Influence of Taxation on Supply and Demand in Tomorrow’s Crowd Energy Paradigm

James Craven, Evgenia Derevyanko, Mario Gstrein, and Bernd Teufel

Influence of Taxation on Supply and Demand in Tomorrow’s Crowd Energy Paradigm

James Craven, Evgenia Derevyanko, Mario Gstrein, and Bernd Teufel

—The emergence of the energy self-sufficient home presents a new role for government taxation. Policymakers now face the challenge of reflecting this technological change in their decision-making and must assume a greater level of engagement. This paper proposes a number of original fiscal concepts for policymakers to implement in the support of micro-grid development. These are designed to optimise a sustainable transition away from the centralised energy system whilst creating shared value among stakeholders throughout the value chain. Concepts are based on residential micro-grid schemata in Switzerland and are applicable in other countries.

Index Terms—Carbon tax, crowd energy, energy harvesting, energy storage, government, micro-grids, photovoltaic systems, power generation economics.

1. Introduction

The technological development in renewable energy systems is a key driver behind the recent evolution of crowd energy[1]. This concept involves the creation and sharing of renewable energy between participants in a defined area using a micro-grid—a small energy system capable of balancing captive supply and demand resources to maintain stable service within a defined boundary[2]. Compared with the traditional centralised system, the micro-grid offers benefits, such as lower distribution costs and environmental impacts, but simultaneously raises the challenge of defining a new role for government and taxation policies.

The traditional relationship between policymakers and energy markets has been fairly independent with the two parties interfacing only in a limited capacity. The issue arising from the new paradigm of crowd energy calls for this relationship to be redefined with governments assuming greater responsibility in fostering renewable energy development. This can be considered a prerequisite for achieving key objectives such as regulating the transition from macro- to micro-grid. The change process involves a number of different stakeholders and a wide range of interests. It is therefore crucial for the policymakers to fully engage with the appropriate parties to gain a broad understanding of the landscape. The appointment of subject matter experts can provide structured thought leadership around the government’s new position and enable successful taxation policies to be configured for different aspects of this rapidly developing market.

The introduction of new forms of taxation can help to build this closer relationship whilst enabling better-informed policies. Establishing both a regulated incentive system for renewable energy adoption and an increased tax for non-renewable energy use could lead to accelerated micro-grid development. This would involve the following considerations, all of which require a high level of government commitment:

1) Identifying the tax methods that make renewable energy sources more affordable for residential energy users.

2) Understanding how a significant demand increase for micro-grids can save energy or reduce fossil fuel dependence, and thereby improve economic sustainability.

3) Recognising taxation’s enabling influence on micro-grid development.

The line of investigation explores from both a supply and a demand perspective how taxation can facilitate the transition of the traditional energy consumer into becoming a prosumer. A prosumer is a customer who both produces and consumes the same energy[3], referred to as “organic energy”hereafter. In proposing new tax concepts, a better understanding can be attained that how prosumers could be encouraged to adopt new technology in their homes and communities where favourable incentives exist. The paper presents different forms of taxation and predicts their impacts around a fictitious residential micro-grid in Switzerland. This is approached by analysing taxation’s impacts before and after a customer joins the micro-grid whilst addressing cost aspects and the resulting effects on a wide range of stakeholders. Although not among the largestand most active participants in the field of renewable energy, Switzerland offers an innovative economy that can utilise developed technology processes, knowledge, and experience from leading nations.

The paper aims to highlight a need to revise the policymakers’ long-standing transactional view of taxation. A redefined role is proposed and aims to cultivate economic growth beyond hardware and installation whilst gaining access to advanced knowledge bases across the energy industry and beyond.

2. Current Landscape

With around 900 companies involved in the production, supply, and distribution of electricity, the Swiss energy market is highly fragmented[4]. The national energy grid is owned and operated by the neutral body Swissgrid who ensures non-discriminatory access for market participants through the separation of grid operations from the production and trading. Each month Swissgrid calculates the amount of balance energy per billing unit basis based on fifteen minutes usage[5]. The price differential can reach up to 50% depending on the canton and location. The electricity bills separately itemise the components for grid and energy, so customers can identify the costs for grid use, energy, and local authority taxes, contributions, and levies[6].

In 2007 the Federal Electricity Supply Act marked the beginning of a liberalised electricity market in Switzerland. Currently, only customers with annual consumption exceeding 100,000-kilowatt hours (KWh) can choose their suppliers, by 2018 smaller customers and residential users are expected to join them[7].

