The Digital Currency of China’s Central Bank: Digital Currency Electronic Payment (DCEP)

Chen Gengxuan

Sichuan Academy of Social Sciences

Jia Qinmin

Southwestern University of Finance and Economics

Ling Hao

The Chinese University of Hong Kong

Liu Yuyang*

Sichuan Academy of Social Sciences

Abstract: DCEP is the Chinese version of Central Bank Digital Currency (CBDC). It is the only legal digital currency in China and meets four conditions: (a) it is issued by the central bank; (b) it is digitized; (c) it is account and wallet based; (d) it is oriented towards the general public. As a retail central bank digital currency, it has three main technical features: a “tiered limit arrangement” (small-scale payments can be made anonymously while largescale payments cannot), a “two-tier operating system” (as with the central bank-commercial bank traditional model), and a “dual offline payment system” (supporting both parties of the transaction). Compared with CBDCs in other countries, China’s DCEP has smaller economic impacts, more obscure strategic goals, and more scarce technical details. But its progress in testing is ahead of central banks of other countries. This article is based on public information and is intended to explain what DCEP is and why and how it was developed. It also offers suggestions for future research.

Keywords: Central Bank Digital Currency (CBDC), Digital Currency Electronic Payment (DCEP), technology characteristics, research prospects

Introduction

CBDC is a recently developed form of electronic central bank currency which can be used by households and businesses to make payments and store value. CBDC is a form of digital money issued by the central bank. Before 2017, there was a lack of academic discussions on CBDC in China and abroad, and it was not until 2018 that the Bank for International Settlements(BIS) published an official definition (CPMI&MC, 2018) so that CBDC became a subject of serious discussions and study, both in China and abroad. A series of BIS papers investigated the central bank’s motivations for creating CBDC and found that although many central banks were being cautious, most central banks (86 percent) are actively promoting CBDC projects (14 percent of the central banks were pushing projects from the original conceptual research to experimental stages).Due to the different characteristics of each country, the motives and design schemes for CBDC were different, and developing countries were more active in this regard than their developed counterparts(Barontini & Holden, 2019; Boar et al., 2020; Boar & Wehrli, 2021).

According to the difference in targeted markets, CBDC can be divided into (a) CBDC for the retail markets, a type of digital currency that can be used by every ordinary user, and (b) CBDC for the wholesale capital markets, a type of digital currency that is only used by banks or other financial institutions for large-value transactions and inter-bank clearing. The former is related to payments,and can help improve domestic payment conditions and financial development, so it is considered more important. However, there are many central banks which also pay attention to the latter (such as the Jasper-Ubin project by the Bank of Canada and the Monetary Authority of Singapore), because wholesale CBDCs can reduce the cost of cross-border payments and have the potential to improve their efficiency as well. The CBDC developed by China, i.e. DCEP, is aimed at the retail market and is directed towards the general public. China decided at the end of 2019 that the DCEP would be piloted in Shenzhen, Suzhou, Xiong’an New Area, Chengdu, and the 2022 Winter Olympics. By October 2020, six additional pilot testing areas had been added, namely Shanghai, Hainan, Changsha,Xi’an, Qingdao, and Dalian. At present, the scope of the DCEP pilot program has been expanded in an orderly manner, and the application scenarios have been gradually enriched, such as supermarkets,restaurants, bus transport services, gas stations, and wages.

At present, we still lack a systematic theory of digital currency, such as Bitcoin and CBDC. Yao(2018, 2019) provides a novel perspective on the understanding of digital currency and his work provides the theoretical background we use to discuss DCEP. Specifically, he proposed to understand the appearance and development of digital currency from the perspective of transaction costs and consensus costs, and systematically look at the history of currency development and future trends through the same framework. This article is based on Yao’s theoretical discussions. To simplify the analysis, we expand our analysis based on comparisons between consensus costs and transaction efficiencies (cost-benefit trade-offs).

From the perspective of social consensus, the development of various currency forms can be seen as an evolution constrained by consensus costs and transaction efficiencies. From barter, commodity currency, metal currency, and credit currency to the current digital currency, we know that the development of digital currency is based on the application of new technologies in the currency field. Digital currencies such as Bitcoin have become very new decentralized “currencies.” From the perspective of consensus mechanisms, the authentication mechanisms of distributed ledger technologies provide a consensus mechanism for Bitcoin; but from the perspective of transaction efficiencies, Bitcoin transaction fees increase with the expansion of transaction scales and cannot adapt to changes in transaction demands promptly. Therefore, theoretically, Bitcoin does not have an advantage in terms of consensus costs and transaction efficiencies.

The development of CBDC is based on Bitcoin and other private digital currencies, which are,issued through the central bank. From the point of view of the consensus mechanisms, CBDC has a national credit endorsement (if distributed ledger technology is adopted). It also obtains technical(decentralized) credibility. Compared with private digital currencies, CBDC can save consensus costs. At the same time, in terms of transaction efficiencies, CBDC can consider different transaction needs and develop different types of CBDCs, although mainly retail CBDC and wholesale CBDC as mentioned. Retail CBDCs need to deal with large-scale real-time concurrent transactions, so decentralized blockchain technology is not fully adopted. Wholesale CBDCs are mainly used in the inter-bank markets or the international markets, so decentralized blocks can be used to improve transaction efficiencies.

