The Information Efficiency of QFII’s Investment in China’s Capital Market

Sun Xianchao

Sichuan Normal University

Zhao Xiaolei

Arizona State University

Liu Xinran

Nankai University

Dong Jianming*

Southwest University of Finance and Economics

Abstract: This paper takes stock price synchronization and price delay as indicators of information efficiency, and uses mixed cross-sectional data of listed companies into which Qualified Foreign Institutional Investors(QFII) have made investments, to study the impact of QFII’s investment behaviors on the information efficiency of China’s stock market. The results show that QFII’s investments can improve the information efficiency of China’s stock market, but its impact is varied. The impact of QFII’s investments on market information efficiency is more significant in bear markets than in bull markets, the impact on private enterprises is more significant than on state-owned enterprises, and the impact on Small and Medium Enterprises (SME) market is more significant than in main board market. Further research also finds that QFII has a certain threshold effect on the information efficiency of China’s stock market. This research paper provides a problem-solving perspective for China’s capital markets to achieve information efficiency through opening up, and at the same time warns against financial risks.

Keywords: Qualified Foreign Institutional Investors, stock price synchronization, mixed cross-sectional data,information efficiency

Introduction

With the development of China’s capital markets, the scale of financing continues to grow.However, the investment scale of residents fluctuates periodically, and the markets often rise and fall sharply. In bull markets, the trading volume is booming, while in bear markets,the volume shrinks sharply. Furthermore, the bull markets are fairly short while the bear markets usually last longer. Stock prices fluctuate sharply between high and low levels, which means there is a serious deviation between the capital markets and the real economy, and that the pricing function of the capital markets in China has not been well developed. In order to build efficient capital markets,the Chinese government has made unremitting efforts, such as strengthening the construction of market reputations, and comprehensive governance of listed companies, trading systems and issuance systems. Among them, opening to the outside world is an important policy. In April 2018, at the Boao Forum for Asia Annual Conference, Xi Jinping in his keynote speech pointed out that several significant initiatives would be launched to continue enhancing the opening-up of financial markets.The government should take measures to ensure the implementation of measures to raise foreign equity caps in the banking, securities and insurance industries. At the same time, we will make more moves toward further opening, including accelerating the opening up of the insurance industry,easing restrictions on the establishment of foreign financial institutions in China and expanding their business scope, and opening up more areas of cooperation between Chinese and foreign financial markets.

Since China joined the World Trade Organization (WTO) in 2000, it has opened its capital and financial accounts in an orderly manner. In capital accounts, free convertibility has been achieved. Foreign direct investment (FDI) in China and Chinese enterprises’ foreign direct investment (OFDI) have emerged. In the process of capital accounts’ opening up, a large number of foreign enterprises have come in, while a large number of Chinese enterprises are investing abroad. In this process, China’s local economy is internationalized, and Chinese local industries and products are developed. Overall, the operational efficiency is effectively improved. Besides, in the opening up of financial projects, the state has implemented QFII and qualified domestic institutional investors (QDII) since 2003. Through the opening of capital markets, the Chinese government tries to improve the efficiency of these markets, promote reforms in domestic finance, and optimize the allocation of resources throughout the world to realize its national strategies, such as the internationalization of the RMB. Of course, the process of opening up is bidirectional. We can achieve the goal by combining introduction with going global. In order to study the opening of capital markets more carefully, this paper intends to study the successful experience of foreign direct investment (FDI) in China’s economic growth, and analyze the impact of foreign institutional investors on the information efficiency of China’s capital markets. As a financial institution coming from mature capital markets, whether FDI can play its role in improving China’s capital markets, especially in asset pricing, is the focus of this paper. This paper studies the information efficiency of China’s stock market from the perspective of the introduction of foreign institutional investors and increase of openness. Also, this paper studies the logical chain between QFII and information efficiency and uses empirical methods to systematically test the links. Based on the results of this study,we put forward corresponding policy recommendations.

Unlike previous studies which focused on the impact of financial openness on economic growth and financial risk management, this paper studies the impact of capital flow on the information efficiency of the securities market under the conditions of financial openness.Particular attention is paid to the ability and speed of stock price response information, which is used as a measure of efficiency. The latest literature studies the relationships between the information efficiency of the stock market and the behavior of the regulatory authorities, because improving the efficiency of the stock market is one of the main objectives of the regulatory authorities. In recent years, regulators have made concerted efforts to establish efficient capital markets, as academia continues to research market operations. Both regulators and academia focus on: short selling constraints, internal transaction legislation, investment protection systems and financial liberalization. Theoretical and empirical studies have found that efficient stock prices can effectively guide the optimal allocation of investment resources. This is because a large amount of information is reflected through stock prices, which will guide the decision-making of enterprises and individuals. Therefore, we determine that there is a definite link between the stock market and the real economy (Bond, Edmans & Gold, 2012). And it is of great significance to build an efficient stock market.

This paper uses empirical methods to verify whether foreign institutional investors can improve the information efficiency of China’s stock market. We mainly used the synchronization of stock prices, which represents the information content of stock characteristics. In order to test robustness, we used Bae, K.H., Ozoguz, A., Tan, H. & Wirjanto, T.S. (2012) as reference and tested the robustness of the response speed of information by using the price delay index as the representative of stock prices. By using these two indicators, this paper empirically tested the impact of QFII on information efficiency of China’s stock market from information content and information reflection speed.

Domestic scholars have relatively little literature on QFII’s investments in China, most of which has been developed since 2006. Rao Yulei, Xu Junlin, Mei Lixing and Liu Min (2013)published an empirical study on the synchronization between QFII and Chinese stock prices and their results indicated that in the long run, QFII’s investments can help stock prices fully reflect information, improve the information content of stock prices; and reduce the synchronization of stock prices. In the short term, QFII’s investments and China’s stock prices will show a synchronous feature, and short-term investments cannot improve the information efficiency of stock market. Through robustness tests, we found that QFII’s investments in bull markets will increase the synchronization of stock prices, while in bear markets they will reduce the synchronization of stock prices (Cheng, Liu & Guan, 2014). By using the Sais measure and fuzzy gray matter-element space theory (FHW) measure to expand and compare herding behavior, we empirically analyzed the differences and relationships between QFII and the herding behavior intensity of domestic institutional investors. The results indicate that the herding effect of QFII’s investment behaviors is lower than that of domestic institutional investors. In terms of investing in domestic stock market, domestic institutional investors have a better understanding of Chinese local culture and are more familiar with the domestic markets. Therefore, in the herd effect, domestic investors are the leader, while QFII are the follower. Based on the analysis of shareholders’ shareholding of A-share listed companies, Wu Weihua, Wandi and Fang Caidi (2011)studied the positions of QFII among the top ten shareholders, and the role of QFII’s investments in China’s stock market from the perspective of finance and corporate governance. The statistical results show that the financial indicators of the listed companies invested by QFII are obviously better than those of the listed companies not invested by QFII. This shows that QFII stick to value investments in China and their investments promote the Chinese stock market to fully reflect the development of the real economy.

The main contributions of this paper are: First, the information efficiency of foreign institutional investment in China’s stock market is discussed from the perspectives of information content and information response based on two indicators of information efficiency: stock price synchronization and price hysteresis. Second, this paper classifies the sample data according to economic cycle, enterprise nature and listed markets and then empirical analysis found that bull markets information efficiency is slightly lower than that of bear markets. Also, the information efficiency of QFII to state-owned enterprises is lower than that of private enterprises. Third, this paper examines the non-linear relationship between foreign institutional investors and information efficiency in the stock market.

The specific contents of this chapter are as follows: Part 2 deduces the logical research hypothesis and derives four research proposition hypotheses; Part 3 constructs the model and explains the variables; Part 4 empirically analyses the impact of QFII’s investments on the information content of stock market based on the index of stock price synchronization; Part 5 is a series of robustness tests based on information reaction speed and other indicators. After that, the content of this paper is summarized.

Research Hypotheses

Capital markets play an important role in economic growth; financing and optimizing the allocation of resources; promoting the reform of the state-owned economy; and developing a socialist market economy with Chinese characteristics. Therefore, it is of great significance to establish efficient capital markets. The role of a stock price in guiding resource allocations depends on its ability to reflect the real information of an enterprise, which is pricing ability.The ability of a stock price to respond to information is an important indicator of the efficiency of a country’s securities market (Jun & Guo, 2014). Various measures have been taken to build a stock market with efficient pricing mechanisms, and the QFII system is one of them. QFII system was born in the mature capital markets. They usually adhere to value investments and focus on mining the specific value information of their potential investment targets. In terms of searching and screening information, QFII are more accessible to information than individual investors,and is often considered as informed traders in the markets. They have economies of scale and run a team of professional analysts at a lower cost. Their ability to acquire and process information is far better than that of individual investors (Deng & Sun, 2014). In terms of information transmission, once a company’s stock is held by QFII, it is likely to send a signal to the markets that the company has strong profitability and good corporate governance. Because of its value,investments, and the ability to acquire and process information, QFII can adequately respond to some real and potential information of the stock market, It will play a positive guiding role in the capital markets, thus improving the information efficiency of the markets. Through the analysis above, it can be concluded that the first way QFII can improve the information efficiency of stock market is to transmit effective information to the markets through trading (Bae, Ozoguz, Tan,& Wirjanto, 2012). The study finds that foreign institutional investors have a high international vision and financial literacy. They can handle and use information more skillfully and transfer private information to stock prices through trading.

After foreign institutional investors enter China, they will influence the information efficiency of domestic stock market through capital input and trading, which are discussed above. Another aspect of the impact of foreign institutional investors on the information efficiency of domestic stock market is to influence the behavior of market participants through market mechanisms,which will promote the optimization of market participants and information efficiency. Market participants are mainly listed companies, domestic investors, and governments. The introduction of QFII can promote the optimization of market participants through market mechanisms, which include competition mechanisms, technology demonstrations, personnel mobility, and industrial chain associations.

In terms of the development of listed companies, QFII can actively participate in the corporate governance of listed companies, restrain the behavior of internal shareholders, and can even optimize listed companies by providing advice and suggestions for development. QFII can also select listed companies with future development prospects through market testing to realize the optimal allocation of resources.

From the perspective of domestic institutional investors, the theoretical premise of asset pricing is the rationality and expertise of investors. Only with it can we realize the construction of the optimal portfolio and find arbitrage opportunities in the markets. These characteristics have enlightening effects on thinking about the information efficiency of the stock market from the demand side. With the introduction of QFII, based on competition mechanisms and demonstration effects, the professional technology of domestic institutional investors has increased, thus promoting the construction of the optimal portfolio.

In terms of institutional construction, with the introduction of foreign institutional investors,their investment habits and requirements in mature capital markets will promote the institutional construction in domestic capital markets, including the promulgation of a legal system, the revision of accounting standards and the improvement of trading systems, thereby promoting the development of the capital markets.

Therefore, it can be concluded that QFII carrie out corporate governance on listed companies through investments and demonstrate their role to other investors with a high level of investment,thus realizing the information efficiency of the stock market. Based on the discussion of the above two perspectives, we can deduce Hypothesis 1.

Hypothesis 1: The introduction of foreign institutional investors (QFII) has brought capital and technology to China’s capital markets. Capital transactions transmit more private information to the markets, and professional investment technology promotes the optimization of market participants, thus improving the information efficiency of the stock market.

China’s stock market is less developed. The speculative circumstance there is relatively strong, which often leads to sharp rises and falls. QFII’s investment in China will inevitably be affected by such circumstance. In addition, the governance structure of listed companies in China needs to be improved. Financial integrity is not yet sound. When foreign institutional investors have certain advantages in China, their risks will be exposed. As QFII have no obvious information advantages over domestic institutional investors, once the markets are not clear, they will take follow-up actions for domestic institutional investors, thus forming a herding effect (Xu, Yu & Yi, 2013). Regulators often take administrative control measures to curb the outbreak of financial risks in extraordinary periods. However, there may be a situation where the government cannot regulate the foreign investment institutions, or where supervision is not effective. Through literature research, we find that there is no linear relationship between QFII positions and the information efficiency of China’s stock market. The information efficiency of the stock market will be reduced if the stock holdings exceed a certain proportion,which will lead to the exposure to financial market risks (Lim, Hooy, Chang & Brooksd,2016). In the early period of the opening up of China’s capital markets, the government was relatively cautious about foreign investors. Its supervision was stringent and the QFII selected were all financial institutions from overseas mature capital markets. They operated steadily and advocated value investments and long-term investments. Besides, in the aspect of portfolio allocations, the allocation ratio of foreign financial portfolios to China’s stock assets was lower than that of other global assets. Even if China’s capital markets fluctuated sharply or other uncertain events occured, the impact on foreign financial institutions was relatively limited. So QFII’s investment portfolio in China was relatively stable.

