REAL ESTATE RUMBLING

By Xiao Xin

Updated guidance for the real estate industry seeks a delicate balance between deleverage and overcorrection as China transitions away from economic reliance on the property sector

Apartment buildings at Evergrande’s “Life in Venice” real estate and tourism development in Qidong, eastern China’s Jiangsu Province, September 21, 2021.(SHEN QILAI)

Of all the sectors capable of starting a profound domino effect that would touch the entire Chinese economy, the property market is the clearest frontrunner.For this reason, even the subtlest tweaks to real estate regulatory policies are often intensely scrutinized for possible broader economic implications.

Scouring changes in policy tone seems especially imperative in the wake of the Evergrande crisis, as a debt crunch implicating some of China’s biggest property developers is awakening homebuyers and investors to a seismic shift in the real estate sector.

At that very moment, December’s Central Economic Work Conference, known as an annual tone-setting meeting, commenced.The conference issued updated guidance for the real estate industry seeking to foster a virtuous cycle and healthy development of the property sector.It was accompanied by reiteration of a phrase first mentioned at the 2016 conference: Houses are for living in, not for speculation.

According to economists and industry watchers, the crucial update offered a glimpse into the country’s resolve to curb property speculation and escape the deleveraging conundrum.

Evergrande in the Limelight

Property heavyweight China Evergrande’s debt problems made global headlines in the second half of 2021, stirring concerns that the real estate sector, responsible for roughly a quarter of China’s GDP, could be experiencing a Lehman moment.

Within months, the Hong Kong-listed developer known for its finely decorated apartments, and Xu Jiayin, its billionaire founder, had been knocked off lofty perches.

The company had run into difficulties in paying off its bonds and wealth management products.Notably, it was stumbling through interest payments on its US dollar bonds that were considered last in line in the event of liquidation.Mounting fears among overseas investors about default on overdue interest payments fanned worries about the economy at large.

Xu hovered near the top of numerous rich lists and earned the internet nickname “belt brother” after photos of him wearing a goldbuckled Hermes belt while attending the annual Two Sessions in 2012 went viral.In stark contrast to the fanfare-filled old days, media coverage of Xu has centered on Evergrande’s debt predicament that purportedly prompted the developer tycoon to sell personal mansions in Hong Kong, fancy homes in Shenzhen and Guangzhou, and several private planes.He also took out new loans against his equity in the company as part of efforts to set Evergrande in motion again.

The Evergrande crisis exemplified many problems that have plagued other developers, especially private companies like Kaisa Group (also Hong Kong-traded), on an expansion spree over the past few years.

The emergence of debt problems and bond defaults, among other crisis-mongering phrases, has likely shaken public confidence in the seemingly everlasting bull run in China’s property market.Rising home prices, especially in bigger cities, over the past two decades have underpinned a rags-to-riches fantasy in the case of lucky early movers.This has nonetheless rendered home ownership a difficult goal for many others.

Such concerns culminated in a momentous evening in early December when the Guangdong provincial government summoned locally headquartered Evergrande after the property developer warned earlier that day in a filing with the Hong Kong stock exchange that it may fail to honor its obligations in the amount of about US$260 million.

After the news, three major financial regulators, the central bank, the banking and insurance regulator, and the securities regulator, quickly moved to reassure the markets in rare simultaneous latenight remarks that the Evergrande issue shouldn’t be a concern for the country’s capital and housing markets at large.

Despite being overshadowed by the Evergrande crisis, the principle of “houses are for living in, not for speculation”remained the cornerstone of the property portion of the Central Economic Work Conference takeaways.

Attributing Evergrande’s debt problems mainly to its poor management and blind expansion,the central bank mentioned support from relevant departments to facilitate overseas bond repurchase.

The central bank’s remarks indicated that “there has been no major deterioration in the housing market and the emergence of risks associated with certain developers can be attributed mostly to their excessive expansion,” according to the Englishlanguage daily Global Times, citing Yan Yuejin, research director at Shanghaibased E-house China R&D Institute.

Those events happened to occur only a few days before the annual economically themed conference.

Embracing Changes

For the first time, the push for “a virtuous cycle and healthy development of the property sector”was written into the annual conference takeaways, pointing to a delicate balancing act between overcorrection and deleverage.

