight monetary policies.

4.3.EPU,adjustment of loan sizes and performance

Facing increasing EPU,is it beneficial to the operational performance of commercial banks to adjust loan sizes downward?We test H3 using the third regression model and report the results in Table 6.Column 1 represents the results for the regression model in which the dependent variable is ROA and LTDR is used to measure loan size.We construct the interaction term of Loan size with EPU and find that the coefficient of interaction labeled LTDR×EPU is statistically negative at the 5%level(coefficient is-0.003,tvalue is -2.36).In Column 2,we construct the interaction term of Loan size with REPU and find that the resultsare consistent with those in Column 1.In Columns 3 and 4,we use GRL as an alternative proxy of loan size, and design the interaction term of GRL with EPU(REPU).The results show that the coefficient of GRL×EPU is negative but not statistically significant in Column 3,whereas the coefficient of GRL×REPU is statistically negative.For the control variables,the coefficient of lagged ROA is statistically positive,indicating that past performance can positively influence current performance.The coefficient of lagged Gdp is statistically negative,which is consistent with contra-cyclical economic development(Pan and Zhang, 2013).Consequently,the results reported in Table 6 prove H3;that is,that banks can improve performance by adjusting loan sizes downward when EPU arises.

5.Additional analyses

The literature suggests that institutional environments are varied and unbalanced in different regions within China,and they inevitably influence financial development and banking operations.Therefore,in this section we further analyze whether and how the differences in institutional environments influence the effects of EPU on commercial banks.We use marketization level and financial development depth to depict the differences in institutional environments.

Our first variable is marketization level.Fan et al.(2011)construct the marketization index using five aspects:the relationship between government and market,non-state-owned economic development,product market development,factor market development,intermediary organization development and law system. Marketization level can regulate the relationship between EPU and lending decisions through the following mechanisms.First,the greater the marketization level,the weaker the government’s intervention in lending decisions.In this circumstance,commercial banks canflexibly and independently manage assets and liabilities to weaken the uncertainty shock resulting from economic policies when banks evaluate governmental policies.Second,when the marketization level is greater,governments play more service-oriented roles and are more likely to seek advice from the public to improve the accuracy and enforceability of economic policies. High-quality government service and economic governance capacity can lower the uncertainty stored in economic policies,reducing the shock of EPU on the lending decisions of commercial banks.Third,intermediary organizations including journalists,accountants,lawyers,analysts,etc.,fare better in environments with higher marketization levels.Abundant information from these intermediary organizations can help commercial banks to scientifically understand and judge economic policies,ultimately reducing the effects of economic policies on banks’lending decisions.Therefore,we assume that the effects of EPU on commercial banks are more pronounced in regions with low marketization levels.

