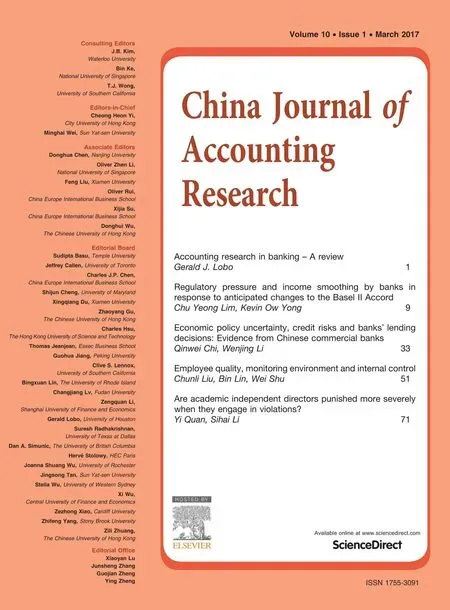

Accounting research in banking–A review

Gerald J.Lobo

University of Houston,United States

Accounting research in banking–A review

Gerald J.Lobo

University of Houston,United States

1.Why carry out accounting research in the banking industry?

1.1.Why focus on the banking industry?

The banking industry is critically important to national and global economies.Banks are vital to the operation of a country’s domestic economy in their role as depository institutions and lenders to both corporations and individuals.For example,Fields et al.(2004)estimate that banks represent over twenty percent of the total public equity market capitalization in the United States.

Compared to industrial firms, firms in the banking industry have a number of distinct characteristics that suggest interesting topics for research.First,banks have an unusually high degree of leverage relative to other firms,with the leverage ratio in the banking sector reported to be as high as 90%.Employing an analytical model,DeAngelo and Stulz(2015)demonstrate why it is optimal for banks to be highly leveraged.In their model,high bank leverage is notthe resultofmoral hazard,taxes or any of the other leverage-related distortions outlined in Modigliani and Miller(1958).In an idealized setting without any such distortions,the only motive for a bank to issue debt is the value generated by servicing the demand for socially valuable safe/liquid claims.

Second,banks have a different governance structure from non- financial firms.Kroszner and Strahan(2001) find that banks in the 1992 Forbes 500 had larger boards and a lower fraction of insiders than non- financial firms.Adams(2011)also reports bank boards to be larger and more independent than the boards of nonfinancial firms in the Riskmetrics database of S&P 1500 firms from 1996 to 2007.However,recent proposals to improve bank governance,such as that made by Walker(2009),suggest that bank governance structures are ineffective because of their differences from those of non- financial firms.The current bank governance regime is also blamed for being responsible in large part for the subprime mortgage crisis(Adams and Mehran,2011).

Third,banks operate with a higher degree of information uncertainty than other firms.Bank operations and products are complex,rendering it difficult to assess risks of large and diverse portfolios of loans or other financial instruments(Autore et al.,2009).Given these complexities,it is difficult to fully understand all the relevant information when communicating about a bank’s future prospects.

Finally,banks are highly regulated.In the United States,they are subject to the scrutiny of the Federal Deposit Insurance Corporation(FDIC),Federal Reserve Board and other government agencies.Regulation restricts banks’activities and imposes other conditions.For example,banks have to maintain minimum levelsof capital,and they were not allowed to engage in the issuance of securities until the late-1990s.Moreover, governments in some countries provide deposit insurance and guarantees,which change the way banks think about risk,an important issue during the recent financial crisis.The highly regulated nature of the industry renders banks relatively homogeneous compared with industrial firms,both in terms of their operating activities and accounting practices.Focusing on a single,relatively homogeneous industry with relatively homogeneous accounting practices facilitates control over other determinants of cross-sectional differences,thus increasing the reliability of inferences from empirical analysis.Hence,focusing on the banking industry allows researchers to avoid many of the problems that arise when dealing with industrial firms.