Within the scope of this discussion on DCEP, we not only emphasize the ability of a digital currency to save consensus costs, but also pay attention to the technical preparations made by China’s DCEP for digital economic developments. China’s DCEP is mainly a retail CBDC issued to consumers, and it has not fully adopted decentralized blockchain technology. On the one hand, it supports the consensus mechanisms which can save consensus costs through central bank issuance;on the other hand, it incorporates an anonymous payment and offline payment technology into DCEP. Many reports show that it also provides an interface for smart contract applications to meet various market transaction needs. DCEP not only appears as a new fiat currency, but also provides the infrastructure for the development of China’s digital economy.

Finally, we organized this paper as follows. To begin with, we discuss the characteristics of DCEP and the reasons for developing DCEP. Then, we turn to the issuance and operating structure of DCEP.Subsequently, we present the literature on DCEP. We then discuss DCEP as completely as possible from different dimensions. The last part is the conclusion.

What Is DCEP?

According to existing public information, the name of the central bank digital currency (CBDC)is “DCEP,” which stands for Digital Currency and Electronic Payment tools. Since the People’s Bank of China has not released an official document to introduce it, this article will first try to define the concept of DCEP based on public information from different sources, and then discuss its attributes.

Specifically, in 2016 Fan Yifei, the deputy governor of the central bank (the People’s Bank of China), emphasized that the CBDC belongs to the category of M0 (i.e., cash in circulation) and is a legal digital currency (Fan, 2016). In 2018 Fan Yifei once again wrote an article about CBDC, holding that “…Regarding indebtedness, the relationship between creditor’s rights and debts has not changed with the currency form” (Fan, 2018). He emphasized the issuance of the Chinese version of CBDC,which is the base currency issued by the central bank of China. In 2018, the CBDC research director Yao Qian pointed out, “At this stage, the primary starting point of China’s research and development of a CBDC is to supplement and replace traditional physical (fiat) currencies. The definition belongs to the category of cash (M0), so it is oriented towards the general public.” (Yao, 2018). This makes it clear that the CBDC can be applied to serve ordinary residents. In 2019, according to the online course lectures published by Mu Changchun, the current director of the Central Bank’s Digital Currency Research Institute, DCEP is defined as a “digital payment tool with value characteristics.”

Characteristics

Many domestic researchers who study DCEP mainly rely on the speeches and articles of the three central bank officials mentioned above. Wang summarized the characteristics of DCEP described above (Wang, 2020). Thanks to the reference provided by Wang (2020) and other public materials, we describe DCEP as follows:

First, DCEP is a base currency. The issuer of DCEP, which belongs to the base currency M0, is the People’s Bank of China. According to the definition, DCEP belongs to the base currency just like the central bank’s reserve currency.

Second, DCEP is a form of digitalized currency. Therefore, it is not a physical (fiat) currency, but a digital equivalent. Formally, it is an electronic RMB cash.

Third, DCEP can be used for payments without an account (but it cannot be used for large-scale payments). DCEP can also realize value transfers without an account. It does not need to be bound to a real-name account and verify the identity of the holder. In the transaction, it only requires one to verify the value of the digital cash itself, which is similar to the process of verifying the authenticity of banknotes. However, when the value of the digital cash exceeds a certain limit, verification should be conducted through the account. Thus, DCEP has a controllable degree of anonymity.

Fourth, DCEP is oriented towards the general public (or called retail CBDC). The target of DCEP is the general public, not financial institutions.

Legal Status

On October 24, 2020, the People’s Bank of China proposed to expand the scope of RMB to include the digital form of RMB in the scope of legal tender (Article 19). Legal digital currency is a currency form issued by the central bank and implemented using specific digital cryptographic technology. Compared with physical (fiat) currency, digital legal currency has been changed into a technical form, but what remains unchanged is the value connotation. In essence, it is still the debt the central bank owes to the public; the debt issued is supported by national credit. Because of this, it has an inherent and incomparable advantage over private digital currencies (such as Bitcoin). DCEP has an unlimited legal reimbursement, with the highest legal status, as it is protected by the central bank’s lender of last resort. As a result, no institution or individual can reject DCEP, which is different from Bitcoin and Alipay.

As to Bitcoin-like currency, some countries and judicial practices support the view that Bitcoin is a legally protected commodity or property. In Canada, digital currency is regarded as a commodity,and the use of cryptocurrency to pay for goods or services is regarded as a barter transaction.Therefore, value-added tax should be paid in the transaction. Australia recognizes that digital currency is a commodity, not a currency or security. China’s policy also holds a commodity standing.In 2013 the Chinese government issued theNotice on Preventing Bitcoin Risksand in 2017 issued theAnnouncement on Preventing Financial Risks from Initial Coin Offerings. The main idea is that China’s law regards Bitcoin as a product, not currency. China prohibits transaction activities that use Bitcoin as a currency.

Advantages

DCEP vs. private digital currency.

Value endorsements.

DCEP is endorsed by the central bank whereas private currency is not. Therefore, the value of DCEP is stable and does not experience drastic price fluctuations like private currencies. At the same time, unlike the stable coins, the value of DCEP (and other CBDCs) is guaranteed by the central bank,while stable coins are only linked to sovereign currencies (such as the US dollar), so they face the risk of price fluctuations.

Bitcoin forms consensus mechanisms through a distributed ledger technology. However, the consensus cost of the Bitcoin ratio increases with the expansion of the transaction scale. For example,the distributed authentication of Bitcoin faces problems such as transaction delays. Therefore,marginal (and average) transaction fees are soaring. Users now need to pay a fee of US$1 to US$1.5 for each transaction through Bitcoin (Yao, 2018). At the same time, Bitcoin cannot adapt to changes in transaction scales, which greatly reduces transaction efficiencies.