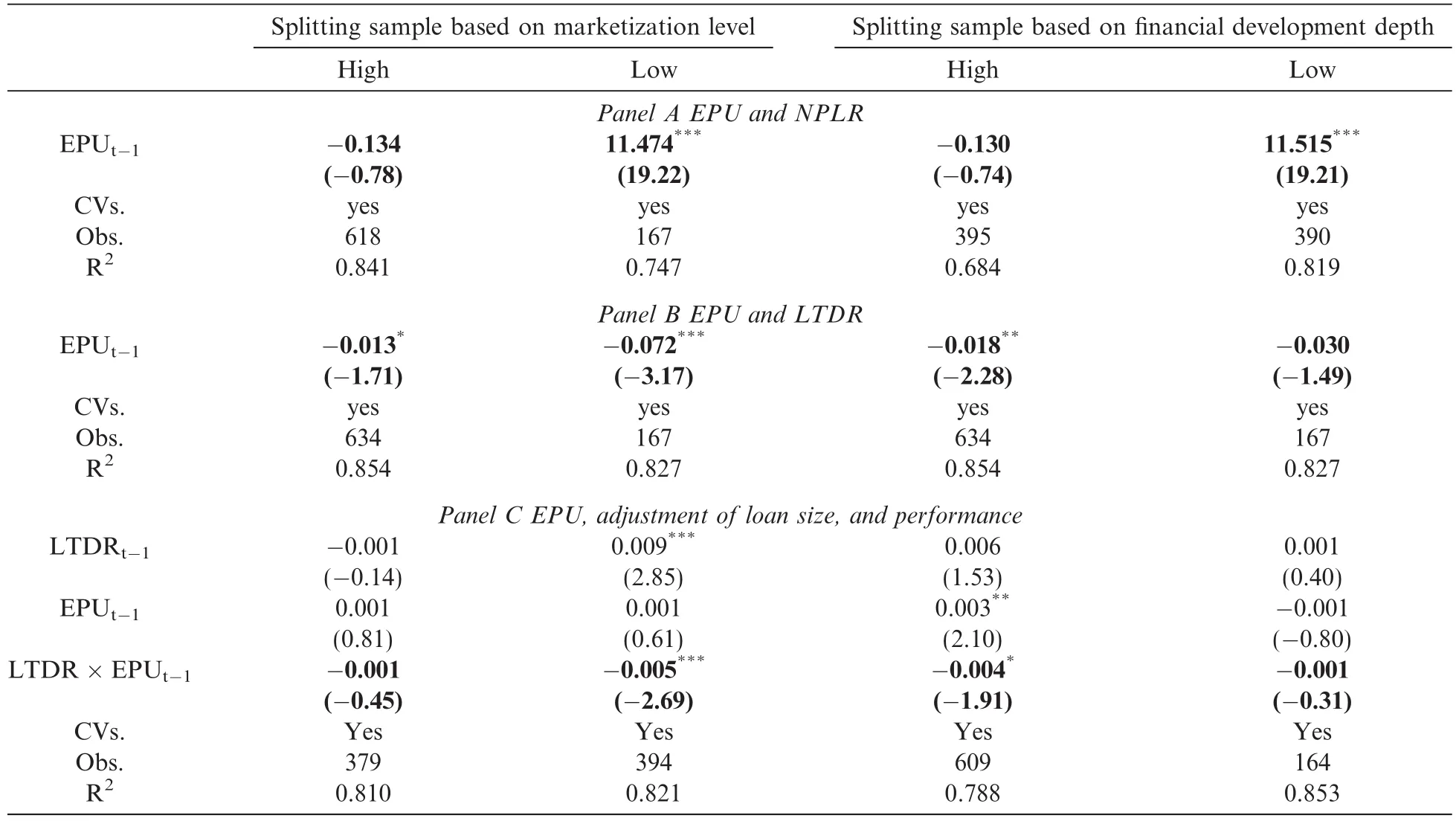

Table 7 Results of additional tests.

Our second variable is financial development depth.This variable depicts to what extent finance permeates the real economy.Greater financial development depth deepens economical monetization and financialization, giving banks a greater effect on real economic development.When the level of financial development depth is high,governments are more likely to consider the effects of economic policies on financial institutions and credit resources,especially for policies that are directly related to monetary and loan policies.From this perspective,EPU’s effects on commercial banks may be more pronounced in regions with lower levels of financial development depth.From another perspective,greater financial development depth implies that banks permeate the real economy,and thus are easily shocked by anyfluctuations.This means that banks are extremely sensitive to the shock of EPU on customer enterprises.According to this theoretical analysis,we assume that the effect of EPU on the lending decisions of commercial banks can be relatively pronounced in regions with greater financial development depth.

The results for these additional analyses are reported in Table 7.We split our sample into four subsamples based on the median values of marketization level and financial development depth.Panel A reports the results of the first regression model.Within the low marketization level subsample,the coefficient of EPU (11.474)is statistically negative(tvalue is 19.22),and it is not significant in the high marketization level subsample.When we split the sample based on the median value of financial development depth,we find the same results.Within the low financial development depth subsample,the coefficient of EPU(78.575)is statistically negative(tvalue is 16.742),and it is not significant in the high financial development depth subsample.Based on Panel A of Table 7,we show that the effects of economic policies on credit risks are moderated by institutional environments.Specifically,increases in marketization levels and financial development depth can moderate the adverse shock of EPU on the credit risks of commercial banks.