The authorities’ resolve against speculative housing bets was to be bolstered by measures focused on long-term rental properties,affordable housing, and supporting the commercial real estate market to better meet homebuyers’ reasonable housing needs, according to a statement issued after the conclusion of the three-day Central Economic Work Conference on December 10.

In so doing, policy arrangements that vary by city were planned to support operation of a healthy property sector.

Strengthening of expectations management alongside rooting for reasonable housing needs would reduce deviations amid the real estate overhaul such as overcorrection, with efforts to satisfy first-time homebuyers and upgraders’ inelastic demands,wrote analysts from the Bank of Communications in a research note circulated following the conference.

On June 26, 2021, buyers crowd the sales office of a real estate project in Huai’an, eastern China’s Jiangsu Province, on the day it opens.(VCG)

The statement is indicative of an extension of policymaking shrewdness beyond mere property transactions,said analysts, expressing expectations for an official endorsement of residents’ inelastic demands as well as normal property development,mergers, and the resultant lending and debt issuance needs of real estate firms.

Some said the deliberately less hawkish tone indicates a pivot toward stabilization as the conference made a caveat to three major challenges facing the Chinese economy in 2022: demand contraction, supply shocks, and the weakening of expectations.

A stable property market certainly matters considerably to the economy amid continued fallout from the prolonged Covid-19 pandemic and sweeping reform moves on multiple fronts if a grand common prosperity vision is to materialize.

The late-night remarks by the three regulators gave property industry participants a sigh of relief in the form of easing of the reins on propertyrelated funding.

Further, the central bank and the banking and insurance regulator issued a notice on December 20 encouraging banks to proceed with loan services for mergers and focus on championing the acquisition of premium projects at troubled major real estate firms by select property firms.

Homebuyers suddenly found it easier to secure mortgage loans.

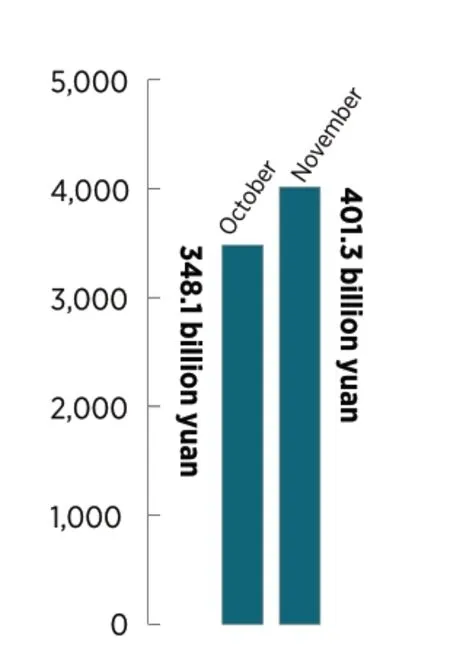

Outstanding personal housing mortgage loans rose by 401.3 billion yuan (US$63.14 billion) to 38.1 trillion yuan (US$5.99 trillion) in November of 2021, central bank data showed.The monthly addition increased by 53.2 billion yuan (US$8.36 billion) from October.The monthly data was only the second such numbers the central bank made publicly available.

Evergrande seems to have emerged from its worst low.In a post on its WeChat official account on December 26, the company disclosed that the number of projects as a percentage of its total development nationwide hit 91.7 percent after rebooting, up 40 percent from the level in early September.

Destined to Decline

Whatever preluded the finetuned policy tone and consequently revived home buying and property development activities will by no means deviate the Chinese economy from its shift away from real estate, essentially a sunset industry, as it gives way to scitech innovation-driven sectors.

A look back at the country’s property policy over the past five years since the much cited slogan “homes are built to live in, not for speculation” emerged from the annual conference in 2016 speaks volumes about an industry destined for decline.

About two months before the 2016 conference, major cities including Beijing, Shenzhen,Guangzhou, and Suzhou were selected to roll out property curbs,mainly restrictions on home purchases and mortgage loans.

The tightening trend continued into the next year when the economy revolved around two main tasks: destocking and deleveraging.As a consequence,China’s macro leverage ratio,noticeably buttressed by real estate-related leverage, fell for the first time in 2018.