With the opening up of China’s financial markets and the loosening of regulations, some small and medium-sized QFII have also begun to invest in China’s capital markets. Thus, the number of foreign institutional investors in China’s capital markets is gradually increasing. At this time, QFII’s allocation ratio of Chinese assets begins to rise in its global portfolio. The fluctuation of China’s stock price will have a significant impact on its entire portfolio. This will increase QDII’s attention to China’s capital markets and increase the flexibility of China’s capital markets.

In the eyes of foreign institutional investors, China’s stock market is immature.Because China’s stock market is one of the largest in the world, once QFII’s position in China increases to a certain extent, QFII’s attention to China’s stock market will increase.In addition, the immaturity of China’s capital markets and the uncertainty of policy, the competitive development of stock market globally, and the fluctuations of international exchange rates will lead to a large inflow and outflow of international funds, which will affect the volatility of the markets, and even have a huge impact on their stability. The pricing function of stock market will be destroyed.

Based on the logic of adverse selection, in the early stage of the capital market opening up,the state must have stricter supervision. Most of the foreign institutional investors who can enter the country are those with better qualifications, larger scale, and a more stable investment style and they all adhere to value investments and long-term investments. Therefore, they will abide by the Chinese government’s system and continue their investment behaviors in the mature capital markets. They will play a positive role in the markets.

With the increasing degree of financial liberalization, some foreign institutional investors with poor qualifications and small scale will enter China one after another, and then the markets will be mixed. At the same time, domestic institutional investors will pay more attention to the investment targets of foreign institutional investors. When excellent foreign institutional investors pay the cost to actively mine the value of their investment targets, other poor foreign institutional investors and domestic investors will follow their investment behaviors. Thus in the short term, a stock price will be pushed to a higher position, resulting in a decline in the rate of return of excellent foreign investment institutions. This kind of hitchhiking behavior eventually leads to foreign institutional investors reducing their enthusiasm for value mining,and the efficiency of market information begins to decline. Based on the analysis above, we will get Hypothesis 2.

Hypothesis 2: There is a non-linear relationship between the investment scale of QFII and the information efficiency of Chinese stock market. When the investment scale reaches a certain threshold,the information efficiency of the stock market will not increase but decrease.

Studying the US stock market, we find that the US stock price index shows a continuous upward trend. Are the US stock market price indices not adjusted? Based on empirical studies,we found that the adjustments of the US stock market is not achieved through price declines, but by the rise of earnings per share. That is why value investments are popular on Wall Street. On the contrary, bull markets and bear markets alternately appear in China’s stock market. The price index changes show a cross-sectional trend in the long run. The market always alternates in the ups and downs. China’s stock market realizes value discovery by adjusting the price substantially.Due to the fluctuations, the stability of the market is impaired, and it also damages the function of the capital markets in serving the real economy. Based on this fact, we want to verify whether the impact of QFII’s investment behaviors on the information efficiency of stock market is the same in bull and bear markets.

In bull markets, the markets are active and noisy, and the price shows obvious synchronization(Rao, Xu, Mei & Liu, 2013). Almost all stocks show a rising trend in varying degrees. Due to the influx of capital, the stock prices of some listed companies with poor performance also rise. During these times, people often ignore bad information as the markets are in a state of fanaticism, and the poor companies have hitchhiked along with the good companies. The asset pricing function of the markets has declined. As an institutional investor, company-specific information is concealed in noisy transactions. As the price rises, QFII will follow the price index to buy stocks, which intensifies the deviation of market price from value. The markets cannot distinguish excellent listed companies from inferior listed companies by price. The asset pricing function of the markets has declined.

In bear markets, prices continue to fall. Stock indices may even show some extreme movements,such as 998 and 1164 in the history of China’s stock market. At this time, the price of many stocks has been seriously lower than their intrinsic value, especially for some excellent listed companies.The investment cost is low, and it will achieve a stable rate of return in a long-term investment. At this time, institutional investors (especially QFII) become relatively rational relative to individual investors. A QFII increases its stock purchases in a bear market, which can be evidenced by the QFII’s quarterly investment quota published by the Foreign Exchange Administration. In bear markets, QFII’s investments stabilize the markets, corrected the markets price, and reduce the synchronization of the stock market. Another phenomenon is that in bear markets, many investors began to withdraw from the markets because of panic. The markets declined due to systemic risk and liquidity tensions. The volume of market transactions drop sharply and the market pricing functions are lost. At this time, the Chinese government will often inject capital into the markets through variable measures including loosening monetary policies, relaxing the approval of QFII inflows, and encouraging more foreign liquidity to flow into the country. At this time, despite the market risks, foreign institutional investors will take advantage of this opportunity to apply for investment quotas to enter the Chinese market for long-term investments. Therefore, in the context of the economic cycle, whether QFII’s investments in China’s stock market have a certain degree of heterogeneity is worth further empirical testing, thus two opposite propositions can be drawn.

Hypothesis 3a: In bull markets, QFII’s investments have no significant impact on stock information efficiency. In bear markets, QFII’s investments will increase the information efficiency and reduce the synchronization of stock prices. Under both markets, the impact of QFII on stock information efficiency is heterogeneous.

Hypothesis 3b: QFII can achieve the information efficiency of Chinese stocks and reduce the synchronization of stock prices in both bull and bear markets.

China’s securities regulatory authorities have been committed to establishing a multi-level capital market to provide financial support for Chinese enterprises at all levels. There are three sectors in Chinese stock market, namely, main board market, and China Growth Enterprise Market (GEM). There are some differences in the listing requirements of enterprises in the three sectors of the markets. Among them, the enterprises listed on the main board market are mainly state-owned enterprises with large market values. The enterprises listed on SMEs are mediumsized state-owned enterprises, collective enterprises, and private enterprises. The enterprises listed on GEM are mainly small and medium-sized private companies.

In China, the reform of the urban economy has always been an important issue of economic development, the core of which is the reform of state-owned enterprises. Large state-owned enterprises are the main listed enterprises in the main board market. State-owned enterprises are not only profit producers in China, but they also bear important social, political, and economic responsibilities such as promoting China’s economic transformation and development, and increasing social employment. But, the unclear property rights of state-owned enterprises,low operational efficiency, slow industrial development and upgrading all seriously restrict the pace of economic development in China. As their large market values are highly related to the development of the national economy, the market information of state-owned enterprises is more transparent. Can we improve the information efficiency of state-owned enterprises through investment transactions? Can we reduce the synchronization of the share price of state-owned enterprises by optimizing market entities?

If SMEs want to survive in the SME sector, they must provide better products and services and get the recognition of the market. So, in their operations, they will play the role of a producer as appropriately as possible. In addition, small and medium-sized enterprises were born at the late period of Reform and Opening Up. So, they have the characteristics of the new economy.Compared with the industries in the motherboard market, the industries that SMEs are engaged in are in the initial development stages, so these enterprises have special characteristics. The industries that state-owned enterprises are engaged in are mature and stable industries. Each state-owned enterprise in the same industry has a highly similar business capability and business development model. But small and medium-sized enterprises may be obviously different in profitability among enterprises in the same industry. QFII select investment targets mainly based on the development and profitability of enterprises. QFII lack the advantages of political resources in China, and there is no interest relationship between them and Chinese industries. So, they will select companies with industry development advantages and profitability in the markets, thus reducing the synchronization of stock prices and improving the information efficiency of asset prices. Accordingly, we put forward Hypothesis:

Hypothesis 4a: QFII’s investments can improve the information efficiency of stocks, both in the main board market and in the small and medium-sized board markets; both in state-owned enterprises and in private enterprises.

Hypothesis 4b: For the state-owned enterprises in the main-board markets, QFII’s investments have no significant impact on their information efficiency. For private enterprises in the SME market,QFII’s investment can reduce the synchronization of stock prices and improve the information efficiency of the stock market.

Models, Data, and Descriptive Statistics

Models

Based on M. Schuppli, M.T. Bohl (2010) and Cho-Min, Lin et al (2007), the basic assumption of this paper is that the QFII system is an open and innovative system in China’s capital markets,which is conducive to the price discovery function and improves the efficiency of capital market asset pricing. Based on the hypothesis deduced above, the relationship between QFII’s position and information efficiency of China’s stock market may be non-linear. Referring to the model setting methods of Kian-Ping Lima, Chee-Wo Hooyb, Kwok-Boon Changc, Robert Brooksd (2016),Li Zhisheng, and Chen Chen (2015), we construct the framework of this study:

In the model, i,t represent the sample individuals and time of the study. Efficiencyi,tis the information efficiency index of stock i at time t. The explanatory variables are: the proportion of QFII’s holdings’ market value to public shares QFIIi,t, and the square of QFII’s holdings’ market value to public sharesControlsi, t are a series of control variables. The selection of control variables is shown below.

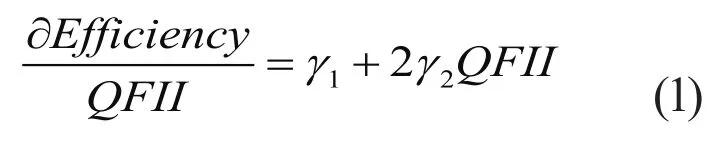

In order to test the non-linearity of foreign institutional investors’ information efficiency in the stock market, a quadratic term is set in the following model 1. According to the derivative relationship, here is:

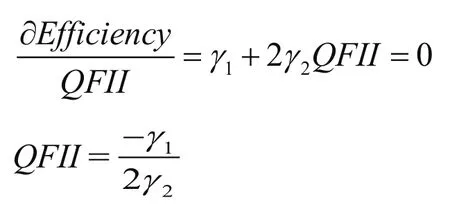

According to the expectation hypothesis of the study, if QFII’s investments can reduce the synchronization of stock prices, and there is a non-linear relationship, then we expect: r1< 0, r2> 0.According to the results of the derivation of the quadratic term, it can be determined that the location of the obedient point is:

Variable Selection

Target variable — stock information efficiency.

Price synchronization index.

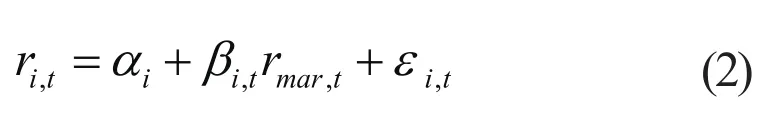

The price synchronization index is based on the method of Roll’s (1988) R2and the research of Mork (2000). The CAPM model is used to obtain the index R2of the market’s explanatory ability to individual stocks.

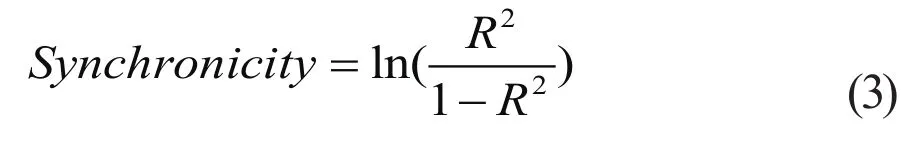

In modal (2), ri,tis the weekly return rate of the sample stocks in the t period. Since dividends are seldom distributed among Chinese stocks, the weekly return only considers the return due to stock price fluctuations. rm,tis the market index weighted weekly rate of return.In this paper, the Shanghai and Shenzhen 300 index, which is a representative index in China’s capital markets, is used as the market return rate. According to the principle of econometrics,in the regression of model (2), the meaning of R2is the degree of explanation of the market return rate to individual stock return rates. Therefore, the bigger R2is, the more the stock price fluctuation is explained by the markets, and the more synchronous the market fluctuation is.Stocks are characterized by the same rise and fall as the markets. According to the R2of the regression model, to ensure that the variables obey the normal distribution, the logarithmic transformation is made into:

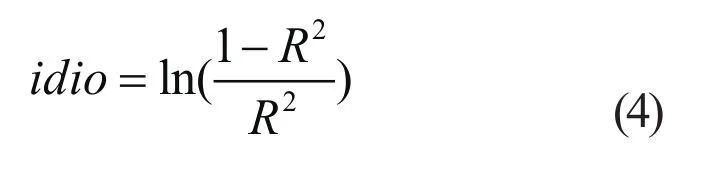

Model (3) is the price synchronization index. The larger the price synchronization index is, the lower the information efficiency of the representative stock is, and to the contrary, the information is more efficient. In some research literature, researchers also use a price asynchrony index. Price asynchrony is the opposite number of price synchronization indicators, which can be expressed as:

Price hysteresis index.