Stable coins reduce consensus costs by pegging to the US dollar, and at the same time change the issuance mechanisms to meet changes in transaction demands. But this currency essentially relies on dollar credits, rather than its consensus mechanism. Besides, stable coins are generally developed by companies, and it is difficult to provide a credible mechanism. This makes it difficult to guarantee the value of stable coins. However, there are also some countries whose currencies are more unstable than the value of Bitcoin or stable coins. This article does not focus on this extreme situation, so we will not discuss it for the moment.

Credit creation and monetary policies.

The credit creation function of currencies is particularly important to modern economies, especially for liquidity assistance during a financial crisis, which is of great significance to the prevention of crisis contagion and the boosting of a rapid economic recovery. DCEP (and other CBDCs) are issued by the central bank, while private currencies are generally issued in a decentralized way. Therefore, private digital currencies have no credit creation function.

Inflation risk.

DCEP (and other CBDCs) are often issued in a centralized manner, so they face the same problems. Because private currencies are a decentralized issuance mechanism, there is no risk of inflation. A target inflation level of 2 percent set by the Chinese monetary authority (the People’s Bank of China) is often interpreted as an inflation tendency (a common concern for centralized currency systems). This can be solved by increasing the independence of the central bank.

Technology.

DCEP is not necessarily based on blockchain technology, or distributed ledger technology (DLT).We at present have no idea if DCEP is based on DLT (we will discuss this in the discussion section),and the People’s Bank of China only said that “the DCEP does not have a predetermined technological path (keep a flexible attitude toward technologies).” The reference of a legal digital currency to blockchain technology should be flexibly applied based on actual business needs. “The system was designed from the perspective of the central bank and does not adhere to the blockchain technology by trying to realize a scalable cryptocurrency controlled by the central bank” (Yao, 2018). Relatively speaking, private currencies are generally issued based on DLT, such as Bitcoin’s POW consensus mechanism, and Bitcoin is issued through the mining algorithm mechanism to maintain its integrity.

DCEP vs. cash.

Release costs.

Paper currency issuance involves printing, storage, and transportation costs which do not apply to DCEP.

Monetary policy.

First, for DCEP (and other CBDCs), the central bank can know the exact extent of currency in circulation. This information is difficult to ascertain when banknotes are used. Therefore, the central bank can adjust monetary policy in a timelier manner by obtaining more information, and may even realize a “helicopter money” monetary policy. Also, DCEP (and other CBDCs), in the digital currency environment, can make possible an effective negative interest rate policy, and the central bank may no longer need to set a target inflation rate buffer. In theory, the central bank’s target inflation rate can be reduced to 0 (Yao, 2018).

DCEP vs. Alipay, WeChat Pay, and Fast Payment.

Anonymity.

Alipay, WeChat Pay, and Fast Payment are all payment systems based on bank accounts without anonymity. DCEP has a certain degree of anonymity, also known as “controllable anonymity,” that is,small payments can be made through DCEP wallet (which means verification is conducted through the wallet and no account information is involved), while large scale payments cannot be anonymous (which requires authenticated identity based on accounts), so account information is required.

Offline payment.

Alipay, WeChat Pay, and Fast Payment are all payments based on bank accounts and require internet connections. By contrast, DCEP can realize dual offline payment through offline technologies.

In sum, DCEP has obvious advantages in terms of consensus costs and transaction efficiencies.First, the consensus mechanism is guaranteed by the central bank issuance, so DCEP has a stable intrinsic value which eliminates the risk of various value fluctuations inherent in private currencies.Second, DCEP improves transaction efficiencies through the application of various technologies.Compared with cash and electronic payments, DCEP can meet payment needs in more scenarios; it also provides the central bank with currency flow information, which makes it possible to implement new monetary policies.

Why Was DCEP Developed?

Central banks develop CBDC for many reasons, from financial stability, financial inclusion, and payment efficiencies to cross-border payments. Because of the characteristics of different countries,central banks often have different motives. Generally, CBDC can be divided into wholesale CBDCs and retail CBDCs. Developing countries generally have stronger incentives to develop retail CBDCs than developed countries because they often desire to improve domestic payment security and efficiencies and financial inclusion. And now, after four years of development, retail CBDCs are being favored by more central banks. However, the reasons and types of CBDC for specific countries need to be analyzed according to the country-specific characteristics. According to China’s domestic payment and financial environment, we believe that China’s motives for developing DCEP may be as follows:

Supplement the Payment Functions of Fiat Currency (RMB)

Retain the features of cash payments without relying on third-party service agencies.

The DCEP can be based on an account or not based on an account (based on a wallet or a token).The main difference between an account and awallet (or a token) is the verification process: one receiving a token will verify whether the token is genuine, whereas an institution is needed to verify the identity of an account holder. In China, AliPay, WeChat Pay, and Fast Payment are very advanced account-based payment systems. In contrast, there is no need to have an account for payments with DCEP, so the binding between “account” and “currency” will be broken. Like cash, DCEP can be used for instant payments and settlements, which is convenient and fast, and provides controllable anonymity to achieve privacy protection.

Provide banking services for people who do not have an account, therefore increasing financial inclusion.

DCEP can provide financial services for people who do not have a bank account, and it can also provide offline electronic payment services for certain situations without a network.

Solve the shortcomings of cash effectively for the People’s Bank of China.

