The relationship between the non-debt tax shields of Chinese listed companies in different industries and their capital structure : Based on the special capital market background of China

Xi Chen

摘要:Numerous scholars have almost universally mentioned the element of non-debt tax shields in their studies of the influences on capital structure. However, few researches have been devoted to an in-depth study on how the non-debt tax shield affects the capital structure choice of enterprises. This paper attempts to explore the relationship between the non-debt tax shield and the capital structure of enterprises in different industries under the special institutional background of China's capital market. In the construction industry, wholesale and retail trade, real estate industry, and other service industries, there is a significant negative relationship between the debt ratio and the non-debt tax shield. The impact of a non-debt tax shield on capital structure varies significantly for different industries, with the most influential industry being transportation, followed by construction and real estate. The above findings help analyze the relationship between the asset structure and the choice of financing policy of enterprises in different industries, as well as to see how enterprises in different industries, with different operational and financial risks, choose the means of tax avoidance and arrange the best capital structure from the perspective of tax avoidance from the perspective of the tax burden, which will provide a reference for further studying the financing behavior of enterprises.

關鍵詞:Non-debt tax shield? Capital structure

Contents

ABSTRACT 2

1.Introduction 4

2.Literature Review 6

3.Methodology 10

4.Empirical analysis 14

5.Conclusion 17

6.Further study 17

Reference 20

The relationship between the non-debt tax shields of Chinese listed companies in different industries and their capital structure :

Based on the special capital market background of China

1.Introduction

1.1 Background and Basic theory

In the gradual development of MM theory under the initial no-tax assumption into MM theory with taxes (both corporate and personal) and trade-off theory, the tax differential school explores the relationship between taxes and capital structure choices, which is highlighted by the tax shield effect. A tax shield is a tool or method for reducing the effect of corporate taxation, including liability and non-liability tax shields. The liability tax shield refers to the fact that interest on liabilities can be deducted from pre-tax profits and thus reduce taxable income, thus bringing value-added utility to the enterprise. On the other hand, depreciation of fixed assets, amortization of intangible assets, and long-term amortization expenses of enterprises can also be charged before tax, which has the same tax deductibility as interest on liabilities.

Numerous empirical studies have shown that there is no significant relationship between non-debt tax shields and firms' choice of financial leverage, and the study by Titman and Wessels (1998) did not find a significant relationship between non-debt tax shields and the choice of capital structure. However, most studies argue that the larger the non-debt tax shield, the less likely it is to be offset by debt, i.e., they argue that the non-debt tax shield is negatively related to capital structure, i.e., the non-debt tax shield is a substitute for debt against tax. For example, DeAngelo and Masulis (1980) argue that the larger a firm's non-debt tax shield, the less debt financing it needs. Lindenberg and Ross (1981) show that when a firm's non-debt tax shield increases, the firm's choice of debt financing decreases. Their conclusion concludes that the relationship between a firm's debt and its non-debt tax shield is negatively correlated. And in the article by Givoly and Hayn (1992), it is also mentioned that a firm's non-debt tax shield can decisively influence its choice of optimal capital structure. In addition to this, Wald (1999) also shows that there is a negative relationship between non-debt tax shield and financial leverage (debt).

In addition, some studies show that show a positive relationship between non-debt tax shield and debt. For example, Scott et al. (1977) and Moore (1986) argue that a firm with a large non-debt tax shield must have a large number of collateralizable assets that can be used as collateral or guarantees to borrow money, thus enabling the firm to finance its debt (collateralized debt is less risky than non-collateralized debt), i.e. the relationship between non-debt tax shield and leverage (capital) is positive. A study by Bradlley et al. (1984) also found a positive relationship between non-debt tax shields and financial leverage.

In general, the relationship between a firm's non-debt tax shield and its capital structure may be negative or positive, or even unrelated. However, few studies in China have been able to find relevant findings that specifically examine the impact of firms' non-debt tax shields on their capital structure, so this is a topic worth exploring.

1.2 Motivation and Research question

Due to the tax shield effect, firms should fully consider the effects of debt and non-debt tax shields when arranging their capital structure. Most of the current studies believe that tax avoidance can replace the debt tax shield, and the debt tax shield is negatively related to the capital structure of the firm, that is, the firm's leverage is low, and less research on the direct relationship between tax avoidance and non-debt tax shield. Bradley et al. (1984) study show that the financial leverage of the firm is positively related to the non-debt tax shield. Thus, tax avoidance can substitute for debt tax shields, proving that non-debt tax shields can be an important factor in influencing the capital structure and have the same tax deductibility as debt interest. Although many scholars almost always mention the factor of non-debt tax shields when studying the factors that influence capital structure. However, there is little literature devoted to delving into how non-debt tax shields affect capital structure choices. This paper attempts to explore the relationship between the non-debt tax shield and the capital structure of Chinese firms in different industries from that perspective, taking into account China's special capital market background.