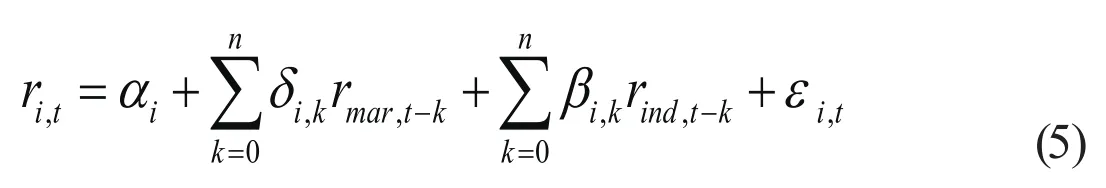

Hou and Moskowitz (2005) argues that information efficiency can be measured by using the reaction speed of stock prices to market information. The method is to construct a market yield lag index (Bae, Ozoguz, Tan, Wirjanto, 2012). If a single stock return rate can fully respond to the current market return rate, it is considered that the stock response to information is fast and the asset information efficiency is high. If a single stock’s return cannot fully respond to the current market returns, but absorbs the response in the subsequent time, thus forming the lag characteristic of the response, then, this characteristic can be embodied by the extended form of the lag order single factor model (Bae et al. 2012).

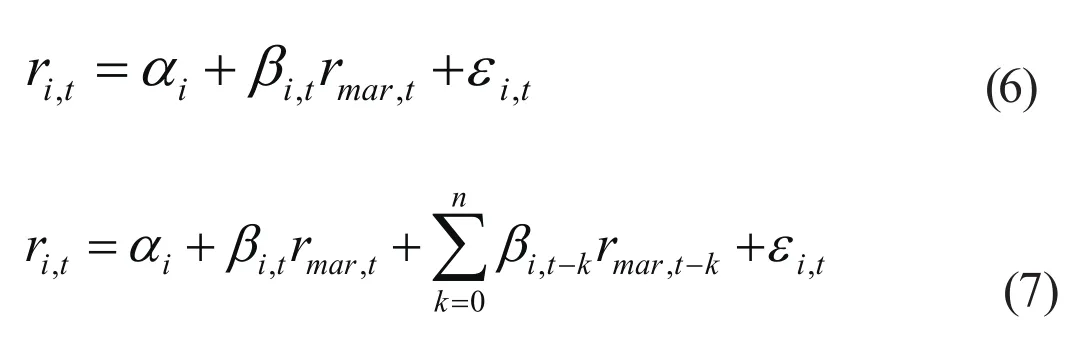

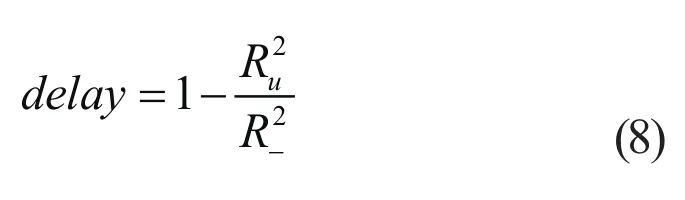

Bae, K.H., Ozoguz, A., Tan, H., and Wirjanto, T.S. (2012) think that the information efficiency of stocks can be reflected by the reaction speed of price to information. Their ideas are easy to apply and verify. After regression of model (5), two different price hysteresis methods are constructed to measure the information efficiency of stocks. We constructed the following two constraint models.

Using the data from 2006 to 2017, the total regression of model (7) is carried out and the coefficient of determination is the obtainedR2_. Using the method of Hou and Moskowitz (2005)to measure price hysteresis, we constructed a model (8). This is the variable expression of price hysteresis. Intuitively, the smaller the delay value, the lower the dependence of stock returns on historical market information, the shorter the time it takes stock prices to absorb market information, and the higher the information efficiency.

Explanatory variable.

Key explanatory variable.

The key explanatory variable is the ratio of the market values of QFII’s positions to public shares and its square. Listed companies report the types of investors in each financial reporting period. The financial reports of listed companies will also report the positions of the top ten shareholders in listed companies. In its information disclosure, the Shanghai and Shenzhen Stock Exchanges regularly announce changes in the amount of QFII holdings. This paper chooses the square of the QFII’s position ratio and the QFII’s position ratio published in the accounting reports as key explanatory variables.

Key explanatory variables use position data to show foreign institutional investors’ views on their investment targets. Another approach is to use data ratios for transactions with listed companies. However, considering the long-term investments, the QFII’s position ratios can better show the long-term and stability of their investments than the transaction data ratios. Trading data may be the result of random disturbances in some markets, so the position data can more truly reflect the investment information. But position data may filter out some responses to information.Considering the value of the study, we used the position ratios to represent the key explanatory variables.

Control variable.

The controlling variables include the listed company’s circulation market size, stock price level (P), domestic institutional investor’s position ratio (Dinst), number of ratings by rating agencies(Analysts), volume, turnover, first largest shareholder’s holding ratio (First1), top ten shareholder’s holding ratio (First10), asset-liability ratio (Lev) and stock weighted average priceearnings ratio (PE).

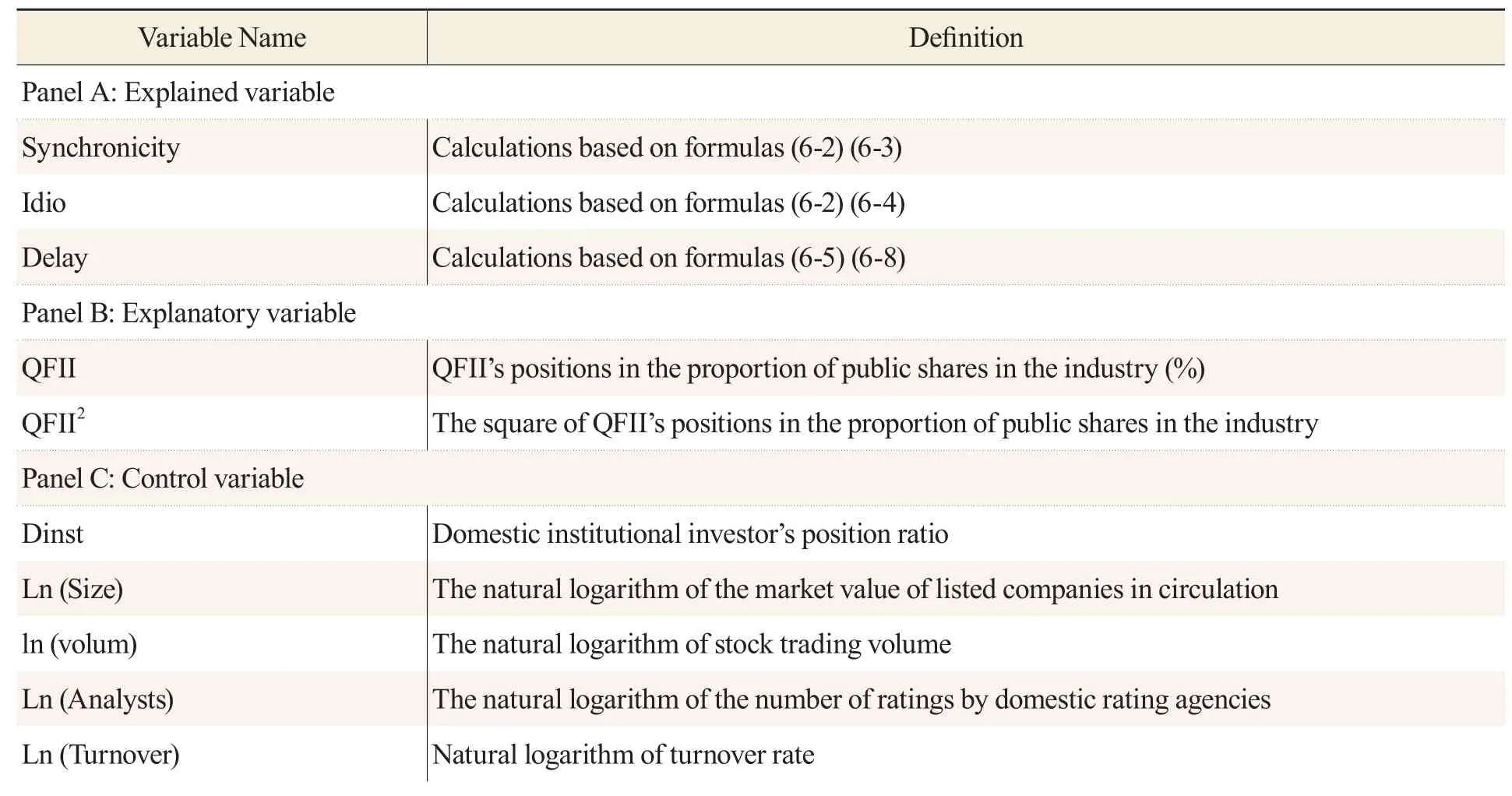

Table 1 gives a summary of the variables used in the article, and the following research will make an empirical analysis of these variables.

Table 1 Definition of Variables

Variable Name Definition First1 Shareholding ratio of the largest shareholder First10 Top ten shareholder’s holding ratio Ln (Lev) The natural logarithm of the asset-liability ratio, which reflects leverage.PE Weighted average price-earnings ratio (PE)

Data Source and Statistical Description.

The data in this paper are based on the QFII-held stocks in the Shanghai Stock Exchanges and Shenzhen Stock Exchanges. The markets range from the first quarter of 2013 to the first quarter of 2017. Some data were eliminated: First, data with short holding time of QFII were screened out. Some stocks were only temporarily held by QFII and they lack representativeness and were eliminated from our study. Second, stocks suspended or specially treated by the exchange were excluded. Sample datas were mainly obtained through Wind Information. Data that could not be collected through Wind Information was collected manually through the China Stock Market &Accounting Research Database (CSMAR).

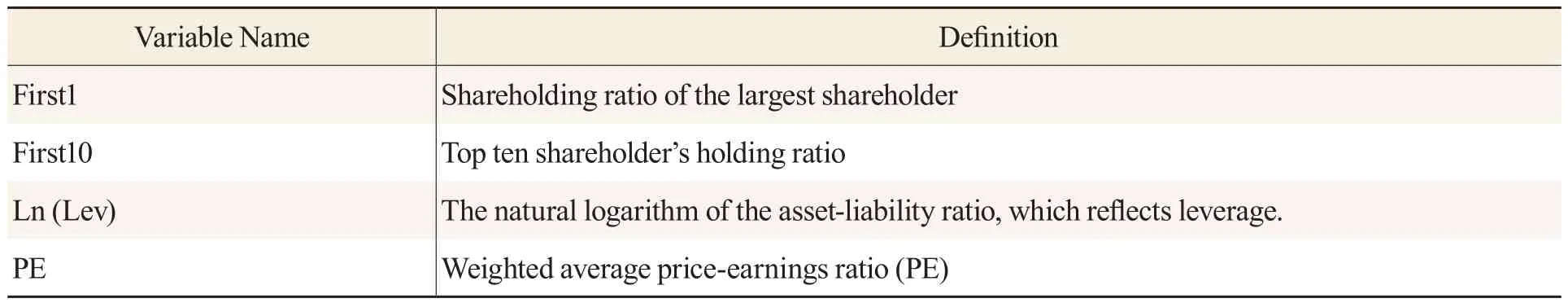

Table 2 Descriptive Statistics for All Variables

Table 2 presents descriptive statistics of the variables used. QFII holds an average of 1.7 percent of Chinese stocks. The median value is 0.97 percent. The maximum value is 18.86 percent. The minimum value is 0.01 percent. The proportion of foreign institutional investors in China’s stock holdings is generally not high. This is due to the limitation of the government’s approval quota. Observing the stock price synchronization index and price hysteresis index, we find that the average value of the stock price synchronization index is -1.22; the median value is-0.98; the average value of price hysteresis index is -1.55; the median value is -0.25. Descriptive statistics show that the data are stable.

Analysis of Regression Results

In this section of the regression analysis, considering that different research objects have different roles in the markets, we used the cross-sectional weighted generalized least squares method (WGLS) with mixed cross-sectional data. The main purpose of this method is to overcome heteroscedasticity and autocorrelation aspheric hypothesis.