DCEP can mitigate the difficulties that may arise from “zero interest rate lower limit,” tax evasion and illegal economic activities, high cost of cash storage, issuance, and processing. Moreover, DCEP can improve the implementation of monetary policy and prevent illegal economic activities.

Respond to the Impact of Third-party Payment Systems

Considering that China’s payment environment is well developed, DCEPs must surpass the existing various private payment tools in quality to maintain the central bank’s relevance in the monetary system. Third-party payment institutions use modern information technology to provide market traders with front-end payments or back-office operation services, which not only fill the gaps in online payments but also enter offline retail businesses through innovations in mobile payment technologies such as “QR codes.”

The problem is that the account payment systems at all levels belong to different departments and are independent of each other, contributing to data gaps, information islands and monopoly power.A typical example is the direct-connected bank interface model adopted by third-party payment systems, which not only has repeated interfaces but also opens multiple reserve accounts. The relationships are complicated and have low transparency. The central bank cannot accurately obtain the capital flow information, and it is difficult to implement penetrating supervision.

About third-party payments, their trustworthiness comes from the depository of funds in commercial banks and the central bank’s implicit guarantees. Compared with bank deposit currencies, third-party payments are weaker in fulfilling promises. So far, China’s central bank(the People’s Bank of China) has issued 271 third-party payment licenses, of which 232 licenses are still valid, and 39 licenses have already been revoked. Among them, Alibaba’s Alipay and Tencent’s WeChat Pay account for more than 90 percent of the market share. By virtue of their oligopolistic market positions, the two payment institutions have increasingly obvious characteristics of system importance. In particular, the Internet giants behind them all hold various financial licenses such as banking, securities, insurance, credit investigation, payment,and wealth management. Relying on a vast user base and advanced technology, these thirdparty payment systems formed their unique financial ecosystem. The People’s Bank of China’s“too big to fail” list includes risk-preferred Internet giants as well as traditional large financial institutions.

DCEP may alleviate the above problems by introducing competition. We will further examine the risks posed by third-party payments in the discussion section.

Provide the Infrastructure for the Development of China’s Digital Economy

This is the motivation of DCEP under the special background of China. We believe that this motive may be more important and subtle than the previous ones. China may be one of the countries in the world that have devoted the most attention and resources to the digital economy. As early as 2014, the People’s Bank of China began to study the digital RMB (the predecessor of DCEP). In 2016 China began to consider blockchain as an important research object for the first time, marking China’s beginning to promote the development and application of blockchain technology. In the following years, blockchain development has been regarded as an important planned project by the central government and local governments. In short, the Chinese government is guiding society to invest in the development and application of new technologies (blockchain) and sees blockchain as one of the driving forces of the digital economy.

The development of China’s digital economy requires special investments in infrastructure.In addition to 5G technology, the digital currency DCEP is also an important “infrastructure” for China’s digital economic development. DCEP remains technically flexible and can provide interfaces for future commercial applications. We will review the possible applications of DCEP as a platform in the discussion section, such as smart contracts.

How Is DCEP Being Developed Going Forward?

There is no official document that introduces DCEP systematically. There are only three public articles from relevant persons in charge of the central bank (Fan, 2018; Yao, 2018; Mu, 2019), which preliminarily outline the design framework of DCEP. Within the framework, several special designs have been adopted, including a “two-tier operating system,” a “tiered limit arrangement” and a “dual offline payment system.” The first “two-tier” model is the core structural design of DCEP while the last two designs are secondary in terms of structure.