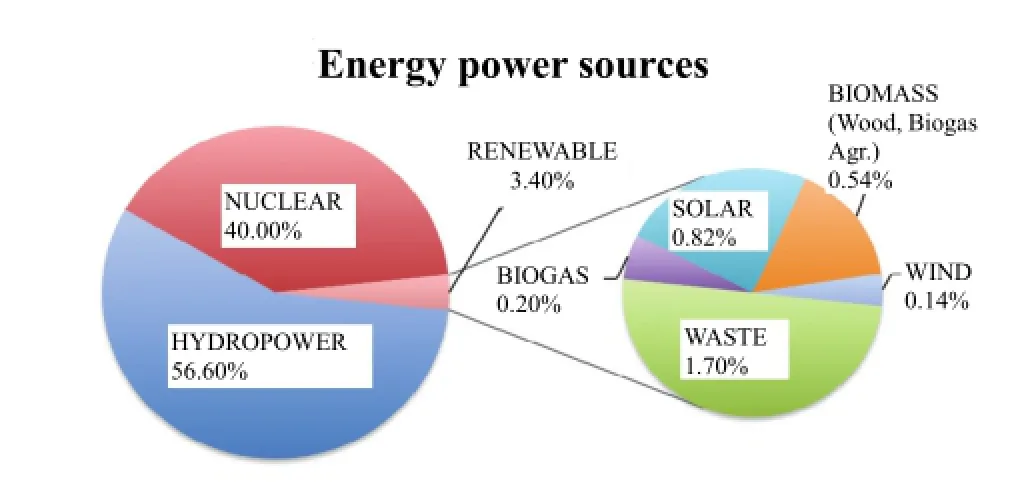

Fig. 1. Energy sources in Switzerland (adapted from Swiss Confederation, “Swiss statistics of renewable energy”, 2014).

The largest energy power source of Switzerland (see Fig. 1) is hydropower, covering 56.6% of the total generation. This is followed by nuclear at 40.0%, and new renewable sources delivering 3.4%—composed of solar 0.82%, biomass 0.54%, wind 0.14%, and waste 1.70%[8]. Solar power is deemed the most promising sector for investment as hydropower energy locations are being utilised near to potential. Many wind zones are protected or privately owned thus offering a limited capacity for scalable wind power development.

The stages of energy generation and distribution are currently joined using cables over large distances. This configuration however lends itself to a number of problems. A claimed loss of 8% is attributed to distribution with further challenges including overloads in power lines, temporal variability in energy demand, and the difficulty in balancing energy generation and demand[9]. The micro-grid concept presents solutions to address problems such as these. Located in the immediate vicinity of the consumers, traditional losses through distribution are eliminated and customers dependent on the macro-grid are reduced[9]. The control and management systems in the micro-grid make decisions to optimise its functionality. On a local level this can forecast power production capabilities of renewable sources, conduct generation scheduling, load shedding, calculate emissions, and demand side management[10].

3. Attributes of Taxation

Taxation is an effective driver of innovations in the renewable energy industry. From the policymakers’perspective, it is essential to balance both the positive and potentially negative results of taxation decisions. The potential hazards have been posited as a prosumer backlash and accelerated grid defection[10]. In this new technological landscape, it is important for governments to achieve manageable equilibrium between these two scenarios whilst following an ideology of enlightened self-interest.

Governments play a dynamic role in the micro-grid regulation. The current introductions of appropriate tax credits and exemptions encourage the use of renewable energy sources to reduce carbon emissions. For taxation, a one-off payment exists in Switzerland where around 30% of investment costs for a reference installation are reimbursed[11]. This opens promising investment opportunities for utility companies to invest in the micro-grid infrastructure. Stimulating this new sector of the economy can promote the employment opportunities in hardware design, installation, and maintenance. By encouraging new customers to purchase the equipment, the micro-grid’s profile could be raised with positive effects dispersing across the value chain. Maintaining consumer confidence is also an important concern for governments who must successfully manage the expectations in this niche market. If tax incentives existing today are likely to disappear in six months without sufficient warnings, then consumers are unlikely to commit to invest in the required assets and their confidence deteriorates.

Taxation currently paid by energy consumers in Switzerland’s partially liberalised markets varies greatly between cantons. This ranges from below 0.77 to above 1.04 rappen per kWh and amounts to around 3% of the total electricity costs paid for by the consumers[12]. The remainder is composed of (see Fig. 2): 44% distribution, 7%transmission, 40% energy procurement, and 6% CRF—the state feed-in tariff for renewable sources[12]. The paradigm shift away from the centralised energy supply towards the customer driven market introduces a need to re-configure the current price breakdown and presents a new dynamic role for taxation.

4. Future Landscape

The shift towards a model of self-harvesting renewable energy calls for a new taxation system for supply and demand. The micro-grid configuration (see Fig. 3) is used to illustrate these new concepts. The configuration comprises eight detached smart-homes in Montana, a remote municipality located at 1,500 metres altitude. With around 2,300 inhabitants, this is one of the sunniest places of Switzerland experiencing a yearly average of 2,143 sun hours[13].

Fig. 3. Micro-grid scenario for a new taxation system.

Each property has twelve 160 watt-peak (Wp) photovoltaics paired with an inverter, both together are capable of yielding around 2020 kWh annually under local conditions. There are various home energy storage solutions available, in this example each home is equipped with an individual rechargeable lithium-ion battery of around 7 kWh. Solar energy harvested during the day is stored in the home battery with a capacity of approximately 63 kWh. The eight homes are inter-connected using underground cables. When a home battery approaches full, the surplus energy can be shared with the other homes.

On the level of crowd energy, a communal flow battery is shared between the properties. This large-scale energy storage platform has the capability of delivering around 30 kW to 50 kW and offers higher discharge duration than conventional batteries[14]. The flow battery can operate in both “island mode” where it contains and distributes energy harvested by the homes, and in “connected mode” where it sources additional energy through a macro-grid interface.

The flow battery has a limited volume and a storage time limit. When these limits are reached, energy is fed into the

macro-grid and distributed to homes outside of the micro-grid. Consumers maintain the visibility of their power consumptions using a smart meter installed in the home. This shows how much energy is fed-in and taken out of the flow battery whilst advising how to improve the domestic energy efficiency.