1.2.Accounting research in the banking industry

The financial crisis of 2007–2009 sparked a surge in accounting and finance research on the banking industry.Conducting accounting research on this industry has many advantages.

First,the banking industry is a good setting for investigating earnings management.Banking was a profitable industry until 2007,and became highly profitable once again after the financial crisis.For example,in 2001,the industry ranked second in profitability after pharmaceuticals among Fortune 500 firms in the United States(Public Citizen,2002)and ranked third in returns on revenue in 2005(CNNMoney.com).These high levels of profitability provide opportunities and incentives for managers to earn quasi-rents by distorting earnings.Moreover,the complexity of banking operations and the high level of information asymmetry increase the need for the communication of private information,and thus also expand opportunities for earnings management.

Second,as the banking industry is highly regulated,there are several regulations that affect banks’financial reporting,auditing,internal control,etc.In 1991,the FDIC Improvement Act(FDICIA)imposed new auditing,corporate reporting and governance requirements on depository institutions with assets exceeding US $500 million(this threshold was raised to$1 billion in 2005)and on their auditors(Murphy,2004).More specifically,the FDICIA requires bank management to evaluate the bank’s internal controls over financial reporting,and auditors to attest to and report on the effectiveness of those controls.Such requirements,particularly in the wake of the financial crisis,raise many interesting and important accounting-related research questions.For example,Jin et al.(2011)examine whether and how accounting and audit properties predicted impending bank failures and trouble during the crisis.

Finally,the exogenous shock to the system caused by the 2008–2009 financial crisis has created considerable interest in conducting research on the banking industry.For example,the crisis provides an ideal setting in which to test the implications of discretionary reporting choices for risk-taking and financial stability. Moreover,as with any empirical research,data constitute the foundation and the banking industry offers a large body of detailed information for public and private banks that is readily available to researchers.

2.What have we learned from recent accounting research in banking?

2.1.Use of reporting discretion

The majority of accounting research in the banking arena focuses on how bank managers use their reporting discretion.Bank managers haveflexibility when preparing financial statements.Therefore,how they use thatflexibility,and particularly whether they manipulate financial reporting,is deserving of study.

Unlike studies on the use of reporting discretion in by non-banking firms,research in the banking sector generally focuses on a single accrual,loan loss provision(LLP)or loan loss allowance(LLA).LLP(LLA) is by far the largest and most important accrual for banks.In normal times,the median ratio of LLP to earnings before LLP ranges between 15%and 20%,according to most studies,and the median ratio of LLA to stockholders’equity is around 10%.Bank managers estimate LLP to reflect changes in expected future loan losses,a process that allows them wide latitude for discretion in LLP estimation(Kanagaretnam et al.,2003). Moreover,the degree of discretion depends on the type of loan.For example,homogeneous loans typically provide management with lessflexibility in estimating LLP than do heterogeneous loans.Bank managers’use of discretion in estimating LLP has received considerable attention from the U.S.Securities and ExchangeCommission(SEC)and bank regulatory agencies.The incurred loss model currently used to estimate LLP (LLA)is similar to accounting for contingencies,which means that bank managers are often estimating the likely implications of events that have already occurred.However,in July 2014,the International Accounting Standards Board issued a new version of IFRS 9,which introduces an expected loss model for the recognition and measurement of LLP(LLA).This model allows managers to incorporate estimates of potential future events,and therefore affords managers considerably more discretion than does the incurred loss model.