Panel B of Table 7 presents the results for the second regression model.The coefficient of EPU(-0.072)is signi ficantly negative at the 1%level(tvalue is-3.17)in the low marketization level subsample,but signi ficantly negative at the 10%level(coefficient is-0.013,tvalue is-1.71)in the high marketization level subsample.When we split the sample based on the median value of financial development depth,the coefficient of EPU is not signi ficant in the low subsample but statistically signi ficant at the 5%level(coefficient is -0.018,tvalue is-2.28)in the high subsample.The results reported in Panel B show that the shock of EPU on loan size is more pronounced in the regions with lower marketization levels.The co-movement between banks’lending decisions and the financing and investments of enterprises is stronger with increased financial development depth.The shock of EPU on enterprises has a greater spillover effect on the lending decisions of commercial banks.Consequently,increases in financial development depth can strengthen the adverse shock of EPU on the credit risks of commercial banks.

Panel C of Table 7 shows the results for the third regression model.Similarly,we focus on the coefficient of the interaction term.In the low marketization level subsample,the coefficient of the interaction term(-0.005) is signi ficantly negative at the 1%level(tvalue is-2.69),but not signi ficant in the high marketization level subsample.The coefficient of the interaction term(-0.004)is also signi ficantly negative at the 10%level(tvalue is-1.91)in the high financial development depth subsample,but not signi ficant in the low financial development depth subsample.The contributing causes of these results are that banks that are adversely shocked by EPU are more flexible and independent in managing assets and liabilities to achieve equilibrium among security,liquidity and pro fitability when the marketization level is relatively high.In contrast,banks must carefully consider the possible shock of adjustments to loan sizes on the real economy when financial development depth increases,particularly in Chinese banking systems where state-owned shares are generally high and it is difficult for commercial banks to achieve such equilibrium by adjusting loan sizes downward.

The results reported in Table 7 show that an increase in marketization level(financial development depth) weakens(strengthens)the adverse effects of EPU on the credit risks and loan sizes of commercial banks.These results imply that commercial banks find it easy to balance security and profitability by adjusting loan sizes when the marketization level is low,and find it difficult to reach the goal of risk management when financial development depth increases.

6.Conclusion and implications

Some researchers are beginning to pay attention to the consequences of EPU,but they are mainly focusing on how it influences the macro-economic development and investment decisions of enterprises,while the mechanisms through which commercial banks deliver the effects of macro-economic policies on enterprises are overlooked.Our research fills this gap by investigating whether and how EPU affects the operational behavior of enterprises.Our results show that EPU can increase NPLR,SBCLR and NLMR,and adversely affect the loan sizes of commercial banks by shocking enterprises’demand for and banks’supply of credit resources,particularly in joint-stock commercial banks.When faced with an increase in EPU,banks can improve performance by reducing loan sizes.Marketization levels and financial development depth can also be used to modulate the effects of EPU on commercial banks.

Our results have the following implications.First,to lower the information asymmetry between commercial banks and raise the efficiency of credit resource allocation,governments should pay more attention to improving the opacity,smoothness,consistency and enforceability of economic policies.Second,commercial banks should pay more attention to the dynamic adjustment of risk management indicators and lending decisions based on changes in economic policies to balance security,liquidity and profitability when serving the real economy.

Acknowledgment

Qinwei Chi and Wenjing Li are grateful for the valuable comments from referees,and for support from the National Natural Science Foundation of China(Project Nos.71032006 and 71372167).

References

Baker,S.,Bloom,N.,Davis,S.,2013.Measuring Economic Policy Uncertainty.Chicago Booth Research Working Paper.

Barry,T.,Laetitia,L.,Tarazi,A.,2011.Ownership structure and risk in publicly held and privately owned banks.J.Bank.Financ.35(5), 1327–1340.

Cai,W.D.,Zeng,Q.,2012.Competition,privatization and the change in lending behaviors of commercial banks.J.Financ.Res.2,73–78 (in Chinese).

Calem,P.,Rob,R.,1999.The impact of capital-based regulation on bank risk-taking.J.Financ.Intermed.8(4),317–352.

Fan,G.,Wang,X.L.,Zhu,H.P.,2011.NERI INDEX of Marketization of China’s Provinces 2011 Report.Economic Science Press, Beijing(in Chinese).

Fan,Y.A.,Xu,B.,2015.China Business Report(2014).CEIBS,Shanghai(in Chinese).

Feng,Y.,2001.Political freedom,political instability,and policy uncertainty:a study of political institutions and private investment in developing countries.Int.Stud.Quart.45,271–294.

Gulen,H.,Ion,Mihai,2015.Policy Uncertainty and Corporate Investment.Purdue University Working Paper.