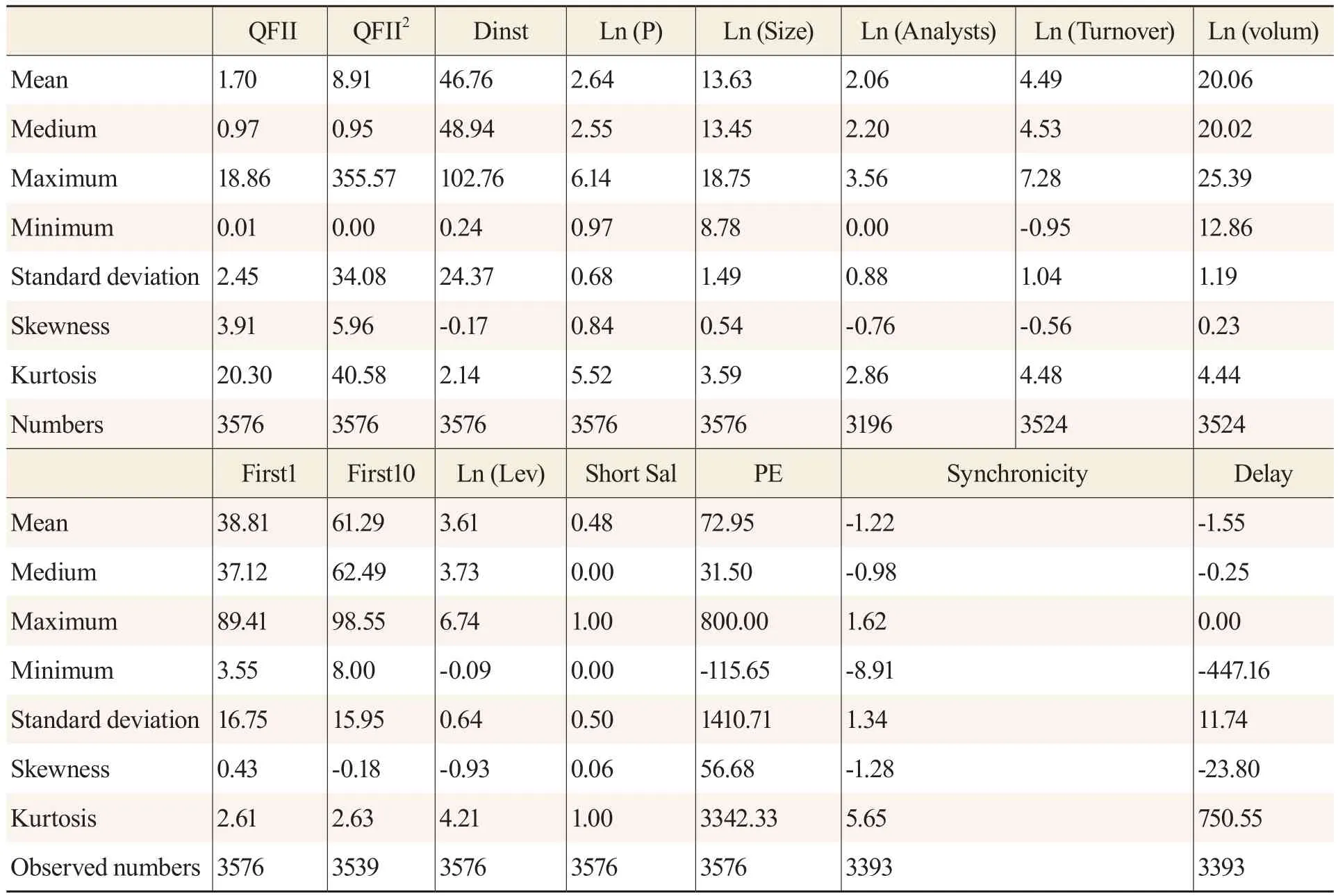

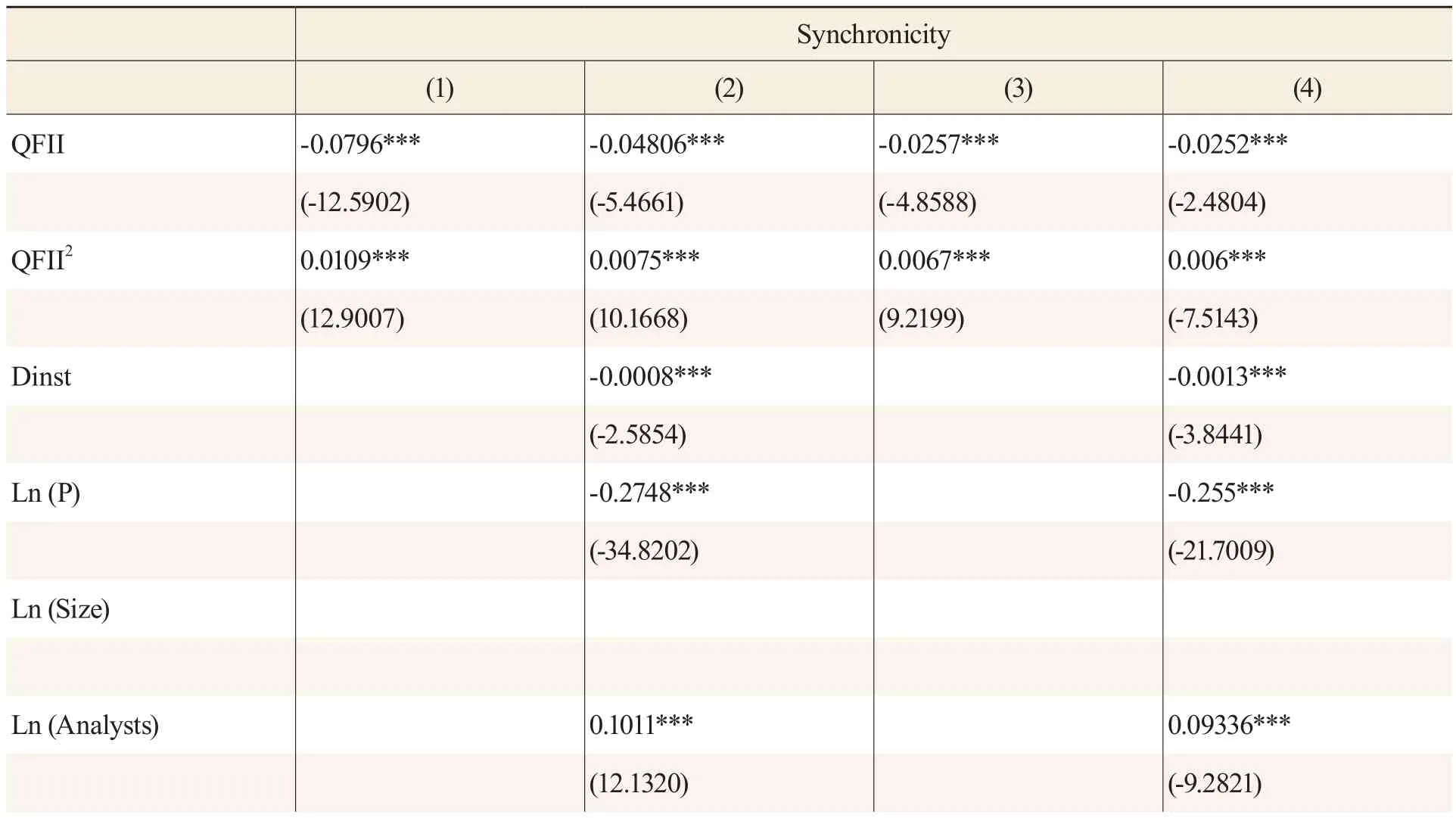

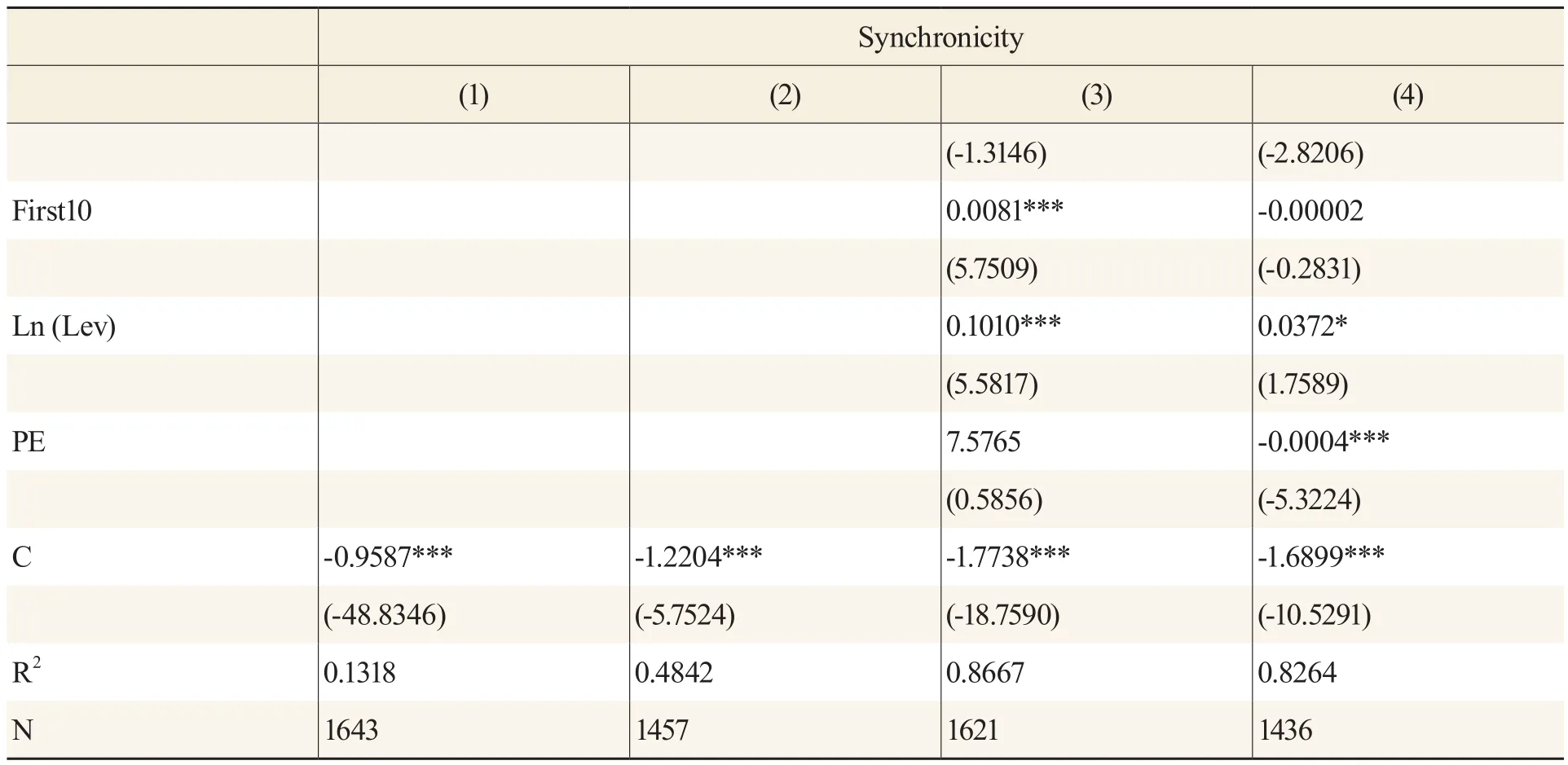

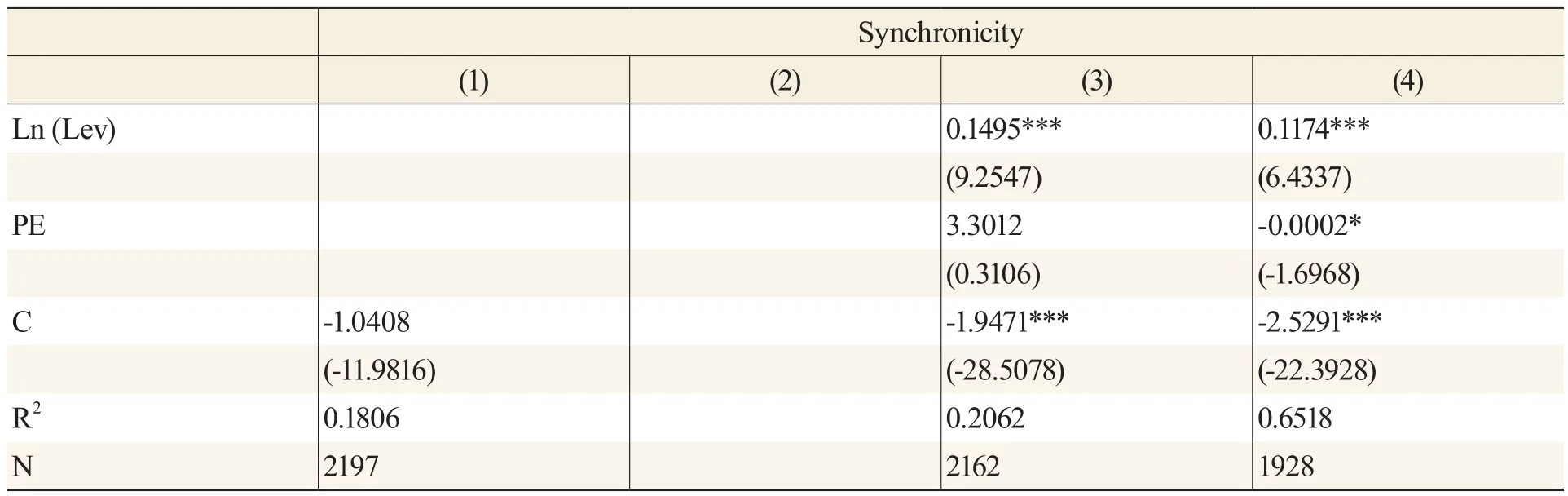

Baseline Regression— Based on the Full Sample

Table 3 shows the Baseline Regression results of the whole sample. The results of the grouping regression in Table 3 (1)-(4) show that QFII investment has a negative impact on stock price synchronization. The regression coefficient of QFII2is positive. All were significant at the 1 percent significance level. The regression results verify Hypotheses 1 and 2, that is, QFII investment in China reduces the price synchronization of the stock market and improves the information efficiency of the stock market. However, with the scale of QFII investment reaching a certain proportion, the information efficiency of the stock market will decline. There is an inverted U-shaped relationship between QFII investment and stock market information efficiency. Column(1) in Table 3 only considers the regression of price synchronization to QFII and QFII2. Table 3 (2)adds variables to the regression that reflect the technical trading indicators of the stock market,including Dinst, the natural logarithm Ln (Size), Turnover, and the natural logarithm Ln (Analysts)of the number of ratings by rating agencies. Table 3 (3) lists some indicators that are added to the public fundamentals of listed companies, including First1, First10 and Ln (Lev), which reflects the leverage ratio of assets and liabilities of listed companies. Column (4) shows regression results based on all explanatory variables. Based on the grouping regression results, we find that in terms of the influence of control variables on the information efficiency of the stock market, domestic institutional investors can significantly reduce the synchronization of stock prices, indicating that institutional investors play the role of rational investors in the markets. Institutional ratings and turnover rates also significantly reduce the synchronization of stock prices, indicating that the efficiency of stock information concerned by institutional ratings will be improved. The stocks with higher turnover rates imply that private information is active in the markets and people trade on the basis of private information. The size of the company’s circulating market value, the assets-liability ratio and the proportion of the largest shareholders have a positive impact on the synchronization of stock prices. This shows that the larger the company size, the higher the assetliability ratio combined with a higher concentration of the largest shareholders, which lead to higher synchronization of stock prices and lower information efficiency.