As noted,the banking literature generally focuses on a single accrual,that is,LLP or LLA.Focusing on a single accrual facilitates a sharper separation of abnormal(discretionary)and normal(nondiscretionary) accruals.Healy and Wahlen(1999)also state that examining specific accruals allows researchers to provide direct evidence for standard setters concerning which standards work well and where there may be room for improvement.Moreover,the measures of abnormal accruals commonly used for industrial firms are subject to serious measurement errors(McNichols,2002).For example,Dechow et al.(2010)show that in crossindustry samples it is difficult to disentangle the smoothness of reported earnings that reflect the smoothness of the(i)fundamental earnings process,(ii)accounting rules,and(iii)intentional earnings manipulation. McNichols(2002)also argues that the complexity associated with the modeling of estimation errors in aggregate accruals is daunting,and that proxies based on aggregate accruals have poor construct validity.Because LLP(LLA)has a more uniform accrual-generating process,it can be decomposed into its nondiscretionary and discretionary components more accurately,thus increasing the power of tests related to discretionary accounting choices.

Bank managers’use of reporting discretion can be classified into two categories based on their motivation. The first is bank managers’use of discretion for reasons of efficiency.For example,they may use LLP(LLA) to signal private information,smooth income to reduce perceived risk,or obtain external financing.The second is their use of discretion for opportunistic reasons.For example,they may use LLP(LLA)to meet or beat performance benchmarks,increase reported income,or enhance job security.The rest of this presentation reviews some of the most important topics relating to bank managers’reporting discretion.

2.1.1.Signaling

Bank managers have an incentive to communicate their private information on the bank’s favorable future prospects.One approach is to signal that the bank is strong enough to absorb future potential losses by increasing current LLP.A common explanation for why increased current LLP constitutes good news is that bank managers are more likely to take hits to current earnings when the bank’s future earnings prospects are favorable(Lobo and Yang,2001).The main empirical approach used to test the signaling hypothesis is to examine the relation between current returns and current discretionary LLP or that between changes in future cashflows and current discretionary LLP.Current discretionary LLP should be positively related to both abnormal returns and changes in future cashflows under the signaling hypothesis.

There is considerable evidence supporting the signaling hypothesis.Beaver et al.(1989)recognize that investors interpret an unexpected increase in LLP as a signal of a bank’s financial strength.Scholes et al. (1990)find that bank managers can lower their cost of capital by conveying private information to investors by exercising discretion over LLP.Wahlen(1994)offers evidence to show that bank managers increase the discretionary component of current LLP when cashflow prospects are expected to improve in future.Consistent with Wahlen’s(1994)findings,Beaver and Engel(1996)also find a positive relationship between bank’s discretionary LLP and stock price.Moreover,Beaver et al.(1997),Liu et al.(1997)and Kanagaretnam et al. (2009)also document evidence of signaling.Ahmed et al.(1999),in contrast,find no evidence in support of signaling and do not observe a positive relationship between one-year-ahead change in operating cashflows and discretionary LLP.

2.1.2.Smoothing

Bank managers’income smoothing behavior has long been the subject of considerable attention from the SEC and banking agencies.In fact,LLP is one of the items under scrutiny by the SEC’s task force on earnings management(The Wall Street Journal,16 November 1998).Banks have strong incentives to smooth income to avoid potential regulatory monitoring due to unusually high or low levels of earnings and to reduce their perceived risk.The implicit assumption is that regulators pay particular attention to banks with unusually high orlow earnings(Lobo and Yang,2001).Beatty et al.(1995)also confirm that regulators monitor banks based on their earnings.Given that LLP is an expense,banks can decrease their income in good times by increasing their LLP and increase their income in bad times by decreasing it.The general approach to testing the smoothing hypothesis is to examine the relation between discretionary LLP and contemporaneous earnings before taxes and provisions.

Numerous studies explore the use of discretion over LLP for smoothing income,but the evidence is mixed. Wahlen(1994),for example,documents a positive relationship between unexpected provisions and current pre-loan loss earnings,which means that the discretionary components of unexpected provisions are used to smooth earnings.Kanagaretnam et al.(2004)find the propensity to smooth income to be stronger for banks with good or poor current performance relative to those with moderate performance.Collins et al.(1995),Liu and Ryan(2006),Fonseca and Gonzalez(2008)and Kilic et al.(2013)also report evidence in support of smoothing.Moyer(1990),Beatty et al.(1995)and Ahmed et al.(1999),in contrast,find no evidence of smoothing.Beatty et al.(1995)fail to find any evidence of LLP being used to manage earnings,and Wetmore and Brick(1994)argue that the income smoothing incentive is not a major factor in determining LLP.