Transactions in the micro-grid are monitored by a smart metering system using predictive analytics. The two involved components are the home controller in the property and the central controller in the flow battery. Integrated within the home controller, the energy-sensing plane observes the property’s real-time energy data and executes a prediction. These data are sent to the central controller and include current and future energy consumption data, current and predicted energy harvesting data—by interfacing with the national weather service, and the current battery energy volume[15]. In this case example the central controller uses these data for energy allocation and pricing decisions for the eight homes.

5. Taxation’s Impact on Demand

The new prosumer is faced with high start-up costs to cover photovoltaic (PV) purchase, installation, maintenance, and energy storage. Currently, photovoltaic plants with an output not exceeding 30 kWp can be supported with a non-recurring payment that covers approximately one-third of the construction costs[16]. This is funded by a levy on every kilowatt-hour of electricity consumptions across the country and remains unchanged in the scenarios that follow.

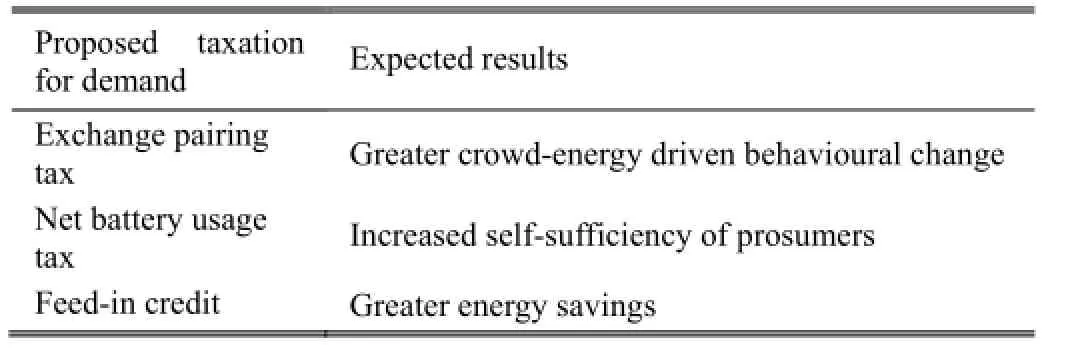

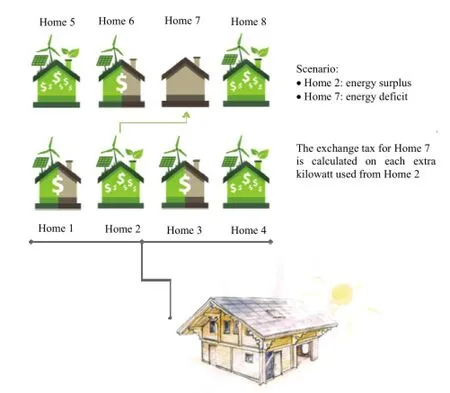

Three concepts are proposed to observe how taxation caninfluence the demand to join a micro-grid (see Table 1): An exchange pairing tax between the community members, a prosumer net battery usage tax, and a tax rebate on the volume of surplus energy fed back into the grid.

Table 1: Expected results of taxation on micro-grid development from a demand perspective

5.1 Exchange Pairing Tax

The introduction of an exchange pairing tax between prosumers may transform the patterns of household energy use. In a July afternoon in Montana, it was 23°C with one-eighth cloud cover. The occupants of house number two (Home 2) were away on a holiday, their home battery had reached the full capacity. Conversely, house number seven (Home 7) were entertaining guests and using an air conditioning system, their home battery was approaching empty (see Fig. 4).

Fig. 4. Concept of the exchange pairing tax.

In this scenario, the controller in Home 7 identifies and pairs with the controller in Home 2 and begins to receive the surplus energy feed. The exchange taxation for Home 7 is then calculated on each kWh of energy received from Home 2. If at the end of the billing period, Home 7 has an organic energy deficit, it would be subject to a tax based on the volume of extra renewable kilowatts used from each of the other connected smart homes. During the same billing period, Home 2 were overseas for a three-week holiday resulting in a consumption surplus. Whilst unoccupied, the home controller automatically re-directs all energy to other households or the flow battery. In return, Home 2 earns the tax credits for future redemption when their demand may exceed the organic production.

5.2 Net Battery Usage Tax

In the second user case scenario, a different configuration is adopted and omits the direct exchange between properties to identify how the smart home interacts with the central flow battery. In this situation, each home battery provides organic energy to its property until becoming empty or full. When approaching full, all surplus energy is redirected to the central flow battery. Conversely, when additional power is required it automatically connects with the central flow battery to access a new source. In these instances, the homes and central controllers interact to monitor bi-directional energy flow and allocate either a tax credit or debit for each kWh fed into or out of the flow battery. This energy can then be redistributed within the micro-grid or, after a defined time limit, fed back to the macro-grid and sold by utility companies to other customers.

5.3 Feed-in Credit

Contributing prosumers are to be allocated credits when their harvested energy is fed into the macro-grid. For example (see Fig. 5), Homes 4-8 fed all of their daily harvest into the flow battery whilst Homes 1-3 are self-sufficient. On receiving the energy feed from Homes 4-8, the central flow battery reaches its storage time limit and as there is no demand from any of the eight smart homes, the energy is fed into the macro-grid. In this scenario, a taxation credit is allocated to Homes 4-8 as a form of remuneration.

Fig. 5. Feed-in credit.