One point we still need to consider, however, is that even if we know the impact and utility of a firm's non-debt tax shield on the use of its debt, we may not be able to directly determine the role of financial leverage. An increase in the leverage ratio (LEV) also increases the likelihood of a firm's bankruptcy by not taking into account the cost of bankruptcy, thereby reducing the value of the firm. For example, if a firm of a certain size is assumed to increase its equity or its retained surplus as its debt level decreases. When the non-debt tax shield changes due to changes in size, equity, retained earnings, or leverage, it increases the probability of financial distress. Faced with this situation, a firm will most likely sell its collateralized assets to reduce its non-debt tax shield and reduce its risk of bankruptcy. At such times, although the firm's debt is reduced, it may become smaller and there is no certainty that its leverage will increase or decrease.

According to the pecking order principle proposed by the American economist Mayer, companies should discharge their optimal choices in the following order when choosing financing means: the first consideration is in-source financing, then external financing, then indirect financing, the fourth consideration is direct financing, the fifth should choose bond financing, and the last is the use of stock financing means. Specifically, in-source financing is chosen first among in-source and exogenous financing, then indirect financing is preferred among direct and indirect financing among exogenous financing, and, finally bond financing among direct financing and equity financing are preferred among bond financing and equity financing. In general, the order of corporate financing should be to consider long-term capital needs, and short-term needs will inevitably be met by internal funds, short-term bank loans, or accounts receivable and payable. However, the preference of corporate financing order in China is contrary to the pecking order theory, where companies prefer equity financing, followed by debt financing, and finally their funds. Huang and Zhang (2011) find that Chinese listed companies' preference for equity financing is important because the cost of equity financing is much lower than that of debt financing, and can even be traced back to China's current financial system and policies. This strong preference for equity financing has a negative impact on firms' capital structure, their growth and their corporate governance. First, under China's current IPO, debt issuance, and banking systems, the unit cost of equity financing is lower than that of borrowing and bank borrowing; second, China's listed companies have not yet adopted the registration system and the number of transactions is limited under the approval system. In the case of arbitrage, the company is not required to have a high enough dividend yield and bears much lower costs than interest-bearing capital.

2.2 Overview of foreign research

Numerous empirical studies have shown that there is no significant relationship between the non-debt tax shield and the choice of corporate financial leverage. The study by Titman and Wessels (1998) also did not find a significant relationship between non-debt tax shield on the choice of capital structure.

However, most studies argue that the larger the non-debt tax shield, the less likely it is to use liabilities to offset taxes, i.e., they argue that the non-debt tax shield is negatively related to capital structure, i.e., the non-debt tax shield is a substitute for liabilities to offset taxes.

DeAngelo and Masulis (1980) argue that the cost of financial distress affects a firm's capital structure, and he compares the firm's non-debt tax shield with the capital structure of different firms over the same period, showing that the non-debt tax shield acts to weaken the tax advantage of debt interest payments, i.e., debt interest can be replaced with depreciation, investment tax credits, and tax loss deferral, effectively function as a corporate tax credit. This result of their research overturns previous theories that capital structure is irrelevant. Specifically, at a given level of debt, the corporate tax shield has become completely ineffective even if the firm is not insolvent so that the supply curve of debt is no longer as elastic as the MM theory describes, within a manageable level of debt. Since the marginal tax shield returns are no longer constant, they are no longer equal to the statutory tax rate. As the level of debt increases, the marginal tax shield returns decrease, leading to the existence of the only optimal capital structure for the firm. It can be argued that the more non-debt tax shields a firm has, the less debt financing it needs.

Lindenberg and Ross (1981) shows that when a firm's non-debt tax shield increases, the firm's choice of debt financing decreases. This is because when a firm's debt increases, it faces an increased risk of bankruptcy, and to reduce the risk, it may choose to increase its non-debt tax shield, thereby reducing its corporate interest tax. And when a firm has low leverage, the marginal income side of its debt is positive; as the cost of bankruptcy increases, the firm's leverage also increases and its marginal tax shield effect is negative, which is a clear indication that the relationship between a firm's debt and its non-debt tax shield is negatively correlated.

And in the article by Givoly and Hayn (1992) also mentioned that the non-debt tax shield of a firm can decisively influence its choice of optimal capital structure. Beyond that, Wald (1999) also shows a negative relationship between the non-debt tax shield and financial leverage (debt).