2.1.3.Risk-taking

Banks can also use their discretion over LLP(LLA)to manage risk.They can do so by recognizing LLP (LLA)earlier(later),which creates incentives for taking less(more)risk.For example,banks can manage risktaking by being more or less conservative in their LLP(LLA)accounting.Banks with a high reported LLP and low reported income in the current period will draw the attention of regulators,and thus limit their risk-taking.Moreover,banks’loan officers are evaluated by the net amount they earn from loans.Hence, if a bank is quite conservative in reporting the LLP for each loan,the LLP amount becomes larger and the loan officer earns less.Under this scenario,loan officers may typically have incentives to take fewer risks in granting loans.The general approach used to test the risk-taking hypothesis is to examine the relation between discretionary LLP(LLA)and risk-taking.

There is some evidence indicating that banks use their discretion over LLP(LLA)for risk management purposes.Jin et al.(2016)argue that banks use their discretion over LLA for efficiency rather than opportunistic purposes,which means that they use that discretion to build a cushion to write offfuture losses and manage risk,not to manage earnings.Bushman and Williams(2012)also find banks that smooth earnings through LLP have less risk-taking discipline,possibly because the reduced transparency makes external monitoring more difficult,whereas banks that recognize LLP in a more timely manner exhibit greater such discipline.

2.1.4.Capital management

Banks have incentives to meet regulatory minimum capital requirements by managing LLP because regulators monitor banks using accounting-based capital measures.The capital management hypothesis predicts that the capital ratio is negatively related to LLP because bank managers with low capital ratios can increase them by charging more LLPs to reduce the regulatory costs imposed by capital adequacy ratio regulations (Lobo and Yang,2001).Ryan(2011)notes that banks’LLA was included in their primary capital without limit prior to 1990.Hence,their ability to influence their capital adequacy ratios through LLA was much greater prior to 1990 than it is now.

The general approach used to test the capital management hypothesis is to examine the relation between a bank’s proximity to the minimum capital ratio and discretionary LLP.As stated above,using data from the pre-1990 period,several studies have found evidence consistent with the capital management hypothesis (Moyer,1990;Beatty et al.,1995;Collins et al.,1995;Ahmed et al.,1999).

2.2.Role of formal and informal institutions

As previously noted,there are many interesting topics concerning whether and how formal and informal institutions affect the behavior of banks.Several studies discuss the implications of institutional differences for banks’income smoothing,risk-taking,earnings management and earnings quality.Formal institutions refer to the rule of law and efficiency of the judicial system and/or bank-specific regulations,whereas informalinstitutions refer to culture,religion and trust.The general approach to testing the role of formal and informal institutions in the banking industry is to examine differences in the earnings properties and/or risk-taking behavior of banks in countries where these institutions are strong or weak.

Recently,several studies have documented evidence on the implications of formal and informal institutions in the banking industry.For example,Kanagaretnam et al.(2011,2014)find the uncertainty avoidance and individualism dimensions of national culture to be related to earnings quality,reporting conservatism and risk-taking.They also provide evidence on the relation between legal,extra-legal and political institutional factors and earnings quality(Kanagaretnam et al.2014).Moreover,Fonseca and Gonzalez(2008)show that banks’income smoothing depends on investor protection,disclosure,regulatory supervision,financial structure and financial development.