Alongside the taxation concepts discussed, the introduction of a time-of-use tariff on all non-organic energy usage is to be implemented. Currently existing in France, this is aimed at peak-shaving seasonal demand. A higher tariff is charged during the certain days of the year and customers are notified of the schedule in advance[17]. This can help to drive behavioural changes in the micro-grid by encouraging consumers to use energy intensive appliances during off-peak times and to be more conscious about the general energy use.

6. Taxation’s Impact on Supply

The supply side of the micro-grid includes infrastructure projects or services that imply regulatory incentives. For developers and investors, solar raises similar problems to other energy projects including development, financing, and market growth. Compared with other renewable projects, solar requires higher investment due to the lack ofstandardisation and high technology fixed costs. Long-term contracts for this sector are however becoming increasingly attractive for investment. The current feed-in-tariff system and low funding are a constraint as it can take between two and three years to cover the costs. Forthcoming government incentives may not be sufficient to bridge this gap, mainly due to the concerns of the low demand that could lead to over-production and market distortion similar to other European countries.

Local utility companies are important suppliers to the micro-grid. Several studies however highlight the risks between these companies and prosumers, claiming they are considered as competitors rather than partners. There are technical and financial doubts on how micro-grids are expected to influence the local power companies’ business models and the functioning of the macro-grid[18]. Whilst the rise in prosumers threatens utility company energy sales, significant opportunities exist for collaboration. According to Wilson Rickerson, utility companies supporting the micro-grid expansion may create new industrial clusters that would profit from greater connectivity while also lobbing jointly on behalf of electricity industry transition[17]. Policymakers currently offer tax windows for companies to encourage private solar adoption. On a cantonal level there are alternative compliance fees whereby if local utility companies fail to purchase the prosumer harvested energy they are subjected to fine. Utility companies across the country currently offer prosumers special incentive programmes on the solar PV installation.

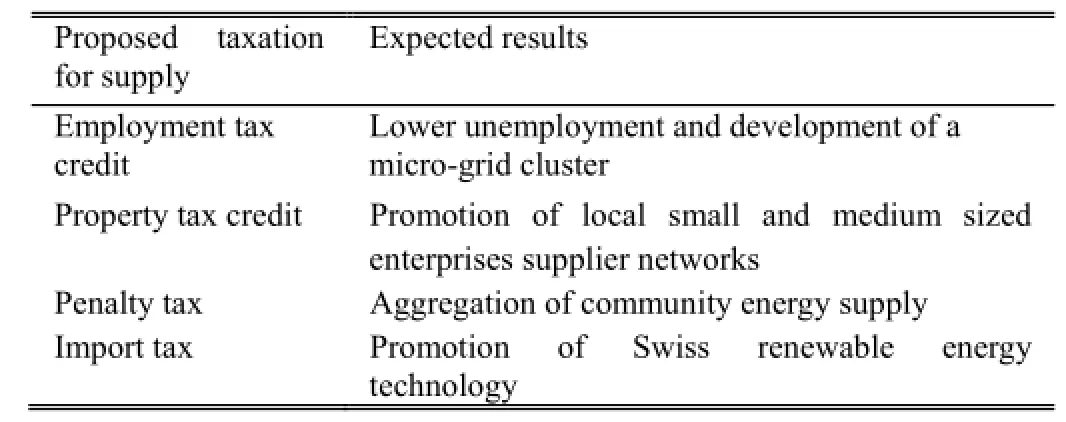

Table 2: Expected results of taxation on micro-grid development from a supply perspective

Four additional concepts are now presented. These are designed to influence supply (see Table 2) and engage a broad cross-section of the value chain. It is through this collaboration that the most lucrative benefits could be achieved through a process of learning and adaptation.

6.1 Employment Tax Credit

The introduction of job creation tax credits for companies producing complimentary technologies or investing in research and development would help create employment. The unemployment rate of 4.0% in Switzerland is comparatively lower than the neighbouring European Union countries[19]. This can be reduced further by promoting opportunities for both skilled and unskilled workers in the energy sector. If companies create a minimum of ten new full-time jobs over a 3-year period they could be eligible for tax credits. This should provide incentives for smaller businesses to expand their operations and develop apprenticeship programmes.

6.2 Property Tax Credit

To empower regional development and economic stimulus, a property tax credit could be introduced. Some isolated residential areas in Switzerland lack a proper energy infrastructure and therefore present high distribution costs. For customers in these locations, the micro-grid can facilitate complementary distributed generation but cannot completely replace the traditional transmission. It is important to note here the importance of integrating micro-grids with local power companies through synergy-geared policies. On a cantonal level, utility companies would receive tax credits on either properties or corporate incomes upon successfully attracting renewable energy suppliers to the region.

6.3 Integration of Utility Companies in the Micro-Grid

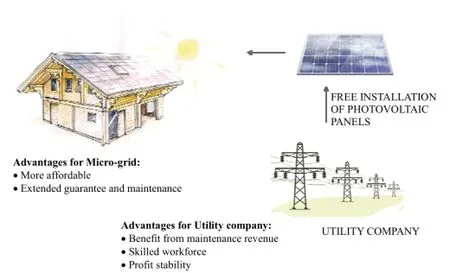

The cost of solar installation is an important consideration for the prosumers. For a building constructed in 2014, future prosumers must currently pay a basic contribution of 1400 Swiss francs (CHF) and a surcharge of 850 CHF per kilowatt peak (kWp)[20]. In this concept (see Fig. 6), an installation is offered free of charge and funded using carbon taxes collected from the non-renewable energy consumption.