Throughout 2019, real estate fine-tuning policy announcements across the country amounted to 620, a record high and up 38 percent from the 2018 level, according to Centaline Property Research Center.The property consultancy opined that the harshest of property curbs are now over and that the housing market should stabilize.

Nonetheless, the real estate sector first saw the new financing rules drafted by the central bank and the Ministry of Housing and Urban-Rural Development in August 2020.

Commonly known as the“three red lines,” the gamechanging new rules crystallized the requirements developers must meet when seeking to borrow more.

The metrics consist of three limits: a maximum 70 percent liabilities to assets ratio excluding advance proceeds, a 100 percent ceiling on net debt to equity ratio,and a minimum cash to shortterm debt ratio of one.

Outstanding personal housing mortgage loans rose by401.3 billion yuan(US$63.14 billion)to 38.1 trillion yuan(US$5.99 trillion)in November of 2021, central bank data showed.The monthly addition increased by53.2 billion yuan(US$8.36 billion)from October.

7o%

1oo%

1%

The metrics consist of three limits:a maximum70 percentliabilities to assets ratio excluding advance proceeds, a100 percentceiling on net debt to equity ratio, and a minimum cash to short-term debt ratio ofone.

Based on how many limits developers violate, they will be categorized into different groups that suggest varying caps on their debt expansion.If a developer succeeds in passing all three thresholds, it becomes eligible for a maximum 15 percent debt growth in the subsequent year.

A group of 12 property developers including Evergrande were selected to test the three red lines before the new rules went into effect industry-wide.

Moreover, at the end of 2020,the central bank and the banking and insurance regulator unveiled a regulation that caps banks’outstanding property loans as a percentage of their total loans and their outstanding mortgages versus total loans, apparently a tougher inhibitor targeting any signs of excessive real estate loans.

Guo Shuqing, chairman of the China Banking and Insurance Regulatory Commission,provided an exemplary account of the overall tough stance on the property sector in an article published in late 2020 describing real estate as the biggest “grey rhino” as measured by current financial risks, citing propertyrelated lending that represents 39 percent of bank loans in addition to bonds, equities, and trust funds that foray into the market.

Despite being overshadowed by the Evergrande crisis, the principle of “houses are for living in, not for speculation” remained the cornerstone of the property portion of the Central Economic Work Conference takeaways.

Bumpy Road Ahead

All these property deleveraging moves that somewhat settled for realitybased recalibration in property financing also served as a wakeup call for an eagerly pursued yet tough-to-reach goal: rebalancing the economy toward being techinnovation-oriented and driven by the domestic market.

For starters, a faltering recovery in domestic consumption, as evidenced by the overall weaker-thanexpected retail sales growth amid the pandemic and a flurry of antitrust moves against unchecked expansion of capital in the platform economy, the backbone of China’s digital economic prowess, complicated the rebalancing.

Secondly, housing speculation could still make an easy comeback.A typical instance was a prominent rise in home prices especially in Shanghai and Shenzhen during 2020, as buoyed by the virus-targeted monetary easing and eased restrictions on household registration in these two metropolises.

Craving for property-powered growth remains prevalent among the country’s less developed regions that have borne the brunt of lackluster housing activities in the wake of the aforementioned stringent financing curbs.

The government of Northeast China’s Heilongjiang Province posted a late-night statement on its official website on December 20 claiming that local housing authorities had hosted a propertyfocused meeting mandating a push for real estate growth to sprint at full speed.

The post had been removed from the provincial government website by the next day.

Unnerved by moderation of home prices, both first and second homes, a total of 21 cities had issued administrative mandates that cap local home price decline as of November,according to Chinese news site guancha.cn.

Evidently it may take longer than expected for China to wean off habitual reliance on the property sector.

- China Report Asean的其它文章

- RCEP: A Foothold For Southeast Asian Enterprises to Reach the World Stage

- CHINESE ECONOMIC PROSPECTS IN 2022

- SoMETHING oLD,SoMETHING NEW

- RIDING THE WAVE oF GLoBALIZATIoN China marks 20th anniversary of joining WTO

- China’s Science Fiction Industry Sets Off on Its Next Voyage

- BREAKING THE ICE