2.3.Relevance of fair value

Banks have numerous financial instruments that are subject to fair value reporting,which renders the banking industry a perfect setting in which to explore the implications of fair value accounting.The underlying theme in the literature is that fair value provides more relevant but perhaps less reliable information to investors.There is a tradeoffbetween relevance and reliability.Hence,the overall usefulness of fair value accounting remains unclear.The general approach to testing its relevance in the banking industry is to examine the explanatory power of fair value versus historical cost measures of financial instruments for the market value of equity or to compare the coefficients relating fair value and historical cost measures to the market value of equity.

Early studies such as Barth et al.(1996),Eccher et al.(1996)and Nelson(1996)find some evidence to suggest that disclosures(under SFAS 107)are not value-relevant,whereas Venkatachalam(1996)documents value relevance(for SFAS 119 disclosures).More recently,Ahmed et al.(2006)examine whether investors’valuations of derivative fair value(before and after SFAS 133)differ depending on whether they are recognized or disclosed.Song et al.(2010)show the value relevance of level-1 and level-2 fair value(under SFAS 157)to be greater than that of level-3 fair value.Moreover,Ahmed et al.(2011)report that derivative disclosures under SFAS 133 provide risk-relevant information to debt holders.

2.4.Role of auditing

The banking industry is also a good setting in which to investigate auditor independence and the implications of audit quality.There is mixed evidence of a relation between abnormal audit fees and abnormal accruals for industrial firms.It is unclear whether this mixed evidence is the result of greater auditor independence or whether impaired auditor independence is masked by error in measuring earnings management.As previously noted,total accruals are more easily decomposed into discretionary and non-discretionary components in the banking industry,and thus an undistorted relation between earnings management and auditor interdependence seems likely.

Several recent studies have discussed the role of auditing in the banking industry.Kanagaretnam et al. (2010a),for example,find auditor independence to be impaired only for small banks.Kanagaretnam et al. (2010b)consider a sample of banks from 29 countries,and show that the presence of Big 4 auditors and industry specialist auditors reduces earnings management.Moreover,Kanagaretnam et al.,2009 report that discretionary LLP is more informative for banks audited by Big 5 auditors and industry specialist auditors.

3.Concluding remarks

As indicated at the start of this review,the banking industry is a rich and rewarding setting for addressing a variety of important and interesting accounting issues.This review does not cover all the interesting questions that have been studied.The recent reviews by Beatty and Liao(2014)and Bushman(2014)provide more detailed discussions and cover a wider range of topics.These papers will help you gain a deeper understanding of and appreciation for the interesting and wide-ranging accounting research questions that have been addressed in the banking setting.

Adams,R.B.,2012.Governance and the financial crisis.Int.Rev.Finan.12(1),7–38.

Adams,R.B.,Mehran,H.,2012.Bank board structure and performance:evidence for large bank holding companies.J.Finan.Intermed. 21(2),243–267.

Ahmed,A.S.,Kilic,E.,Lobo,G.J.,2006.Does recognition versus disclosure matter?Evidence from value-relevance of banks’recognized and disclosed derivative financial instruments.Account.Rev.81(3),567–588.

Ahmed,A.S.,Kilic,E.,Lobo,G.J.,2011.Effects of SFAS 133 on the risk relevance of accounting measures of banks’derivative exposures. Account.Rev.86(3),769–804.

Ahmed,A.S.,Takeda,C.,Thomas,S.,1999.Bank loan loss provisions:a reexamination of capital management,earnings management and signaling effects.J.Account.Econo.28(1),1–25.

Autore,D.M.,Billingsley,R.S.,Schneller,M.I.,2009.Information uncertainty and auditor reputation.J.Bank.Finan.33(12),183–192.

Barth,M.E.,Beaver,W.H.,Landsman,W.R.,1996.Value-relevance of banks’fair value disclosures under SFAS No.107(digest summary).Account.Rev.71(4),513–537.

Beatty,A.,Chamberlain,S.L.,Magliolo,J.,1995.Managing financial reports of commercial banks:the influence of taxes,regulatory capital,and earnings.J.Account.Res.33(2),231–261.