Fig. 6. Integration of utility companies in the micro-grid (free installation of PV panels).

This government income would be assigned to financing tertiary education courses specialising in micro-grid configuration and design. The objective is to promote domestic innovation and provide a skilled workforce to conduct the installation of micro-grid hardwares on a macro level. Utility companies would also invest in this scheme and benefit from the future maintenance revenue through long-term prosumer contracts.

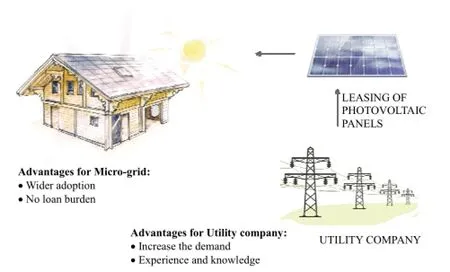

The high purchase cost and payback period of photovoltaic panels makes the investment unfeasible for many consumers. The equipment leasing (see Fig. 7) is a viable alternative to expensive loans, and utility companiescould provide this purchase option for customers. This would enable greater market penetration and cross-selling opportunities for maintenance and installation. Problems with this idea do exist however with several experts in the United States expressing their concerns about the feverish demand for PV leasing and comparing it to the recent mortgage crisis where payments terms were not met. To avoid this scenario, policymakers must enforce strict regulations and limit the number of panels available per year.

Fig. 7. Integration of utility companies in the micro-grid (leasing of PV panels).

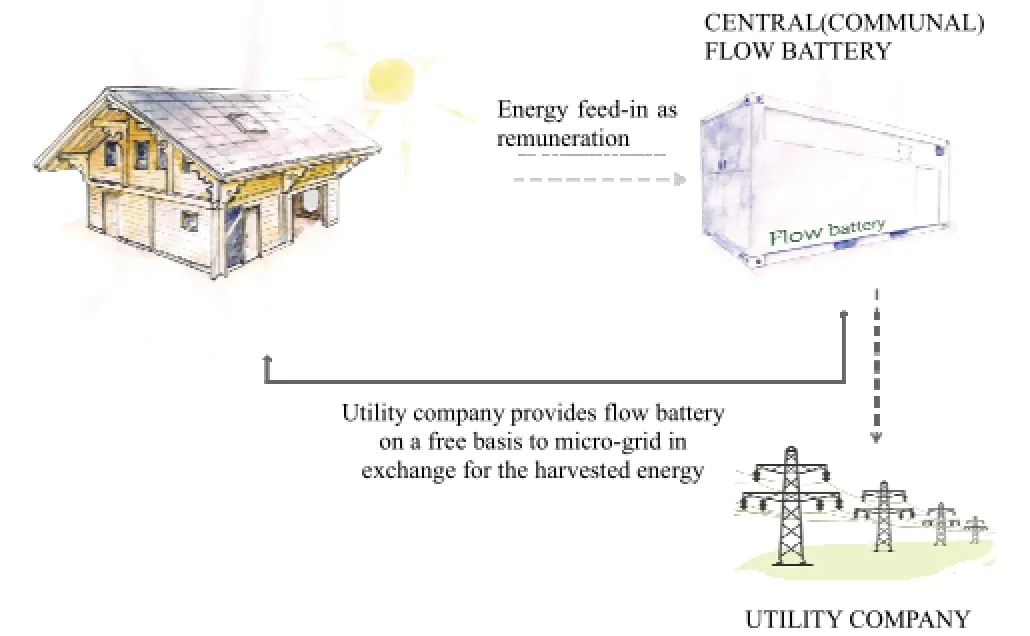

6.4 Penalty Tax

The introduction of a prosumer penalty tax has both monetary and behavioural objectives. In this concept, utility companies provide the communal flow batteries for the micro-grid (see Fig. 8). Companies can recover these costs by selling the energy prosumers fed into the central flow battery to other customers on the macro-grid. In this situation, prosumers are obliged to meet a monthly battery feed-in target. This idea aims to deepen the prosumers’ commitment to the crowd energy ethos by not over-consuming whilst ensuring utility companies receive sufficient remuneration for battery provision. The success of this initiative would be supported by a penalty tax enforced upon customers who fail to meet the feed-in target.

Fig. 8. Integration of utility companies in the micro-grid (penalty tax).

6.5 Import Tax Exemptions

The availability of communal flow batteries can be widened using temporary import tax exemptions. This aims to enable a greater number of micro-grid programmes to be launched whilst driving domestic innovation of similar products in Switzerland’s already robust innovation ecosystem. An increase in Swiss patents and intellectual properties in this market space can also enhance the country’s credibility and attraction of foreign talent and investment.

6.6 Home Energy Audit Service

Consumers are often ignorant of how much energy they waste. This issue can be addressed by establishing a private-public partnership to offer the prospective micro-grid customers a home energy audit service. The service would see the measurement of energy consumption and advices given on how to reduce the costs. Trainee technicians following the carbon-tax funded tertiary education programmes would deliver the service. Properties would be inspected in the areas such as insulation and historical billing examined. This can help to manage expectations of cost savings and better educate the customers as a means of driving behavioural changes. The home service would be offered free of charge to households with the costs indirectly covered by the carbon tax revenue.