Taking Regression Table 3 (1) as an example, if the QFII shareholding ratio increases by 1 percent, there will be a decrease of 0.0657 units in stock price synchronization. The inflection point of the second term is:When QFII holdings reach 3.35 percent,continued foreign ownership will lead to a rise in stock price synchronization.

Table 3 EGLS Regression Results for the Whole Sample

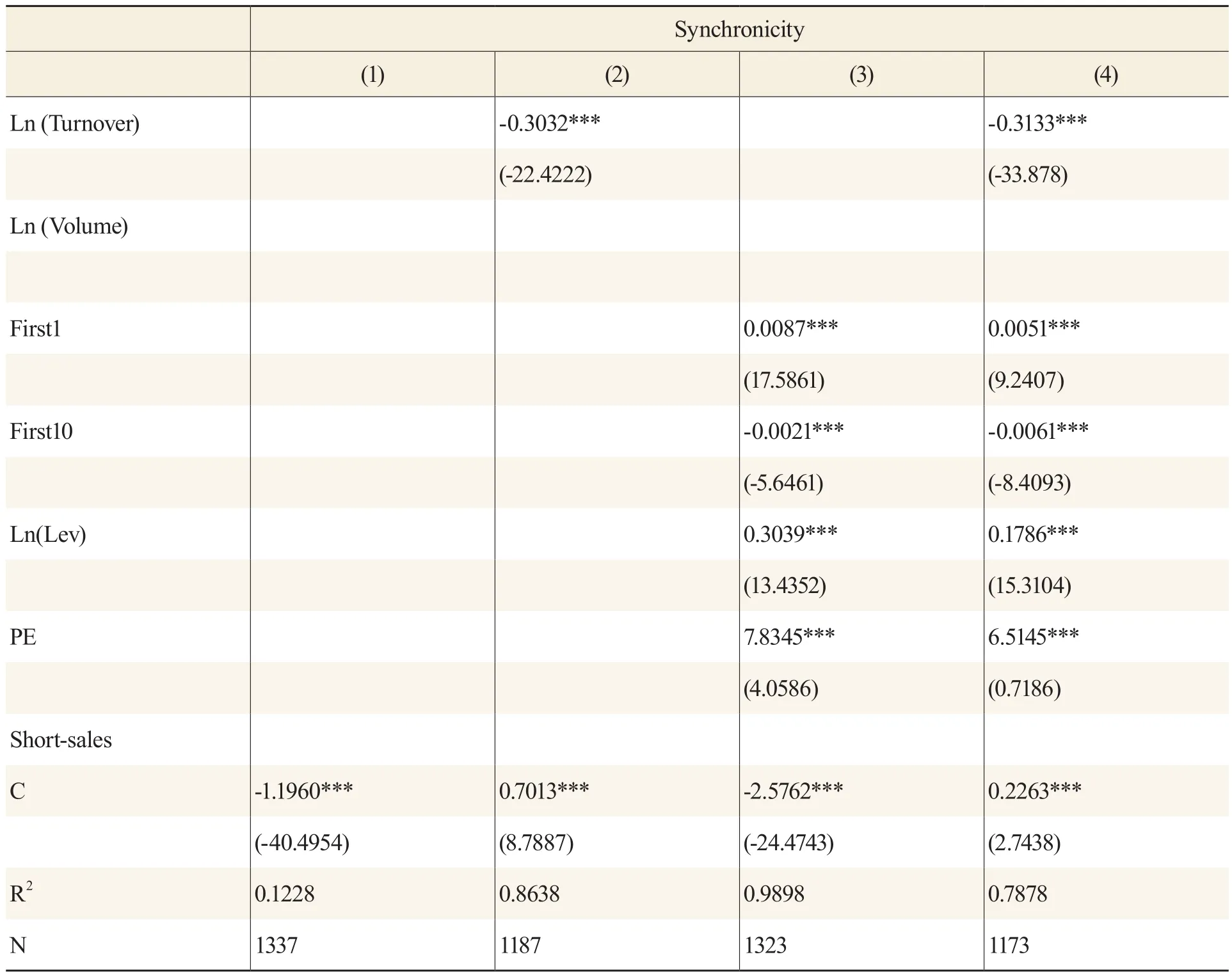

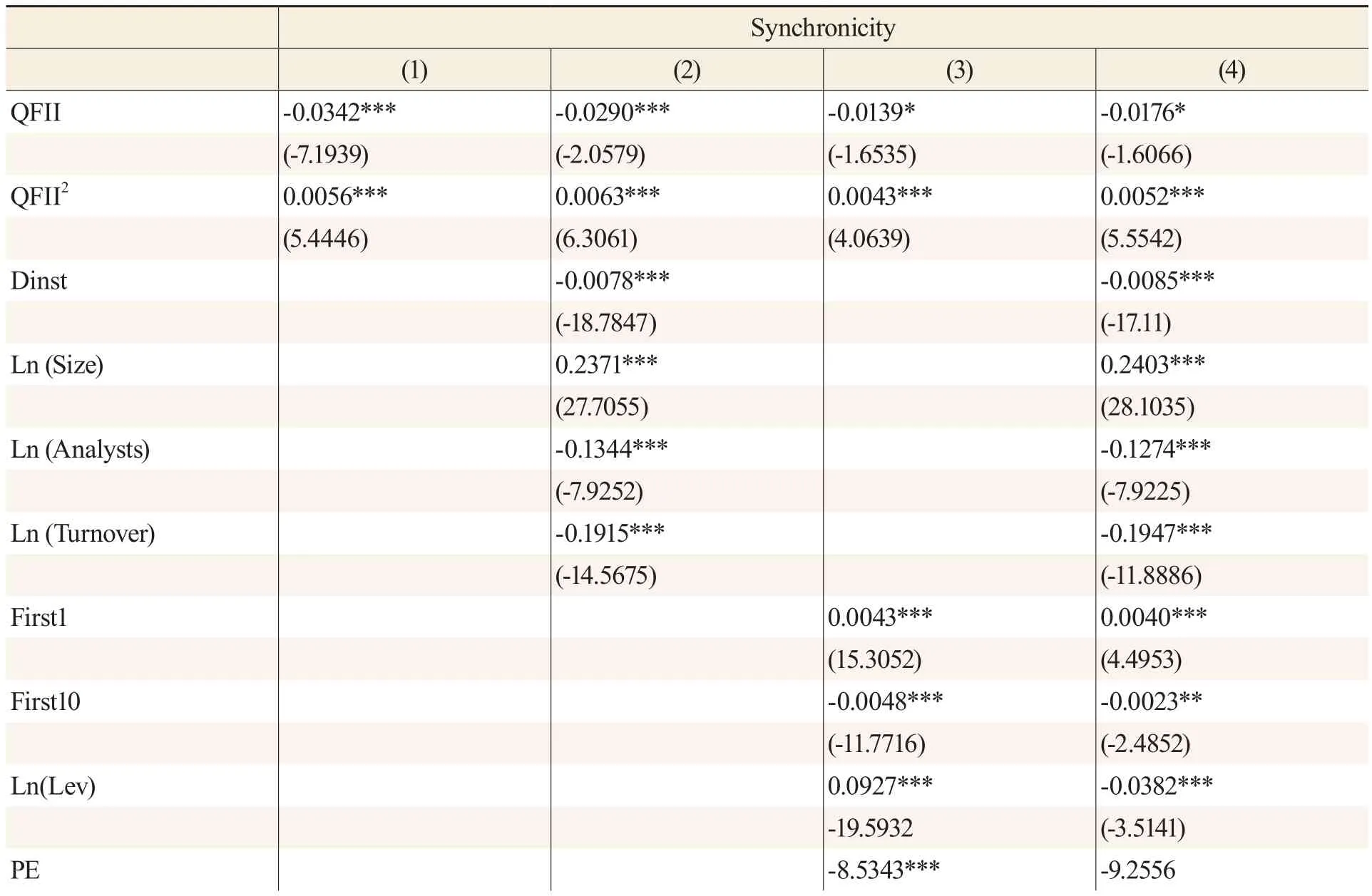

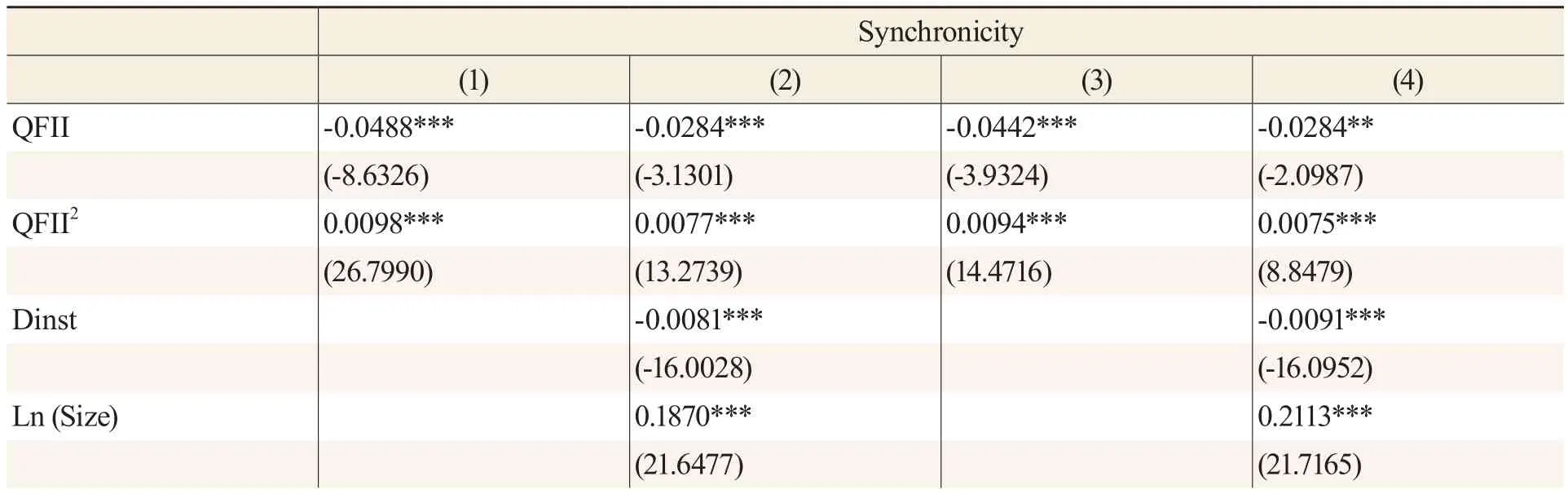

Classified Regression Based on Stock Market Cycles

There is the phenomenon of alternating bulls and bears in the capital markets. In China’s capital markets, there is a pattern of long bears and short bulls. In different stock economic cycles, the capital markets will show heterogeneity. Studies on institutional investors have found that institutional investors have different investment performance and strategies in the bull and bear markets. So how do QFII perform in the bull and bear markets in China’s stock market?This is the focus of this classification. The regression results of tables 4 and 5 show that QFII’s investments reduce the synchronization of stock prices, and are significant at a higher level of significance, whether in bull or bear markets. By investigating the two coefficients of QFII, we found that the squared term is also positive, and has a high level of significance. Therefore, we concluded that QFII can promote the information efficiency of the stock market in both bull and bear markets. In the bull and bear markets, the influence of QFII on the information efficiency of the stock market is non-linear, showing an inverted U shape. The impact of QFII on the stock market in the bull and bear markets will lead to a decline in information efficiency after reaching a certain threshold. According to the quadratic formula, the inflection point of the QFII’s position is calculated with the regression data in Table 4 (1).That is, in a bear market,after QFII’s position reached 3.65 percent, stock price synchronization began to rise. Based on the regression data in Table 5 (1), the inflection point of QFII is:

Table 4 EGLS Regression of Bear Markets Samples (2015.q3-2017.q1)

Note: The values in () are t-value statistics, in which “*, **, ***” represent significant levels of 10 percent, 5 percent and 1 percent respectively.