Two-tier Operating System

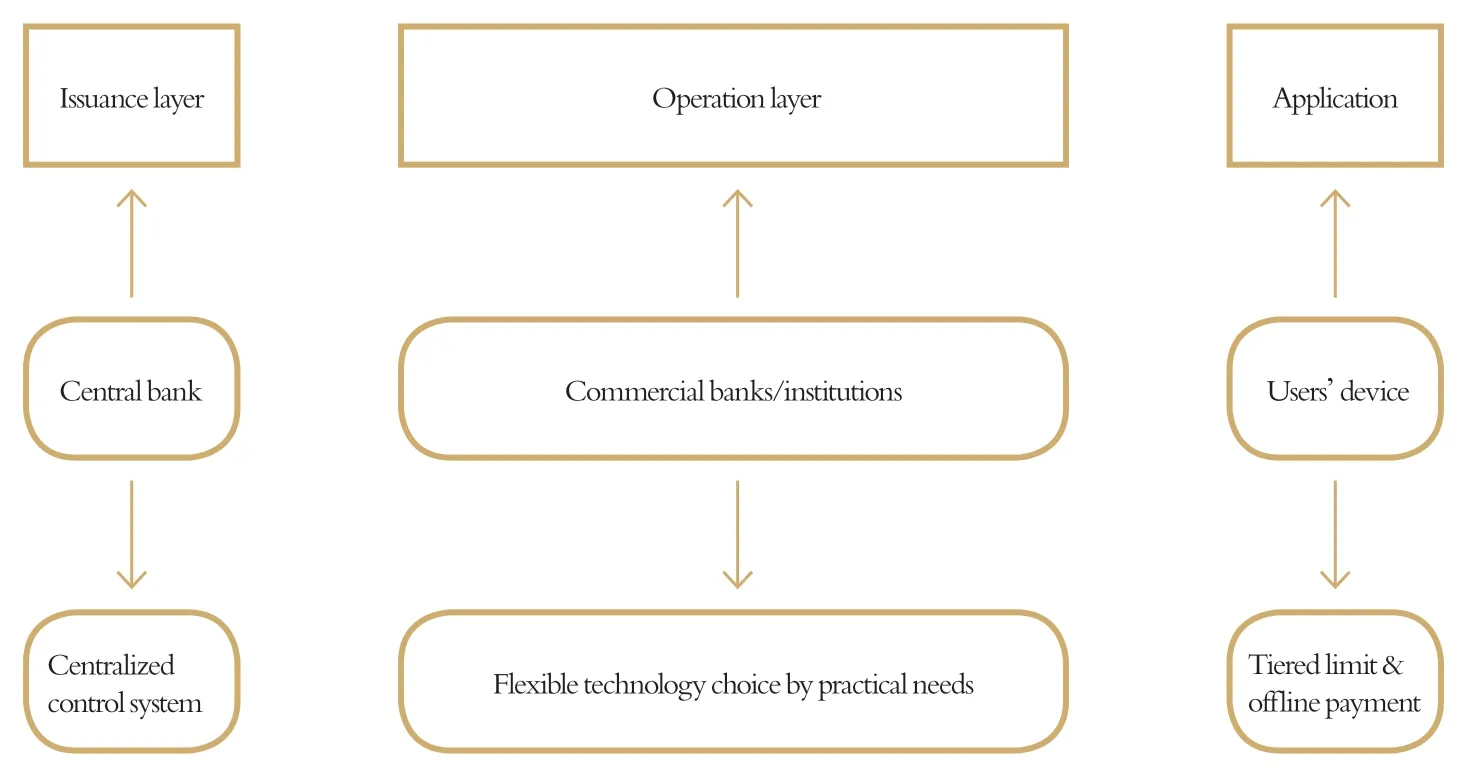

The People’s Bank of China plans to adopt a two-tier operating system for digital currencies(DCEP), that is, from the People’s Bank of China to commercial banks or institutions and then to individual users, as shown in Figure 1. Specifically, the central bank issues DCEP, commercial banks (or other institutions as payment service providers) open accounts in the central bank and pay 100 percent of the reserve fund. Individuals and enterprises will open digital wallets in commercial banks or institutions. DCEP held by individuals and enterprises still belongs to central bank liabilities.

The two-tier model has two advantages: one is less disruptive as financial institutions play their original roles in distribution and payment services; the other is that this layered approach allows the central bank to outsource part of the account management work to commercial banks or otherinstitutions, and it also enables third parties to build on top of the core structure (Shah et al., 2020).This type of model may be the most popular CBDC model.

Figure 1 The Two-Tier Model of DCEP (piloting)

China’s two-tier system of DCEP adopted a centralized issuance model for the following reasons: First, because the CBDC is still a central bank’s liability to the public, the relationship between its creditors and debts has not changed with the currency pattern. As a result, the central bank’s central position in the release process is still guaranteed. Second, the central bank’s functions of macro-prudential scrutiny and monetary policy control need to be guaranteed and strengthened. Third, the meta-account system maintains the original monetary policy transmission method. Fourth, in order to avoid over-issuing currency, the central bank must have the right and ability to track and supervise digital currency releases. It is not clear what technology is used in this operational layer (in the pilot, commercial banks are designated to operate the DCEP wallet,and no other functionality is involved). The People’s Bank of China deploys a flexible technology path for future commercial applications. We will discuss possible applications in the discussion section, such as smart contracts.

Tiered Limit Arrangement

Since DCEP can be traded anonymously like cash, which violates the principle of anti-money laundering, China plans to use big data analysis to identify illegal activities at the regulatory level, and also adopt a “tiered limit arrangement,” that is, for unbound accounts, it can only make small daily payments for anonymous use; large transactions require account binding and identity verification. Fan Yifei and Yao Qian described it as “controllable anonymity.” In other words, “DCEP can be based on the form of less-account-bound so that the degree of dependence on the account in the transaction link is greatly reduced. In this way, both cash and DCEP can be harmonious. Cash is easy to circulate and can achieve controllable anonymity.”

Dual Offline Payment System

Payments can be made offline, so DCEP does not rely on the network, like cash. This design is conducive to the implementation of inclusive finance in areas where existing electronic payment coverage is insufficient, and it also helps to cope with extreme scenarios of network signal interruptions.

Related Literature

Relevant information on the DCEP research mainly comes from researchers and officials of the People’s Bank of China. These researchers focus on the technical characteristics (such as anonymity),legal status, application scenario analysis, and economic impact of DCEP.

Regarding the technical characteristics of DCEP, Fu et al., (2019) comparatively studied the encryption technologies that may be used in current digital currencies to illustrate the encryption technologies for the design of DCEP. They believe that DCEP needs to be weighed between anonymity and security, guaranteeing that DCEP can obtain a certain degree of anonymity under the premise of security. Similarly, Yuan et al., (2016, 2017), Xie and Wang (2016), Wang et al., (2017), Qin et al., (2017), and Zeng et al., (2018) discussed blockchain technology and its implications in the DCEP design. However, since there is no DCEP information (currently no technical details are disclosed),these studies are just making educated guesses and suggestions. More valuable references are the papers by officials from the People’s Bank of China. For example, Fan Yifei (2016) mentioned China’s digital fiat currency structure (i.e., the tiered limit arrangement), which is now the main technical structure of DCEP.