Beatty,A.,Liao,S.,2014.Financial accounting in the banking industry:a review of the empirical literature.J.Account.Econo.58(2–3), 339–383.

Beaver,W.,Eger,C.,Ryan,S.,Wolfson,M.,1989.Financial reporting,supplemental disclosures,and bank share prices.J.Account.Res. 27(2),157–178.

Beaver,W.H.,Engel,E.E.,1996.Discretionary behavior with respect to allowances for loan losses and the behavior of security prices J. Account.Econo.22(1),177–206.

Beaver,W.H.,Ryan,S.G.,Wahlen,J.M.,1997.When is‘bad news”viewed as‘good news”?Finan.Anal.J.53(1),45–54.

Bushman,R.M.,Williams,C.D.,2012.Accounting discretion,loan loss provisioning,and discipline of banks’risk-taking.J.Account. Econo.54(1),1–18.

Bushman,R.M.,2014.Thoughts on financial accounting and the banking industry.J.Account.Econo.58(2–3),384–395.

Collins,J.H.,Shackelford,D.A.,Wahlen,J.M.,1995.Bank differences in the coordination of regulatory capital,earnings,and taxes.J. Account.Res.33(2),263–291.

DeAngelo,H.,Stulz,R.M.,2015.Liquid-claim production,risk management,and bank capital structure:why high leverage is optimal for banks.J.Finan.Econ.116(2),219–236.

Dechow,P.,Ge,W.,Schrand,C.,2010.Understanding earnings quality:a review of the proxies,their determinants and their consequences.J.Account.Econo.50(2),344–401.

Eccher,E.A.,Ramesh,K.,Thiagarajan,S.R.,1996.Fair value disclosures by bank holding companies.J.Account.Econo.22(1),79–117.

Fields,L.P.,Fraser,D.R.,Wilkins,M.S.,2004.An investigation of the pricing of audit services for financial institutions.J.Account. Public Policy 23(1),53–77.

Fonseca,A.R.,Gonzalez,F.,2008.Cross-country determinants of bank income smoothing by managing loan-loss provisions.J.Bank. Finan.32(2),217–228.

Healy,P.M.,Wahlen,J.M.,1999.A review of the earnings management literature and its implications for standard setting.Account. Horizons 13(4),365–383.

Jin,J.,Kanagaretnam,K.,Lobo,G.J.,2016.Discretion in bank loan loss allowance,risk taking and earnings management.Account. Finan.,forthcoming

Jin,J.Y.,Kanagaretnam,K.,Lobo,G.J.,2011.Ability of accounting and audit quality variables to predict bank failure during the financial crisis.J.Bank.Finan.35(11),2811–2819.

Kanagaretnam,K.,Krishnan,G.V.,Lobo,G.J.,2009.Is the market valuation of banks’loan loss provision conditional on auditor reputation?J.Bank.Finan.33(6),1039–1047.

Kanagaretnam,K.,Krishnan,G.V.,Lobo,G.J.,2010a.An empirical analysis of auditor independence in the banking industry.Account. Rev.85(6),2011–2046.

Kanagaretnam,K.,Lim,C.Y.,Lobo,G.J.,2010b.Auditor reputation and earnings management:international evidence from the banking industry.J.Bank.Finan.34(10),2318–2327.

Kanagaretnam,K.,Lim,C.Y.,Lobo,G.J.,2011.Effects of national culture on earnings quality of banks.J.Int.Bus.Stud.42(6),853–874.

Kanagaretnam,K.,Lim,C.Y.,Lobo,G.J.,2014a.In fluence of national culture on accounting conservatism and risk-taking in the banking industry.Account.Rev.89(3),1115–1149.

Kanagaretnam,K.,Lim,C.Y.,Lobo,G.J.,2014b.Effects of international institutional factors on earnings quality of banks.J.Bank. Finan.39,87–106.