Further research shows that in bear markets, the absolute value of the QFII regression coefficient is significantly greater than that in bull markets. This shows that although QFII can promote the information efficiency of the stock market in both bull and bear market.It plays a greater role in information efficiency in the bear markets. The research on QFII squared shows that the coefficient of QFII2in bear markets is significantly smaller than that in bull markets, which indicates that QFII’s investments in bull markets will accelerate the critical point of information efficiency in stock market. This paper puts forward valuable suggestions for the supervision of foreign exchange stocks in China: QFII can be encouraged to invest in stocks in bear markets, while staying alert to risk as much as possible in bull markets to reduce damage to the markets. Empirical tests show that foreign institutional investors’ investment in Chinese stocks, whether in bull markets or bear markets, has a promoting effect on the information efficiency of Chinese stocks, that and there is a nonlinear relationship. Empirical tests verify Hypothesis 3b.

Table 5 EGLS Regression of Bull Market Samples (2013. q1-2015. q2)

Through the whole sample regression analysis and the sub-economic cycle regression analysis, we can infer that the critical value of the impact of foreign institutional investors on the information efficiency of China’s stock market is about 4 percent.

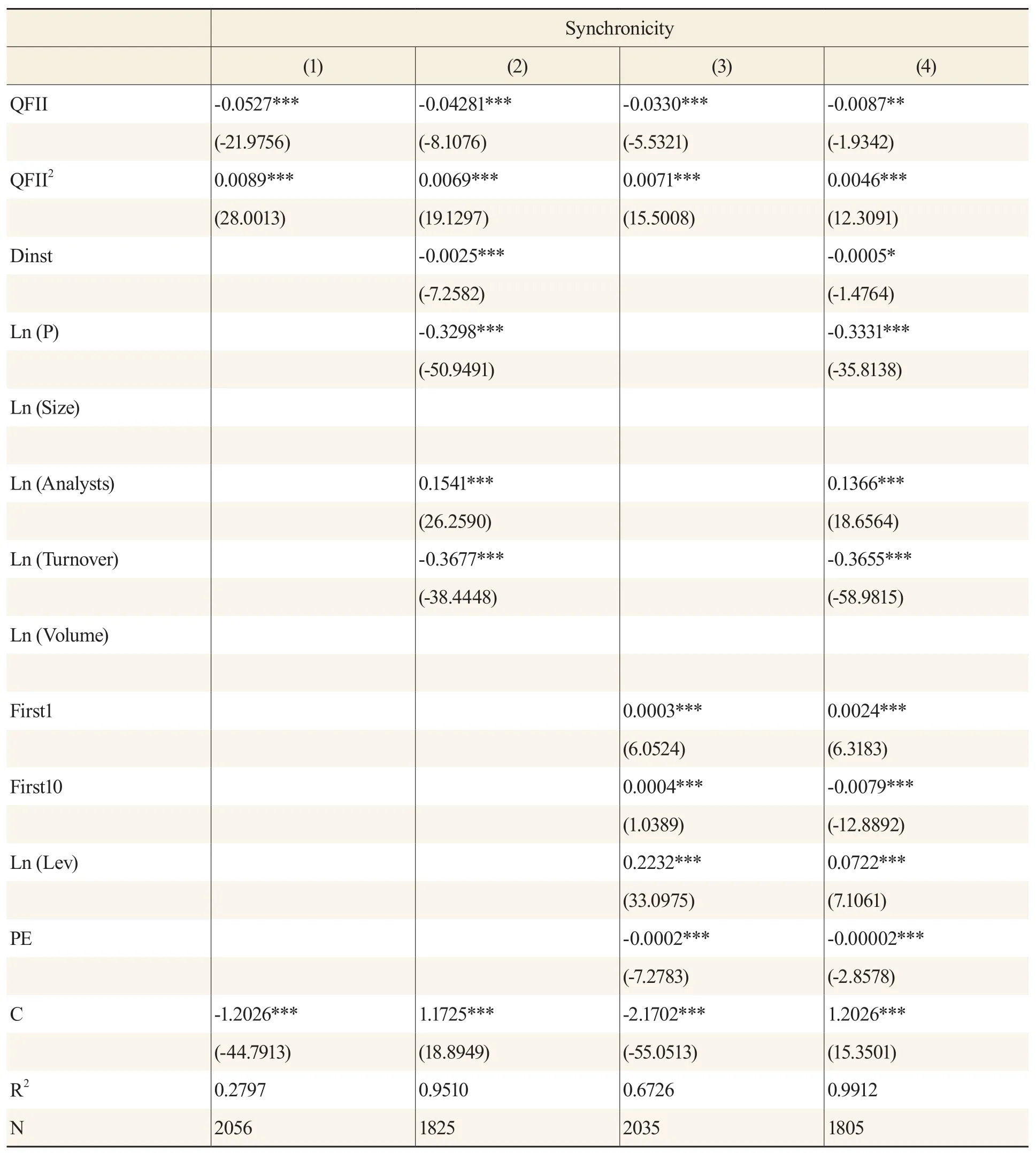

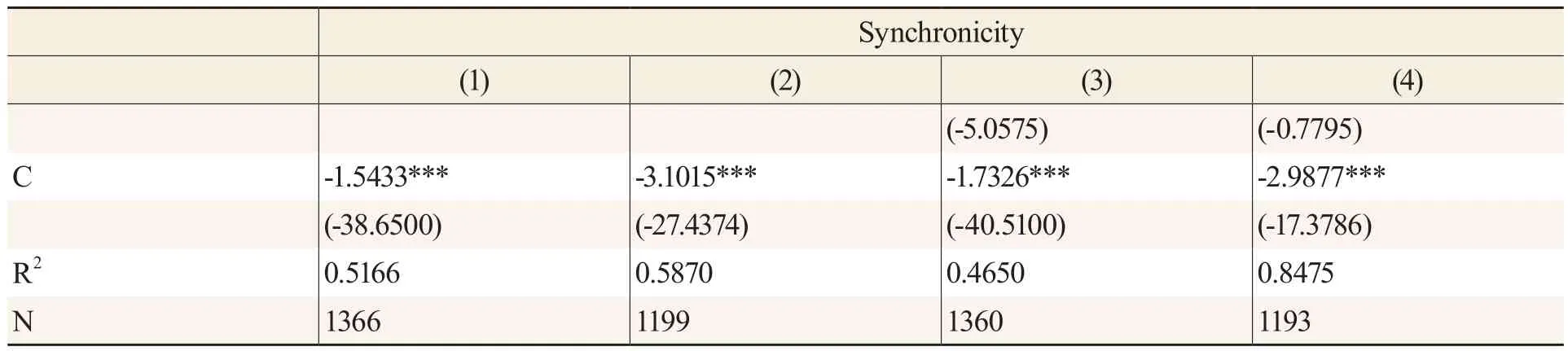

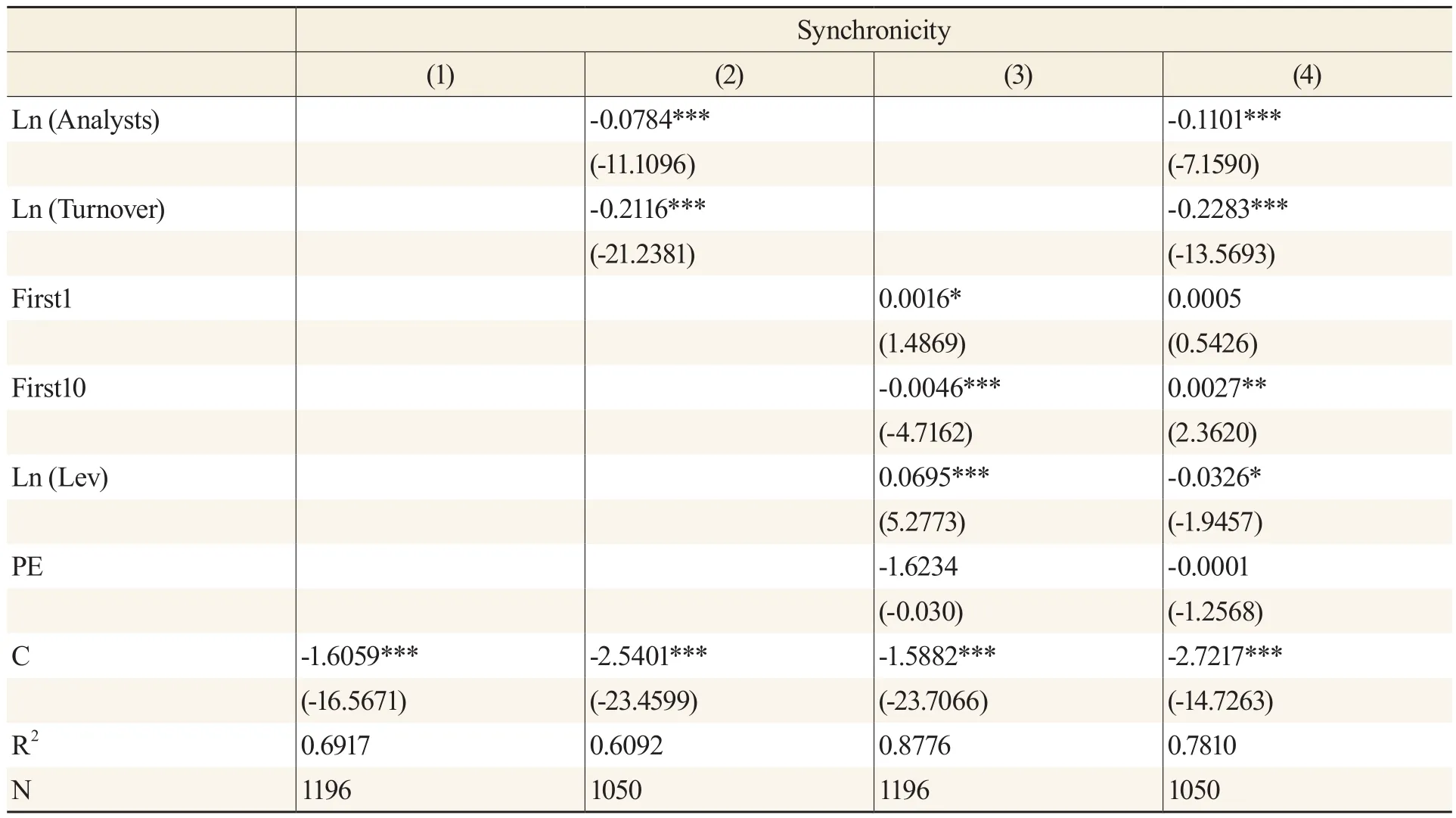

Regression of Different Enterprises

Among the listed companies in China, state-owned enterprises account for a higher proportion of financing. And the proportion of private and foreign-funded enterprises is much lower. There are significant differences of different enterprises in China in terms of operation and profitability.Considering the difference between state-owned enterprises and private enterprises, their regression results are compared in this group. The regression results of Table 6 and Table 7 show that the QFII regression results of column (1) in the regression of state-owned enterprises are not significant. The QFII regression in column (3) is not significant. In the regression of private enterprise group, the regression coefficient of QFII is negative, and the regression results are significant. This result shows that the key problem in the development of China’s capital markets is state-owned enterprises, which play an important role because of their large scale. Based on the analysis of regression results, it can be concluded that QFII have no significant impact on the information efficiency of state-owned enterprises, which may be due to the large scale of stateowned enterprises and the low proportion of QFII’s investments in state-owned enterprises. Why is the proportion of QFII’s allocation in state-owned enterprises so low? Research has found this is because of the persistent institutional problems existing in the state-owned enterprises themselves and the fact that there are many non-market factors hindering the operation of the state-owned enterprises in China. The results of this regression may provide a reference supporting the construction of capital markets in China from the perspective of the reform of state-owned enterprises.