Regarding the application of DCEP, Yao Qian, a researcher and official from the People’s Bank of China, conducted some tentative research to explore the theoretically possible scenarios for DCEP application, mainly in two aspects. First, DCEP will be used with smart contracts in the future, such as in the P2P field, although China banned P2P in 2018. The application of the P2P platform can reduce the risk of embezzlement of funds and the default risk of loan contracts (Yao, 2018). Yao (2017)also studied the role of CBDC in factoring business trends and found that the introduction of a CBDC can not only simplify operations, but also reduce costs. In addition, it can also solve the problems of security management and control of capital flows in the business markets, and reduce payments risks when a payment institution is exposed to liquidity risk. Second, DCEP will be used in the policy area. Jiang (2021) studied the possibility of fiscal digitization; Yao (2018), and Fang and Huang (2020)discussed new monetary policy tools under a DCEP system, which may help solve the problems of poor monetary policy transmission, the difficulties in counter-cyclical control, and inadequate management of policy expectations. Among them, “zero interest rate” is one of the traditional monetary policies, but in the context of DCEP, it is possible to gain a negative interest rate in the sense that fees may be charged for using DCEP, which is essentially equivalent to implementing a negative interest rate policy and can break the zero interest rate lower limit constraint.

Regarding the economic impact of DCEP, it should be pointed out that the macro-financial research on DCEP is insufficient. Comparing the “macro research” and “practical advancement” of CBDCs in other countries, we found a sharp contrast between the process of China, where “practical advancement” precedes “macro-research,” and the process of developed countries such as the United States, the United Kingdom, Sweden, and Denmark, where “macro-research” precedes “practical advancement” (Wang et al., 2020; Davoodalhosseini, 2018; Meaning et al., 2018; Andolfatto,2018). There are no rigorous academic papers on the potential economic impacts of these different procedures. Xie and Feng (2019) studied the impact of CBDC on monetary policies and cross-border payments. Yao (2019) used the dynamic stochastic general equilibrium (DSGE) model (Barrdear& Kumhof, 2016) to empirically simulate the economic effects of China’s legal digital currency,and the model indicated that the issuance of a CBDC has a controllable impact on China’s banking system and financial structure and that DCEP will help increase economic output in the long run.Specifically, Yao found that DCEP could increase economic growth by 0.01 percent when compared to the economic output in the steady state of the DSGE model.

Discussion

DLT Technology in DCEP

DCEP was issued in a centralized way at the issuance stage, but it is not certain whether DLT has been adopted. According to the relevant information and patent materials released by the People’s Bank of China, the Digital Currency Research Institute of the People’s Bank of China has applied for DLT related technologies. Most likely, the central bank would consider only permissioned DLT (if DLT is adopted), in which a network of preselected entities perform the updating of ledgers. Because the cost of the permissionless DLT process is very high, DCEP is likely to use permissioned DLT.Specifically, at the issuance stage of DCEP, the central bank uses permissioned DLT and serves as the center to solely control user identity verification and payment management. The People’s Bank of China has designed three centers for centralized management: (a) the verification center (which conducts centralized management of DCEP-operating institutions, mainly state-owned banks for the present and user identity information. It is a basic component of the payment verification system and of the controllable anonymity system); (b) the registration center (which records the information regarding the entire process of the generation, circulation, liquidation, and demise of the DCEP, and corresponding users’ identities, and completes the ownership registration); and (c)the big data analysis center (which is for anti-money laundering, analysis of payment behaviors,analysis of monetary indicators, etc.). However, in the operational stage, DCEP did not adopt a clear technological path. The People’s Bank of China adopted an open attitude towards the operational stage, “technology is determined by market competition.” The only duty of the central bank is to make the design of DCEP itself concise, efficient, and compatible. The commercial applications based on DCEP are on the market. We are almost sure that the People’s Bank of China is the center of the permissioned chain, and that the central bank performs identity verification and recording.Commercial banks mainly act as the verification nodes of the private chains and as wallet managers during the operational stage. Users cannot directly log into the private chains to read or write information, but one can access the relevant information in the central bank’s data center through a commercial bank (permissioned verification nodes).

Anonymity technology.

DCEP uses the tiered limit arrangement. That is, there is no need to verify the identity of the account in micropayments, but the account needs to be verified if a certain payment limit is exceeded.This technology guarantees a certain degree of anonymity, but to prevent illegal transactions and money laundering, it is impossible to guarantee complete anonymity. The extent of DCEP anonymity is somewhere between Bitcoin and AliPay. Therefore, the value of this pseudo-anonymity (called controllable anonymity) to the average consumer seems to be an empirical question. Since this technology does not rely on bank accounts, it allows those who do not have a bank card to obtain payment services. According to reports, in 2019, the number of bank accounts per capita nationwide reached 8.09, and in 2020, the number of bank accounts per capita nationwide reached 8.90. This kind of technology should increase financial inclusion in areas lacking banking services.

Offline payment technology.

An offline stored value DCEP would take the form of a mobile wallet app on which prepaid values are stored locally. According to relevant patent information, this kind of dual offline value is not always offline. The payment is verified by the local chip to complete the transaction in case of temporary network disconnection, but because this transaction is not recorded in the central bank database, the transaction is not truly completed. Only after the network is reconnected, does the local chip send the offline transaction information to the commercial bank for verification, and then the commercial bank sends it to the central bank data center for verification and registration.Afterwards the transaction is considered complete. The technical risk lies in the double-spending problem, because offline transactions do not truly complete the payment. The main remedy for the double-spending risk is to set limits for offline transactions and related legal constraints.This technology ensures that payments can also be made under extreme conditions, such as an earthquake or in other countries where the network infrastructure is not well developed. This technology can guarantee the convenience of DCEP for transactions in all parts of the world and in various environments.