Kanagaretnam,K.,Lobo,G.J.,Mathieu,R.,2003.Managerial incentives for income smoothing through bank loan loss provisions.Rev. Quant.Finan.Acc.20(1),63–80.

Kanagaretnam,K.,Lobo,G.J.,Yang,D.H.,2004.Joint tests of signaling and income smoothing through bank loan loss provisions. Contemp.Account.Res.21(4),843–884.

Kilic,E.,Lobo,G.J.,Ranasinghe,T.,Sivaramakrishnan,K.,2013.The impact of SFAS 133 on income smoothing by banks through loan loss provisions.Account.Rev.88,233–260.

Kroszner,R.S.,Strahan,P.E.,2001.Bankers on boards:monitoring,con flicts of interest,and lender liability.J.Finan.Econ.62(3),415–452.

Liu,C.,Ryan,S.,Wahlen,J.,1997.Differential valuation implications of loan loss provisions across banks and fiscal quarters.Account. Rev.72(1),133–146.

Liu,C.C.,Ryan,S.G.,2006.Income smoothing over the business cycle:changes in banks’coordinated management of provisions for loan losses and loan charge-offs from the pre-1990 bust to the 1990s boom.Account.Rev.81(2),421–441.

Lobo,G.J.,Yang,D.H.,2001.Bank managers’heterogeneous decisions on discretionary loan loss provisions.Rev.Quant.Finan.Acc.16 (3),223–250.

McNichols,M.,2002.Discussion of the quality of accruals and earnings:the role of accrual estimation errors.Account.Rev.77 (Supplement),61–69.

Modigliani,F.,Miller,M.H.,1958.The cost of capital,corporation finance and the theory of investment.Am.Econ.Rev.48(3),261–297.

Moyer,S.E.,1990.Capital adequacy ratio regulations and accounting choices in commercial banks.J.Account.Econo.13(2),123–154.

Murphy,C.W.,2004.Goodbye FDICIA,hello sarbox–sort of.Pricewaterhouse Coopers Publications,New York,NY.

Nelson,K.K.,1996.Fair value accounting for commercial banks:an empirical analysis of SFAS No.107.Account.Rev.71(2),161–182.

Ryan,S.G.,2011.Financial reporting for financial instruments.Found.Trends Account.6(3–4),187–354.

Scholes,M.S.,Wilson,G.P.,Wolfson,M.A.,1990.Tax planning,regulatory capital planning,and financial reporting strategy for commercial banks.Rev.Finan.Stud.3(4),625–650.

Song,C.J.,Thomas,W.B.,Yi,H.,2010.Value relevance of FAS No.157 fair value hierarchy information and the impact of corporate governance mechanisms.Account.Rev.85(4),1375–1410.

Venkatachalam,M.,1996.Value-relevance of banks’derivatives disclosures.J.Account.Econo.22(1),327–355.

Wahlen,J.M.,1994.The nature of information in commercial bank loan loss disclosures.Account.Rev.69(3),455–478.

Walker,D.,2009.A review of corporate governance in UK banks and other financial industry entities Final recommendations,26 November http://www.hm-treasury.gov.uk/d/walker_review_261109.pdf.

Wetmore,J.L.,Brick,J.R.,1994.Commercial bank risk:market,interest rate,and foreign exchange.J.Finan.Res.17(4),585–596.

E-mail address:gjlobo@uh.edu

http://dx.doi.org/10.1016/j.cjar.2016.09.003

1755-3091/?2016 Sun Yat-sen University.Production and hosting by Elsevier B.V.

This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

China Journal of Accounting Research2017年1期

China Journal of Accounting Research2017年1期

- China Journal of Accounting Research的其它文章

- Are academic independent directors punished more severely when they engage in violations?☆

- Employee quality,monitoring environment and internal control

- Economic policy uncertainty,credit risks and banks’lending decisions:Evidence from Chinese commercial banks

- Regulatory pressure and income smoothing by banks in response to anticipated changes to the Basel II Accord☆