Johnson,S.,Boone,P.,Breach,A.,Friedman,E.,2000.Corporate governance in the Asian financial crisis.J.Financ.Econ.58(1),141–186.

La Porta,R.,Lopez-de-Silanes,F.,Shleifer,A.,Vishny,R.W.,1998.Law and finance.J.Polit.Econ.106(6),1113–1150.

La Porta,R.,Lopez-de-Silanes,F.,Shleifer,A.,2002.Government ownership of banks.J.Financ.57(1),265–301.

Laeven,L.,Majnoni,G.,2005.Does judicial efficiency lower the cost of credit?J.Bank.Financ.29(7),1791–1812.

Le,Q.,Zak,P.,2006.Political risk and capitalflight.J.Int.Money Financ.25,308–329.

Li,F.Y.,Yang,M.Z.,2015.Does economic policy uncertainty reduce investment of firms?Evidence from China economic policy uncertainty index.J.Financ.Res.4,115–129(in Chinese).

Liu,M.F.,Zhang,X.L.,Zhang,C.,2012.The research on diversification,operational performance and risk correlation.Stud.Int.Financ. 8,59–69(in Chinese).

Pan,M.,Zhang,Y.R.,2013.Does ownership structure affect the periodic features of lending behaviors in commercial banks?Evidence from banking industry in China.J.Financ.Res.4,29–42(in Chinese).

Pan,M.,Zhang,Y.R.,2012.The research on risk taking of banks under macro-economicfluctuation:on the perspective of heterogeneity of ownership structure.Financ.Trade Econ.10,57–65(in Chinese).

Pastor,L.,Veronesi,P.,2013.Political uncertainty and risk premia.J.Financ.Econ.110,520–545.

Panousi,V.,Papanikolaou,D.,2012.Investment,idiosyncratic risk,and ownership.J.Financ.67,1113–1148.

Qian,J.,Strahan,P.E.,2007.How laws and institutions shape financial contracts:the case of bank loans.J.Financ.62(6),2803–2834.

Qian,X.H.,Cao,T.Q.,2015.Law,credit and lending decision of banks:evidence from survey in Shandong province.J.Financ.Res.5, 101–116(in Chinese).

Qian,X.H.,Cao,T.Q.,Li,W.A.,2011.Promotion pressure,officials’tenure and lending behavior of city commercial banks.Econ.Res.J. 12,72–85(in Chinese).

Rao,P.G.,Jiang,G.H.,2013.The impact of monetary policy on the relationship between bank loans and business credits.Econ.Res.J.1, 68–82(in Chinese).

Song,Q.,Zheng,Z.L.,2011.Basel agreement III,risk aversion and banks’performance.Stud.Int.Financ.8,67–73(in Chinese).

Ulrich,M.,2012.Economic Policy Uncertainty and Asset Price Volatility.Columbia Business School Working Paper.

Wang,H.J.,Li,Q.Y.,Xin,W.,2014.Economic policy uncertainty,cash holding and market value.J.Financ.Res.9,53–68(in Chinese).

Zhang,M.,Liu,Z.,Zhang,W.,2012.Related party loan and compensation contract of commercial banks.J.Financ.Res.5,108–122(in Chinese).

Zhang,J.H.,Wang,P.,2012.Bank risk taking,bank loans,and legal protection.Econ.Res.J.5,18–30(in Chinese).

Zhu,B.X.,2002.Research on system risk of commercial banks.Manage.World 11,136–147(in Chinese).

Zuzana,F.,Risto,H.,Laurent,W.,2011.The Influence of Bank Ownership on Credit Supply:Evidence from the Recent Financial Crisis. BOFIT Discussion Papers,No.34.

*Corresponding author.

E-mail address:1596425chi@163.com(Q.Chi).

http://dx.doi.org/10.1016/j.cjar.2016.12.001

1755-3091/?2016 Production and hosting by Elsevier B.V.on behalf of Sun Yat-sen University.

This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

Credit risks

Lending decisions

China Journal of Accounting Research2017年1期

China Journal of Accounting Research2017年1期

- China Journal of Accounting Research的其它文章

- Are academic independent directors punished more severely when they engage in violations?☆

- Employee quality,monitoring environment and internal control

- Regulatory pressure and income smoothing by banks in response to anticipated changes to the Basel II Accord☆

- Accounting research in banking–A review