Table 6 EGLS Regression of Samples of State-owned Enterprises

Note: The values in the regression list () are t values, in which “*, **, ***” represent significant levels of 10 percent, 5 percent and 1 percent respectively.

The regression results of QFII2indicate that there is an inverted U-shaped law in both stateowned and private enterprises in China. And it is significant at the 1 percent significance level.

Table 7 EGLS Regression of Private Enterprise Samples

Note: The values in () are t-value statistics, in which “*, **, ***” represent significant levels of 10 percent, 5 percent and 1 percent respectively.

Compared with private enterprises, the market value of state-owned enterprises is larger,and they gain more attention in social life. Logically, the information efficiency of state-owned enterprises should be higher. However, the empirical results show that the impact of foreign institutional investors on the information efficiency of state-owned enterprises is not significant.It is unstable. Therefore, Hypothesis 4b can be verified.

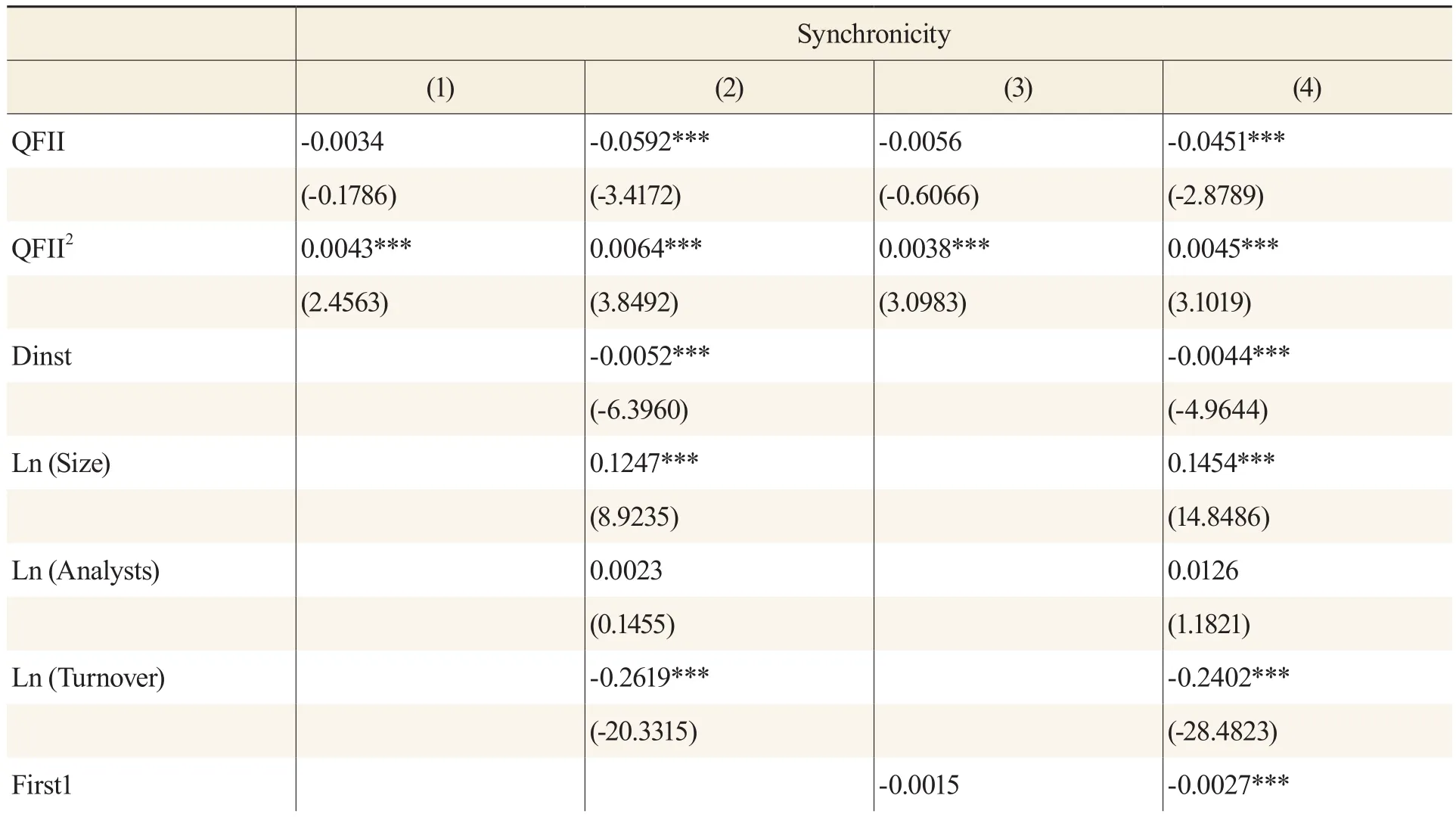

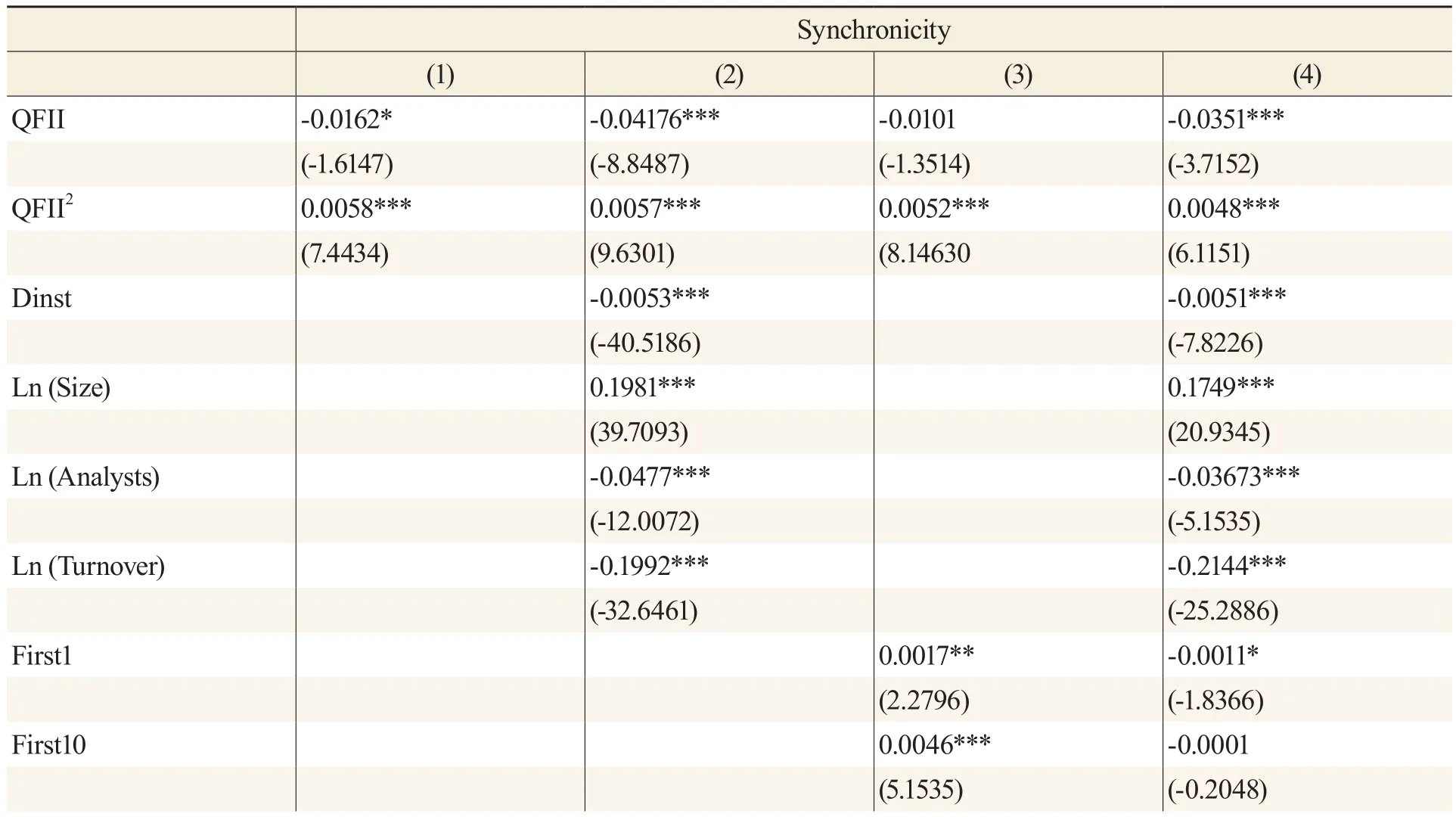

Classified Regression Based on Different Levels of the Markets

China’s regulators are committed to establishing multi-level capital markets to better provide financial services for enterprises at different levels. There are three sectors in Chinese stock market, namely, main board market, small and medium-sized board market, and GEM market in China. We divided the listed companies according to their different levels in the capital markets and carried out empirical research accordingly.

Table 8 EGLS Regression of Main Board Samples

Note: The values in () are t-value statistics, in which “*, **, ***” represent significant levels of 10 percent, 5 percent and 1 percent respectively.

The empirical results in tables 8 and 9 show that the effect of QFII on price synchronization is unstable in the main board market. In (1), the coefficient of QFII is negative, but the significance is not high. In (3), the coefficient of QFII is positive, but it is not significant at all. Only in columns (2) and (4) are the results significant. This indicates that QFII have an unstable influence on the information efficiency of the stocks in the main board market. In Table 6-11, through the investigation of small and medium-sized venture market, empirical research verifies that the QFII coefficient is negative and significant. QFII have a very stable role in promoting the information efficiency of the stocks in small and medium-sized venture market. The empirical results further verify Hypothesis 4b.

In the regression of QFII2, we find that the impact of QFII on stock information efficiency is non-linear and has an inverted U-shaped characteristic, whether in the main board market or small and medium-sized venture market. In this regard, our empirical study is highly consistent with previous studies, which indicates that introducing QFII in China can indeed improve the information efficiency of the stock market. But its promotion has a certain threshold effect. When the investment scale of QFII exceeds a certain threshold value, it will play a restraining role on stock information efficiency.

Table 9 EGLS Regression of Small and Medium-sized Venture Market Samples

Note: The values in () are t-value statistics, in which “*, **, ***” represent significant levels of 10 percent, 5 percent and 1 percent respectively.

Based on the nature of enterprises and the classification and regression of listed companies, the empirical tests show that QFII’s investments in non-state-owned enterprises and listed companies in non-main board market can reduce the synchronization of stock prices. This indicates that these types of enterprises have greater heterogeneity. Rational professional institutional investors are needed to make investment choices to ensure the survival of the market.