7. Discussion and Results

Taxation in the micro-grid is shaped by a number of influencers. This includes consumer demand and development in parallel technologies such as synthetic fuels. Whilst the role of taxation is important, the residential micro-grid’s emergence is underpinned by a number of other demand drivers. These span economic, behavioural, technological, and national conditions. Government policies surrounding these include the legal definitions of prosumers, procedures for connecting to the grid, rules governing the treatment of excess electricity, and efforts to reduce soft costs[16]. Climate also plays a fundamental role. In Switzerland the topography and rainfall help to explain the dominance of hydropower, but in developing a PV micro-grid, the annual average sun hours is most important[21]. The canton of Glarus for example experiences 1274 sun hours whilst Montana’s average is 2143 hours[22]. The disparity here indicates the significance of climate when determining the validity of a micro-grid’s business case in a particular location.

Through various push and pull factors, the micro-grid can be considered a driver behind the future growth of solar energy. An accurate growth forecast is difficult to provide giving the number of variables and dependencies discussed. On a macro level, the energy supply from fossil fuels is expected to continue to prevail for many years. The accelerated deployment of green technologies however puts greater pressure on governments to reduce carbon emissions through increasing taxes.

As an additional clean energy source, biofuel offers a number of alternative benefits. Introduced to the Swiss market in 2008, biofuel was met with limited success as consumers appeared more sensitive to price than environmental protection[23]. In April 2015, a German car manufacturer announced their state-of-the-art fuel“e-diesel”—a synthetic, clean-burning, and petroleum-free fuel made from water, carbon dioxide, and renewable energy sources. Although this clean technology has a net carbon footprint of zero, its commercialisation remains a long way off. Synthetic fuels such as this offer an attractive proposition for utility companies. With its extensive hydropower capabilities, Switzerland could produce synthetic fuel on a macro level as an additional source of energy. With an expected cost of between 1 CHF and 1.5 CHF per litre, these types of fuels are thought to be a strong competitor to the traditional diesel[24]. Considering the characteristics and price of synthetic fuel, the taxation currently applied to sales of unleaded petrol and diesel can be replicated. This would present the opportunity for utility companies to use environmentally friendly synthetic fuels in parallel with macro-electricity generation.

The policymakers must deliver incentives that foster micro-grid expansion whilst subsequently ensuring autonomy remains to make adjustments to the demand. Customer application processes and waiting lists both assist in regulating the transition from macro- to micro-grid. Without this control mechanism, the level of exposure is heightened for the traditional energy value chain and wider stakeholders. The current application system to receive a‘one-off remuneration’ for photovoltaic installation serves as a good example of this.

Reducing carbon emissions is also a major concern for governments. Instead of supporting the development of alternative fuels, the issue is often tackled by reducing the demand for polluting fuels through increasing taxes. On becoming a prosumer, it is reasonable to assume that individuals become more frugal in their energy usage. A greater transparency of the consumption and a better understanding of the cost implications can promote domestic smart appliances. This impact could then cross-pollinate across different areas of innovations that are geared towards the efficient delivery of services.

Traditional utility companies have high levels of structural inertia typically associated with high sunk costs. Whilst innovative in nature, this internal environment does not offer the agility required to quickly change the strategic directions. National economies have a high dependency on energy providers, it is therefore imperative to fully integrate them into the new micro-grid concept. This can avoid weakened sales performance through residential customer attrition whilst their expertises can be used to support domestic innovations.

Although the electricity market in Switzerland is not liberalised for residential customers, utility companies supplying power to homes within a certain region must be fully engaged as stakeholders in micro-grid adoption. The conceptualised investment model of utility companies funding energy storage platforms serves as a good example. This measure is aligned with creating greater assimilation between prosumers, consumers, and energy providers who in pursuing similar objectives can benefit from creating shared value. Greater engagement could also enable utility companies to access remote residential areas at lower costs and complexity. Economies of scale could arise when flow battery investment reaches a certain level and utility companies can benefit from the lower distribution costs to surrounding non-micro-grid properties.

Limitations exist with implementing a micro-grid in Switzerland, these originate from the market environment and the technical challenges of renewable energy products. The integration of PV solar panels, for example, can cause problems such as power overloading and blackouts[25].

Switzerland’s limited market potential reduces its desirability to investors. Large funds, asset managers, and venture capital firms consider investments in European countries, United States, and China to be more attractive. According to Nicolas Geinoz from the Association of Swiss Electricity producers (VSE), 80% of Swiss-based company investments go to renewable energy projects of which few are in Switzerland[26].

The high number of old residential buildings raises a further issue, as solar panel installation is more costly for older properties. Some modern homes however present similar problems with contemporary designs favouring flat-roofs, which are not conducive to the angled PV installation. According to the Eurostat Statistics, the rented accommodation accounts for 51.8% of the overall property market[27]. Owners show little interest in the solar panel investment, as they do not pay for the electricity consumed by their tenants. This limitation can be addressed by making property owners more accountable for the energy consumed in their properties. A further socioeconomic limitation derives from the individual’s resistance to change. Inhabitants of remote villages tend to oppose new innovations designed to help them. This mind-set presents a significant challenge for utility companies as they seek to integrate the micro-grid into a target market of small communities. Methods such as the home energy audit seek to educate customers of the benefits and reduce this constraint.

A further limitation is the solar PV market remuneration. In Switzerland, as in other European countries, feed-in-tariffs were introduced to facilitate the use of renewable energy by offering prosumers the opportunity to sell the harvested electricity to utility companies in exchange for fees above the market price. In Switzerland, policymakers oblige small prosumers to sell generated energy for market price whilst large energy producers have the possibility to trade energythrough the feed-in-tariff system. This reduces the attraction for small prosumers to invest in the renewable resources.