Furthermore, there are also studies that show a positive relationship between the non-debt tax shield and debt. For example, Scott et al. (1977) and Jensen (1986) argue that a firm with a significant amount of non-debt tax shields must have a significant amount of collateralizable assets that can be used to borrow money as collateral or security so that the firm can finance its debt (collateralized debt is less risky than non-collateralized debt), i.e., the relationship between non-debt tax shields and leverage (capital) is positive. A study by Bradlley et al. (1984) also found a positive relationship between non-debt tax shield and financial leverage.

2.3 Overview of China research

Most studies in China only consider the non-debt tax shield as one of the factors affecting the capital structure. In Feng et al.'s (2000) study, they selected financial data of listed companies before 1996 for correlation analysis, where they concluded that firms with lower effective tax burden generally prefer equity financing, and mentioned that non-debt tax shield is positively correlated with the debt ratio of firms. In Xiao and Wu's (2002) study on the influencing factors of capital structure, they selected 117 companies listed in Shenzhen from 1996 to 1998 and concluded that the non-debt tax shield is negatively related to the debt level through regression analysis. However, in another study by Xiao (2004), he found that the non-debt tax shield seems to be positive but not significantly related to financial leverage. Using a different sample, the opposite conclusion was reached, which he suggests may be because depreciation expense may have other proxies in addition to the non-debt tax shield, making the positive and negative effects of depreciation expense on leverage cancel each other out. Jia and Peng (2007) analyze panel data from 30 listed companies in China's power sector from 2003 to 2007. They found that the three factors of non-debt tax shield, cost of capital, and current ratio are negatively related to the capital structure of the firms. Hu and Huang (2006) used stepwise regression to analyze the data of non-financial A-share companies, and they found that the non-debt tax shield is significantly negatively related to the balance sheet and current ratio.

2.4 Research hypothesis and Industry selection

2.4.1 The relationship between tax avoidance and capital structure: an analysis from the perspective of non-debt tax shields

In summary, the relationship between non-debt tax shields and capital structure can be positive, negative, or even uncorrelated. Like different industries, different sizes, as well as different growth and profitability of firms, will show different states when it comes to financing options and capital structure arrangements. Therefore the first research hypothesis of this paper is:

Hypothesis 1 (H1): There is a correlation between the capital structure and the non-debt tax shield of Chinese listed companies in different industries.

According to the aforementioned DeAngelo and Masulis (1980), firms can use some non-debt items such as depreciation, tax credits, and pensions to offset the firm's tax expense. Since firms substitute between tax shields and debt interest relief and their capital structure decreases as non-debt tax shields increase, firms with more non-debt tax shields are likely to have less debt, i.e., non-debt tax shields are negatively related to the firm's debt ratio. So the second research hypothesis proposed in this paper is:

Hypothesis 2 (H2): there is a negative relationship between the capital structure and non-debt tax shields of Chinese listed companies in different industries and tax avoidance has a substitution effect on debt tax shields, i.e., non-debt tax shields are negatively correlated with leverage.

2.4.2 Study the selection of specific industries

There are not many known studies in China that mention the relationship between industry-specific and firm-specific non-debt tax shields and the impact of their capital structure. Jia and Peng (2007) found that the non-debt tax shields of Chinese firms in the power industry are significantly negatively related to their capital structure when studying the factors influencing the capital structure of the Chinese power industry. They argue that it is because Chinese listed companies in the power industry are generally larger, so their fixed assets such as power equipment depreciate faster and their non-debt tax shields have a strong tax avoidance effect. Firms with such characteristics are less likely to use debt to avoid taxes. But other than that, Chinese researchers are not conducting such studies on specific sectors anymore.

Since this paper is an attempt to empirically study the factors influencing the capital structure of listed companies in different industries based on existing studies at home and abroad, it excludes the power industry. Therefore, excluding the power industry, this paper considers the following sectors for the study.