Smart contracts.

Smart contract technology is currently the most promising technology that can be applied to DCEP. In 2021 the People’s Bank of China plans to fund projects related to DCEP, which are mainly divided into two categories: one is the new monetary economics based on DCEP and the other is the smart contract system based on DCEP. Smart contract technology is based on the programmable properties of DCEP and writing the contents of the contract on DECP will further expand the functions of DCEP. Smart contracts have the advantages of transparency and credibility, automatic execution, and mandatory performance. When combined with DCEP, they can be applied to business scenarios such as conditional payments and scheduled payments. It is conceivable that smart contract technology will develop rapidly during the operational stage as planned. Commercial banks and third-party companies will provide smart contract services for the market, and the central bank will maintain the stable operation of DCEP.

As previously mentioned, Yao (2018) conceptually argued that the application of DCEP on the P2P platform can reduce the risk of embezzlement of funds and the default risk of loan contracts.This is about the application of smart contracts. Smart contracts are a self-enforcing program based on DLT without the support of any intermediaries. According to the verification mechanism of smart contracts, smart contracts can be divided into two categories: permissioned DLT smart contracts and permissionless DLT smart contracts. Different verification mechanisms involve different risks. The former involves collusion risk, and the latter involves privacy concern, so it seems that there is a key trade-off between consensus generation and information distribution (Lin et al., 2019). The main problem with DCEP-based smart contract applications probably lies in how to design a verification mechanism which provides the right incentives for maintaining consensus on specific blockchains.

In conclusion, from the information we have collected, the main impact of the technical characteristics of DCEP is to strengthen the central bank’s ability to obtain and analyze transaction information. We looked at the broader impact of DCEP from an information perspective. First, in terms of law, although DCEP has obtained the same legal status (as detailed below) as paper money(M0) in the issuance and operational stages, related rules and obligations that commercial banks and third parties should abide by when operating digital wallets are not determined by laws and regulations. Second, changes in the information environment also exert impacts on several important markets and policy-making processes.

Impacts on the Legal Side

China’s DCEP practice is much faster than legal research. Da (2019) and Yang (2020) discussed the legal issues of digital currencies (mainly Bitcoin), but their discussions did not cover the legal status of DCEP. In the operational stage, commercial banks and third-party institutions undertake part of the information verification and management functions. It remains unclear what rules they should follow. If the application of smart contract technology is taken into consideration, these institutions still have new transaction models brought about by the combination of DCEP and smart contracts,which will also bring challenges to legislation and justice. For example, the problems brought by smart contracts would be to determine which user information needs to be protected, and which smart contracts are illegal (Ma, 2020). There is a big gap between DCEP and traditional currencies in terms of issuance method, circulation method, and supervision mechanism. At present, laws and regulations have not been discussed in this field.

Regarding financial regulations, the central bank and other affiliated institutions can obtain detailed transaction information of users through DCEP. This requires legal restrictions on relevant institutions’ access to user information. For example, it is necessary to stipulate that the central bank and the “three centers” can only access the information for anti-money laundering and anti-terrorism investigations. However, relevant legal issues have not yet been discussed.

Impacts on Markets

Credit markets.

DCEP may change the traditional credit markets, which mainly rely on collateral (such as equipment and real estate) for credit allocation. It is difficult for small and medium-sized enterprises(SMEs) to obtain credit capital, and large enterprises and local governments (in Chinese mainland)have more credit resources. As a result, SMEs are crowded out of the Chinese credit markets (Huang et al., 2020). DCEP allows banks to directly obtain corporate cash flow information, and thus change the traditional collateral-based financing model to a cash flow-based financing model (Lian& Ma, 2021). Although this involves the legal authority of commercial banks to access customer transaction information, it is technically feasible. As a key node in the DCEP permissioned chain, a commercial bank has the right to apply for access to the central bank’s data center. If the cash flow data of a certain company is analyzed within the scope of the law, the process of using the data by the commercial bank can be verified by a third party and, then DCEP can greatly reduce the cost of information asymmetry. This process requires the participation of lending banks, SMEs, central banks, and third parties for supervision. Commercial banks and SMEs will be motivated to carry out this business if the cost is low enough.

Payments in cross-border retail markets.

DCEP currently mainly targets the retail markets. The transactions and payments in the domestic retail markets are mature. For example, the two online platforms of Taobao and JD, and the payment systems (AliPay and WeChat Pay) have greatly promoted the development of the domestic retail industry. Also, the establishment of these retail platforms and payment systems has greatly promoted domestic employment and entrepreneurship (Yin et al., 2019). DCEP may not have a significant marginal impact on the domestic retail markets. However, a noteworthy change is that DCEP is being used in a cross-border payment system. Unlike the existing cross-border RMB payment system known as the Cross-border Interbank Payment System (CIPS), DCEP is not based on bank accounts.In theory, if users have the DCEP wallet from the People’s Bank of China, they can make crossborder payments which greatly increases the efficiencies of cross-border retail transactions. After China conducted a domestic pilot experiment of DCEP in 2020, it is currently conducting a crossborder payment test (in Shenzhen and the Hong Kong Special Administrative Region (SAR)). China has not fully opened capital flows at present, which means that DCEP-based cross-border payments are still mainly used for small retail payments. However, the cross-border payment test of DCEP and the development of cross-border payment projects will help increase the international influence of RMB and promote the formation of a new international retail market. The efficient improvements in DCEP-based cross-border retail payment systems may promote the cross-border retail markets between China and other countries along the Belt and Road.