8. Conclusions

In a global context, the disruptive technology introduced by the micro-grid presents both threats and opportunities for utility companies. The traditional supply chain of centralised generation and long distance transmission is somewhat abolished. On a global scale, according to the International Energy Agency, micro-grids hold significant potential to eliminate the energy poverty that affects over one billion people[28]. Utility companies and their suppliers must ensure they focus on creating shared value in the new paradigm of micro-grids. Unless they integrate themselves as a key component in the value chain, they risk losing their long enjoyed market domination and control.

The taxation concepts discussed in this paper span imports, credits, windows, carbon emissions, exchange, and penalties. The objective behind each of these is defined with the expected results and effects on different stakeholders. Taxation plays an important role in shaping micro-grid development and renewable energy distribution throughout the world. Governments have an important function in facilitating this change through a diligent process of thought leadership. A balanced input of technical skill and knowledge across a broad spectrum is required to ensure accurate forecasting and delivery of successful taxation policies. This comprehensive understanding of key drivers can optimise the transition from consumers to prosumers and form the critical foundation from which policymakers can operate.

Acknowledgement

The authors would like to thank the members of the crowd energy and smart living lab research groups at the International Institute of Management in Technology (iimt) for fruitful discussions on the topic.

[1] S. Teufel and B. Teufel, “The crowd energy concept,” Journal of Electronic Science and Technology, vol. 12, no. 3, pp. 263-267, Sep. 2014.

[2] M. Burr. (April 2015). About micro-grids. Micro-Grid Institute. [Online]. Available: http://www.micro-gridinstitute. org/about-micro-grids.html

[3] Q. Sun and A. Beach, “An economic model for distributed energy prosumers,” presented at the 46th Hawaii International Conf. on System Sciences, Wailea, HI, USA, January 7-10, 2013.

[4] Power hub Switzerland. Swissgrid Ltd. [Online]. Available: https://www.swissgrid.ch/swissgrid/en/home/reliability/power _market/power_hub_ch.html

[5] Electricity prices for 2015. Swissgrid Ltd. [Online]. Available: http://www.swissgrid.ch/dam/swissgrid/company/electricity_p rice_2015/tarifgrafik_2015_en.pdf

[6] M. Walser. (May 2008). Costs and tariffs in Swiss transmission grid. Swissgrid Media Service. [Online]. Available: https://www.swissgrid.ch/dam/swissgrid/current/ media/media_releases/2008/MM_080523_tariffs_grid_use_en .pdf

[7] G. Racine. (October 2014). Federal Council launches public consultation on electricity market liberalization. Globe Business Publishing Ltd. [Online]. Available: http://www.internationallawoffice.com/newsletters/detail.aspx ?g=5b23c6a4-5f4c-4fee-9c8a-e6396ee143b1

[8] E. Pauli, Schweizerische Statistik der Erneuerbaren Energien, Bundesamt Für Energie, Jun. 2015.

[9] J. F. Sanz, G. Matute, H. Bludszuweit, and E. Laporate,“Micro-grids, a new business model for the energy market,”in Proc. of Intl. Conf. on Renewable Energies and Power Quality, 2014, pp. 1-6.

[10] T. Peschel. (January 2014). Swiss solar market experiencing strong growth. Sun & Wind Energy. [Online]. Available: http://www.sunwindenergy.com/photovoltaics/swiss-solar-ma rket-experiencing-strong-growth

[11] I. Tsagas. (November 2014). Swiss PV growth but FIT cuts push market towards self-consumption. PV Magazine. [Online]. Available: http://m.pv-magazine.com/news/details/ beitrag/swiss-pv-grows-but-fit-cuts-push-market-towards-self -consumption_100017270/

[12] Prix de l’électricité 2015: En moyenne, les tarifs sont en hausse pour les ménages et les PME. Confédération Suisse. [Online]. Available: https://www.news.admin.ch/message/ index.html ?lang=fr&msg-id=54336

[13] Annual sunshine a year in Switzerland. Meteo Swiss. Current Results. [Online]. Available: http://www.currentresults.com/ Weather/Switzerland/annual-sunshine.php

[14] P. Medina, E. M. G. Rodrigues, J. P. S. Catalao, et al.,“Electrical energy storage systems: Technologies state-of-the-art, techno-economic benefits and applications analysis,” in Proc. of the 47th Hawaii Intl. Conf. on System Sciences, 2014, pp. 2295-2304.

[15] Z. Huang, T. Zhu, Y. Gu, et al., “Minimizing electricity costs by sharing energy in sustainable micro-grids,” in Proc. of the 1st ACM Conf. on Embedded Systems for Energy-Efficient Buildings, Memphis, 2014, pp. 120-129.