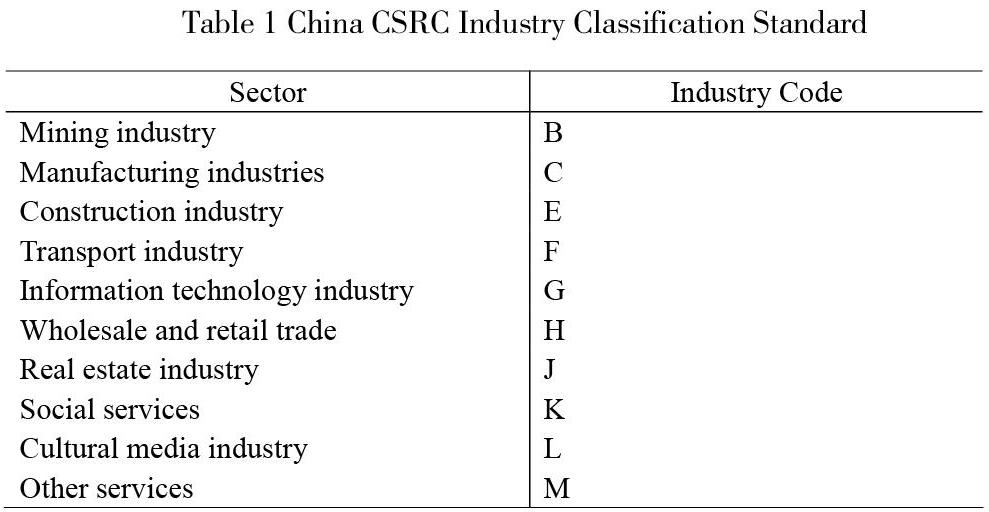

Table 1 China CSRC Industry Classification Standard

3.Methodology

3.1 Selection of models

In this paper, the relationship between capital structure and non-debt tax shield is tested using a mixed OLS approach, based on a multiple linear regression model.

3.2 Sample selection and data sources

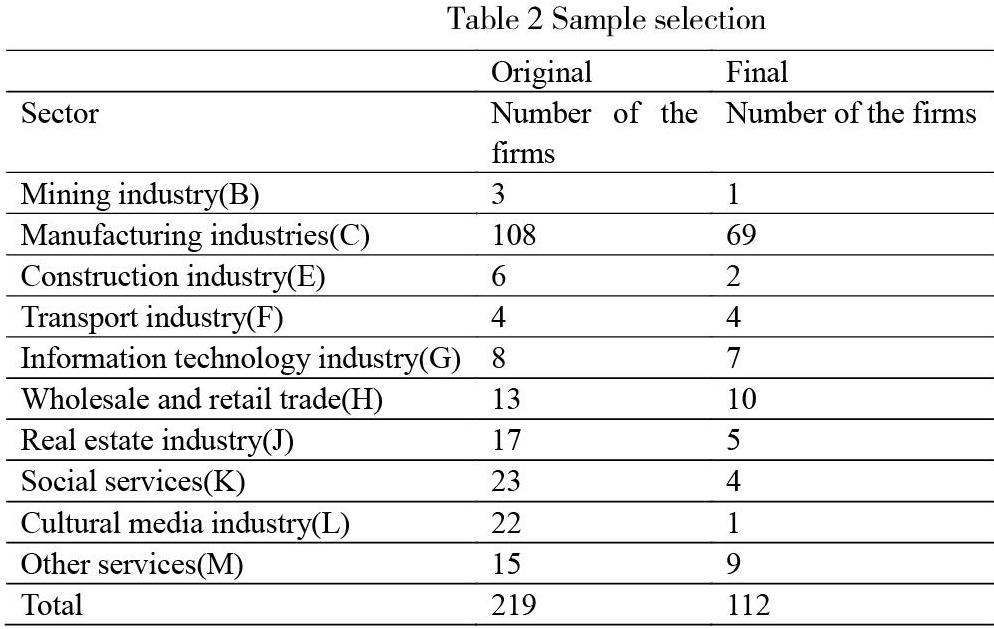

The randomly selected sample for this empirical study is the unbalanced panel data of these ten types of listed companies in China from 2006 to 2011 as the sample observations for the empirical study, and the data are processed to exclude the ST, PT listed companies and financial listed companies with incomplete financial data. For the time being, the nominal tax rate (25%) given by the government is selected, and all data come from Datastream and related websites of the Shenzhen Stock Exchange and Shanghai Stock Exchange, and we processed and analyzed by Eviews (11th edition).