Payment system markets.

Domestic electronic payment systems are quite mature. Relatively speaking, DCEP has two main characteristics, namely controllable anonymity and offline payment technology. At present,the two characteristics have not formed strong competitiveness against the existing bank-based payment systems or electronic payment systems (e.g. Fast Pay and AliPay). As the current DCEP design minimizes the impact on the commercial banking systems and the existing electronic payment systems, DCEP will not have a significant impact on the existing payment markets. In the international payment markets, DCEP is mainly being used for cross-border retail payments.

Impacts on Policy

Monetary policies.

The centralized design of DCEP enables the central bank to obtain and analyze the flow of DCEP at very low costs. Therefore, DCEP can directly affect the transmission channels and policy formation of China’s monetary policies. Yao (2018) discussed the possible impact of DCEP on monetary policies, arguing that DCEP can directly control commercial bank credit and reduce the procyclicality of commercial banks, and at the same time track and monitor the circulation information once the DCEP is released, to make possible forward-looking policy designs.

Fiscal policies.

The Chinese government can use DCEP to carry out targeted currency placement, making“helicopter money” possible. For example, in the pilot experiment of DCEP, residents received a certain amount of DCEP as gifts and were asked to spend the DCEP funding at designated shops.Therefore, it is foreseeable that DCEP can be used as a fiscal policy tool for targeted tax cuts,subsidies, and consumption stimulation. More importantly, China’s local governments have a special position in economic development, and DCEP will enhance their ability to manage the regional economy.

Other Discussions

In addition to the above-mentioned studies and discussions, we also talk about some concerns for the banking systems created by DCEP. DCEP belongs to M0, bears no interest, and is equivalent to digital banknotes. Will DCEP cause bank deposits to be transferred to DCEP wallets in some cases? Under normal circumstances, individuals and companies have no incentive to convert bank deposits to DCEP, unless there is a bank run (this possibility is faint). There is no need to consider the narrowing bank problem raised by Broadbent (2016). On the contrary, DCEP reduces the cost of holding currency “cash” and may be more sensitive to interest rate variations. Therefore, the interest rate (benchmark interest rate) for competing deposits among interbank markets may decrease, thereby reducing lending rates and expanding bank assets and liabilities. The second situation is that many commercial banks (or other institutions) may be involved in market competition in the process of operating DCEP wallets. Although these payment service providers (PSPs) such as commercial banks and other institutions are operating wallets, due to the existence of scope, commercial banks may also compete for the right to operate DCEP wallets, which in turn will encourage banks to take risks to carry out DCEP-related innovative business (off-balance sheet business). This in turn will introduce new risks to the commercial banking system.

Conclusion

In spite of foreign studies of the impact of CBDC on the economy, there is no rigorous macroand micro-financial research, or sufficient discussion on the risk of DCEP, and its impact on related laws and regulations in China. The main risk of issuing CBDC is that it may squeeze out depositors’demands for deposits, thereby affecting the credit supply of the real economy. Officials from the central banks of the United Kingdom, Norway, and Sweden have all expressed their concerns and examined the crowding-out effect of CBDCs on deposits in official reports (Broadbent, 2016; Carney,2018; Norges Bank, 2019; Sveriges Riksbank, 2018), whereas further academic research is needed in China. At the same time, the study of the impact of China’s DCEP on RMB internationalization is also an important topic, but there is not yet enough research (Ma, 2020).

Still, the DCEP pilots and related patent data reflect a lot of information. First, DCEP deployed a centralized issuance method. The People’s Bank of China has established three data centers for DCEP-related verification, registration, and big data analysis. Second, DCEP adopted a marketoriented manner in the operational stage and allows market competition to promote the application of DCEP and technology development. Among them, the integration of smart contracts into DCEP is the most promising. Third, DCEP will build a new cross-border retail payment system, which is expected to make a great difference.

Finally, the current discussion on DCEP focuses on the retail markets, which will be greatly affected by the development path of DCEP. In the future, DCEP may be applied to wholesale markets or in international payment systems; but considering the current status of the RMB in international payment systems (RMB only accounts for 4 percent of the international payment currency) and the current domestic economic development needs, DCEP may focus on the retail markets (including cross-border retail payments) at this stage. Also, this article mainly focuses on the latest developments of DCEP, and does not discuss the relevant monetary theory in depth. It is conceivable that the development of CBDC will give rise to new monetary theories, which can also be an important aspect of future DCEP research. DCEP development emphasizes practice, but there is a lack of theoretical research. By comparison, while foreign countries emphasize CBDC-related studies, their practices lag behind. We believe that China’s DCEP practice needs to be thoroughly examined to develop useful theories.

Contemporary Social Sciences2021年4期

Contemporary Social Sciences2021年4期

- Contemporary Social Sciences的其它文章

- The Shu Road and the Silk Road:Re-verifying the Diffusion Route of Indian Buddhism in Central China

- On the Canonicity of the 1947 Edition of T‘a(chǎn)i-Chi Ch‘üan

- A Study on the Management of Career Development of Young Teachers in Higher Education Institutions from the Perspective of Career Anchors

- Zhang Sixun and the Prosperous Astronomy in the Song Dynasty