[16] Renewable energies. Swissgrid Ltd. [Online]. Available: https://www.swissgrid.ch/swissgrid/en/home/future/renewable _energies.html

[17] W. Rickerson, T. Couture, G. L. Barbose, et al. (June 2014). Residential prosumers: Drivers and policy options (re-prosumers). Intl. Energy Agency (IEA)—Renewable Energy Technology Deployment. [Online]. Available: http://iea-retd.org/wp-content/uploads/2014/06/RE-PROSUM ERS_IEA-RETD_2014.pdf

[18] S. Lundry. (2014). Think micro-grid: A discussion guide for policymakers, regulators and end user. Energy Efficiency Markets. [Online]. Available: http://blog.schneider-electric. com/wp-content/uploads/2014/06/Think-Microgrid-Special-R eport.pdf

[19] K. Schwab. (September 2014). The global competitiveness index 2014-2015. World Economic Forum. [Online]. Available: http://www3.weforum.org/docs/WEF_Global CompetitivenessReport_2014-15.pdf

[20] Ordonnance sur l’énergie (OEne). Le Conseil Fédéral Suisse. [Online]. Available: https://www.admin.ch/opc/fr/classified -compilation/19983391/201506010000/730.01.pdf

[21] Electricity consumption up 0.6 percent in 2013. Swiss Federal Office of Energy. [Online]. Available: http://www. bfe.admin.ch/energie/00588/00589/00644/index.html?lang=e n&msg-id=52616

[22] Average sunshine in Switzerland. Meteoswiss FOMC. [Online]. Available: http://www.currentresults.com/Weather/ Switzerland/annual-sunshine.php

[23] D. Bechtel. (January 2010). New biodiesel factory fuels energy debate. [Online]. Available: http://www.swissinfo.ch/ eng/new-biodiesel-factory-fuels-energy-debate/8112498

[24] F. Macdonald. (April 2015). Audi has successfully made diesel fuel from carbon dioxide and water. [Online]. Available: http://www.sciencealert.com/audi-have-successfully-made-die sel-fuel-from-air-and-water

[25] E. Wesoff. (February 2014). How much solar can HECO and Oahu’s grid really handle. [Online]. Available: http://www. greentechmedia.com/articles/read/How-Much-Solar-Can-HE CO-and-Oahus-Grid-Really-Handle

[26] L. Jorio. (June 2011). Swiss companies ride foreign wind. [Online]. Available: http://www.swissinfo.ch/eng/swiss-comp anies-ride-foreign-wind/30550228

[27] Housing statistics, Eurostat statistics. (May 2015). [Online]. Available: http://ec.europa.eu/eurostat/statistics-explained/ index.php/Housing_statistics

[28] C. Hertzog. (April 2015). The disruptive possibilities of micro-grids. [Online]. Available: http://www.smartgridlibrary. com/2013/04/15/the-disruptive-possibilities-of-micro-grids/

James Cravenwas born in Lincoln, U.K. He received the B.S. degree in management and marketing from De Montfort University, Leicester, U.K. in 2007. He is currently pursuing the M.S. degree in European business at the University of Fribourg, Switzerland. His professional background is in IT systems integration, and research interests include renewable energy management and change leadership.

Eugenia Derevyankowas born in Almaty, Kazakhstan. She received the B.S. degree in economics in 2007 and M.S. degree in accounting, analysis, and audit in 2009 from the Saint-Petersburg State University of Finance and Economics (RUS). Currently she is pursuing the M.S. degree in accounting and finance at the University of Fribourg, Switzerland. Her research interests include crowd energy, renewable energy management, visualisation, and data analysis.

Mario Gstreinstudied business administration and informatics at the Berufsakademie L?rrach (GER) and received the B.Sc. degree in 2001. He received the M.Sc. degree in innovation and technology management at the Science and Policy Research Unit (SPRU), University of Sussex (UK). He is currently pursuing the Ph.D. degree with the International Institute of Management in Technology (iimt), University of Fribourg, Switzerland. His research interests include energy systems, electricity management, innovation management, value network, and simulation of complex systems.

Bernd Teufelstudied computer science (Informatik) at the University of Karlsruhe, Karlsruhe, Germany. Subsequently he joined the Department of Computer Science, ETH Zurich, where he received his Doctor’s degree (Ph.D.) in 1989. He was a lecturer at the Department of Computer Science, University of

Wollongong, Australia, and a scientific consultant with Commonwealth Scientific and Industrial Research Organization (CSIRO), Sydney, before he founded the company “ART Informationssysteme GmbH” in Germany. After several mergers, he left the organization in 2008 and founded the consulting agency “Dr. Teufel Consultancy Services” in Switzerland in 2009, which mainly focuses on independent research consultancy. His research interests include ICT-management, social media, management of energy systems, energy turnaround, innovation and project management.

Manuscript received May 1, 2015; revised July 16, 2015.

J. Craven, E. Derevyanko, and B. Teufel are with the International Institute of Management in Technology, University of Fribourg, Fribourg 1700, Switzerland.

M. Gstrein is with the International Institute of Management in Technology, University of Fribourg, Fribourg 1700, Switzerland (Corresponding author e-mail: mario.gstrein@unifr.ch).

Digital Object Identifier: 10.11989/JEST.1674-862X.505011

Journal of Electronic Science and Technology2015年3期

Journal of Electronic Science and Technology2015年3期

- Journal of Electronic Science and Technology的其它文章

- Energy Management Strategies for Modern Electric Vehicles Using MATLAB/Simulink

- Hybrid Aging Delay Model Considering the PBTI and TDDB

- Time-Efficient Identification Method for Aging Critical Gates Considering Topological Connection

- Residual Phase Noise and Time Jitters of Single-Chip Digital Frequency Dividers

- A Methodology to Measure the Environmental Impact of ICT Operating Systems across Different Device Platforms

- Enhancement of Distributed Generation by Using Custom Power Device