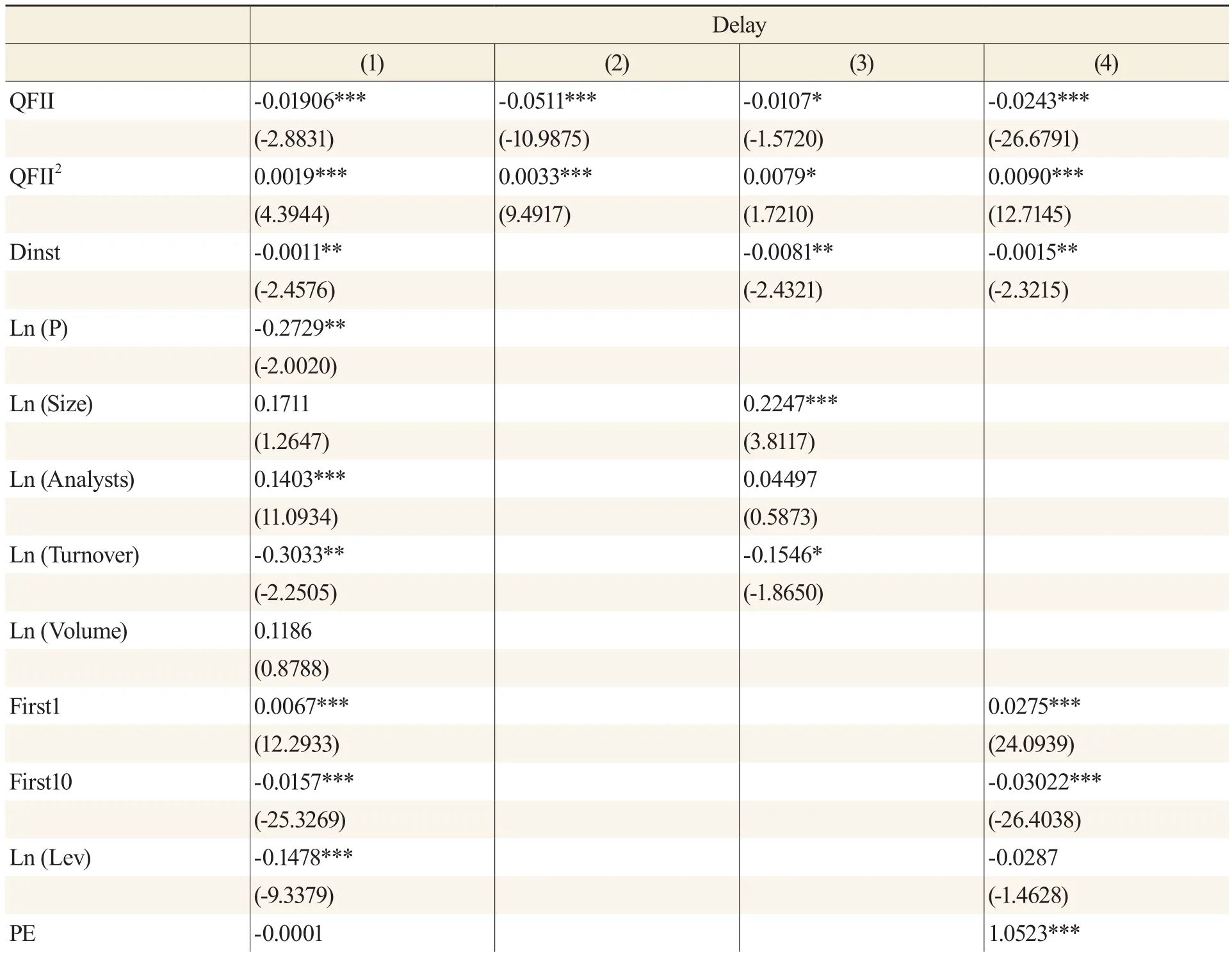

Robustness Test and Endogeneity Test

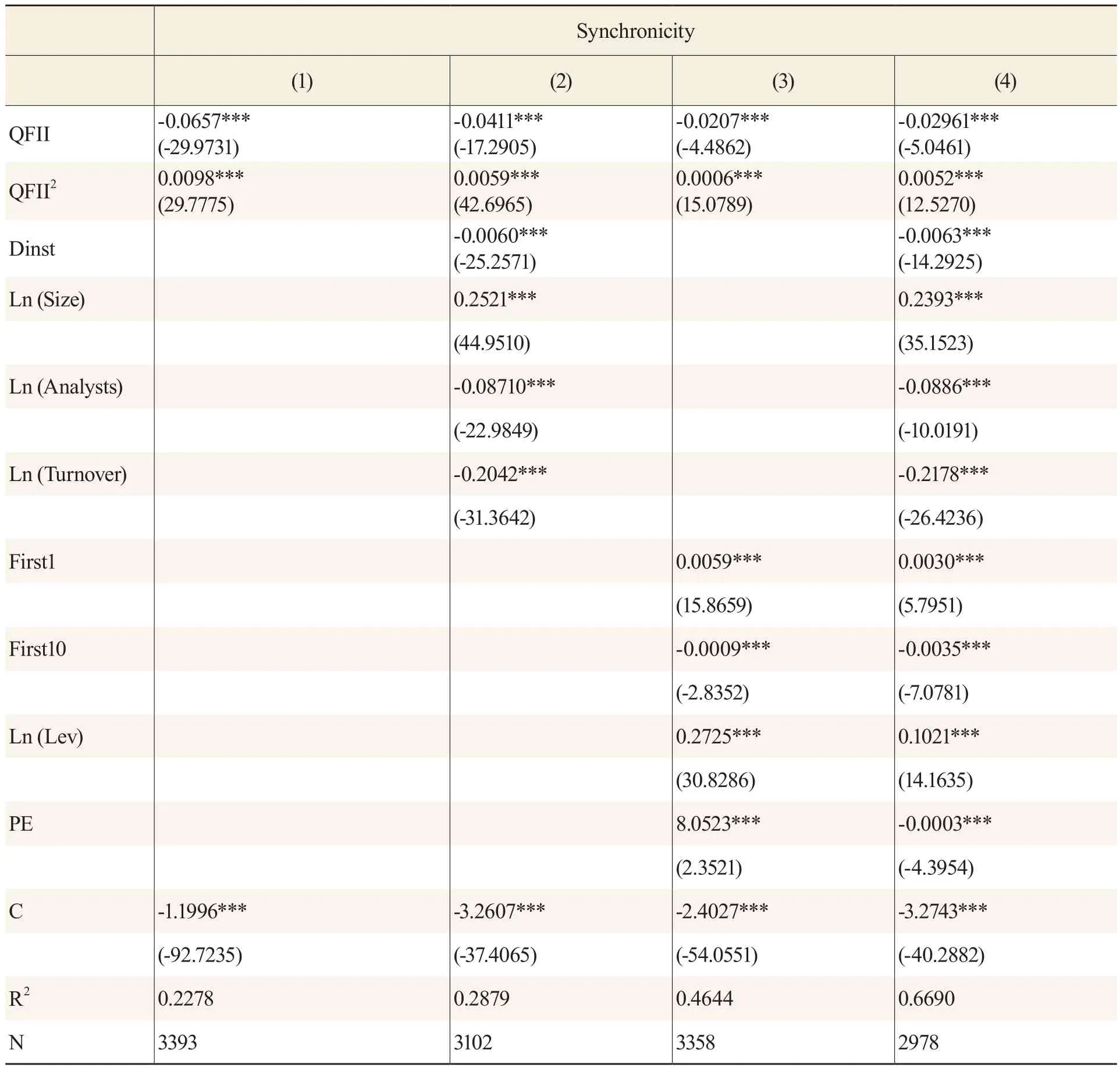

According to previous research, stock price synchronization is based on R2transformation.The index of stock price synchronization reflects the specific information content of stock, and it is a method to measure information efficiency. According to the research of Hou and Moskowitz(2005), we can construct a delay index, which is used to measure the reaction speed of stock price to information. The larger the index, the more contribution the historical information makes to the current stock price. The smaller the index is, the more the current information contributes to the stock price. The difference between delay and synchronicity is that the synchronicity of a stock price reflects the indifferent property of stocks rising and falling together. Delay reflects the reaction speed of stock prices to current market returns. The better the current market rate of return reflects the individual stock rate of return, the faster the stock responds to information. By regressing the markets returns with and without lags, we construct the delay by using the R2of different regression results. The smaller the delay value, the lower the dependence of stock returns on historical market information, and the shorter the time it takes for stock prices to absorb market information, thus the higher the information efficiency. We used “delay” to replace the interpreted variable “synchronicity” and used the mixed cross-sectional stock data to test whether the regression results were consistent to judge the robustness of the logical relationship.

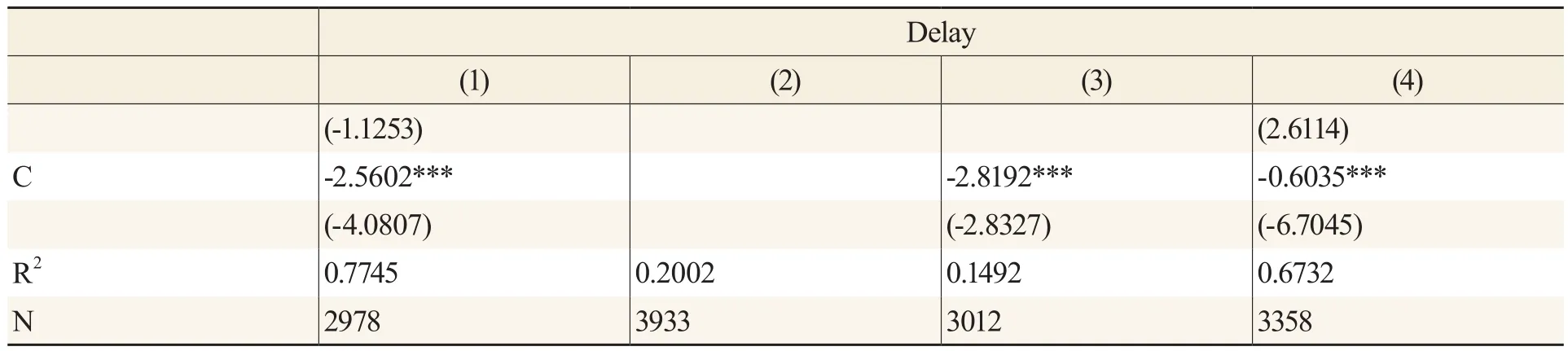

Table 10 is a regression test based on the whole sample. The interpreted variables are replaced by delay. By comparing Table 10 with Table 3, we found that QFII have a negative effect on delay in the regression of Table 10, and both are very significant. This shows that QFII’s investments reduce the delay and improve the information efficiency of the stock market. In delay’s regression of QFII square terms, the coefficients of QFII2terms are all positive, and the significance level is very significant. This indicates that the relationship between delay and QFII is not monotonous decreasing, but non-linear. When QFII’s investments increase to a certain proportion, the investment of QFII will increase delay, and the information efficiency will change from increasing to decreasing. The regression results are consistent with Table 3 after using a price hysteresis index (delay), which further verifies Hypothesis 1 and Hypothesis 2.

Table 10 Robustness Test Based on Mixed Section Data (EGLS)

Note: The values in ( ) are t-value statistics, in which “*, **, ***” represent the significant levels of 10 percent, 5 percent and 1 percent respectively.

Endogeneity Test

When investing, QFII may choose efficient industries according to the information efficiency of past stock market. The industries invested by QFII are the industries with high pricing efficiency. Foreign institutional investors prefer stocks with high transparency and information content when choosing investment targets. This may lead to endogenous problems.To overcome this endogenous problem, we used the method of metrology (Woodridge, 2006)lagged QFII’s data. We used QFII’s investments with lag periods as instrumental variables to deal with endogenous problems, and obtained consistent estimators by the two-stage least squares method. In the mixed cross-section data, we lagged the key explanatory variables for one period as instrumental variables. Using two-stage least squares method, the regression results are consistent with the previous results of non-equilibrium panel data, indicating that the model is not endogenous, and that the specific regression results are similar to the regression results of balanced panel data. Due to the limited space, the process is not detailed here.

Research Conclusion

Based on the perspective of information content and information response, this paper empirically examines the relationship between foreign institutional investors and information efficiency in China’s stock market by using QFII’s investment data. The results indicate that foreign institutional investors can reduce the synchronization of China’s stock prices and improve the information efficiency of the stock market. However, there is a non-linear relationship between foreign institutional investors and information efficiency due to adverse selection,foreign institutional investors’ concerns, and the policy risks of China’s capital markets. Empirical research shows that the impact of foreign institutional investors on the information efficiency of China’s stock market is more significant in bear markets than in bull markets, and more significant in private enterprises of SME market than in state-owned enterprises of main board market. The conclusions of this study are expected to provide enlightenment for efficiency improvements in China’s capital markets.

Contemporary Social Sciences2021年2期

Contemporary Social Sciences2021年2期

- Contemporary Social Sciences的其它文章

- Research on the Realization Mechanism of and Approach to Ecological Product Valuations

- Research on the Cultivation of the Innovative Subcenters in Sichuan Based on the Chengdu-Chongqing Economic Circle Strategic Background

- Analysis of the Focal Issues of the Implementation of the Block System Reform in China—From the Perspective of the Protection of Civil Rights

- A Comparative Study on the Buddhist and Brahmanic Conceptions of the Relationship between the Secular World and the Emancipation Realm

- The International Profile of Chinese Visiting Scholars in the UK:Improvement Needed in Linguistic,Cultural, and Academic Confidence

- Fractal Analyses Reveal the Origin of Aesthetics in Chinese Calligraphy