Table 2 Sample selection

3.3 Variable analysis

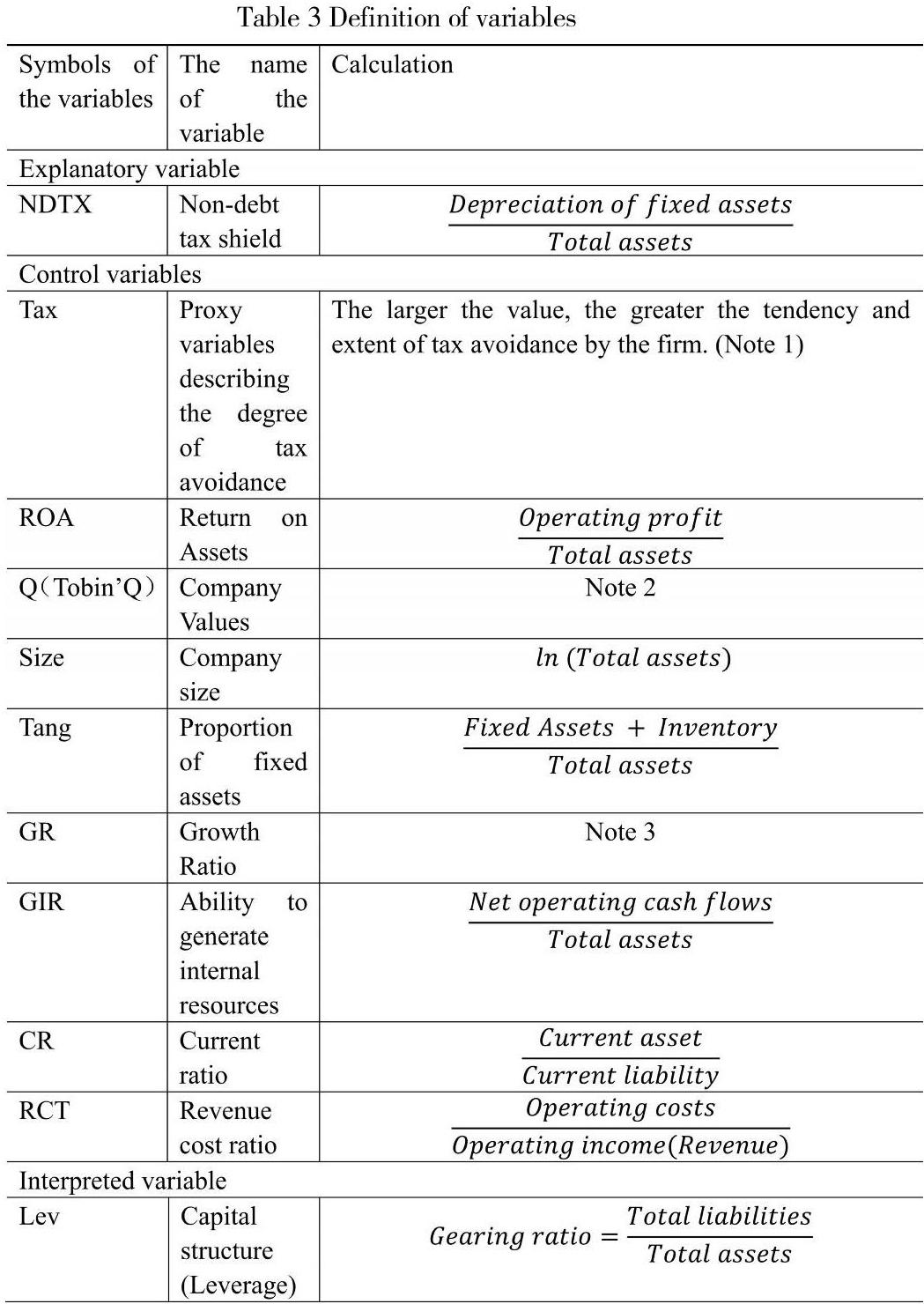

This paper investigates the impact of the non-debt tax shield on the capital structure of listed companies in different industries in China, hence the explained variable in this paper is the capital structure of the firm. According to Rajan and Zingales (1995), the definition of the capital structure depends on the objective of the study, and the most common one in the above empirical analysis is the gearing ratio (LEV) as a proxy variable for capital structure, hence this measure is also chosen.

And the main explanatory variable is the non-debt tax shield (NDTX), which is a measure of the ratio of depreciation expense to total assets.

In addition, based on the aforementioned theoretical analysis and as well as the findings of other researchers, this paper also selects eight control variables to control the effect of other factors on capital structure, which are Tax(expected sign-), ROA (+/-), Q (-), Size (+ /-), Tang(+), GR(+/-), GIR(+/-), CR(+/-), and RCT(-), while we also define time dummy variables to control for yearly differences in macro factors. The proxy variables for all factors and their definitions are shown in Table 3.

Table 3 Definition of variables

Note1: The treatment of the measure of the degree of tax avoidance in this paper is based on reference to Kim et al. (2011), where the book profit of the firm is chosen instead of the actual profit. In order to eliminate the effect of the management part of the firm's surplus, it was finally decided to measure the degree of tax avoidance (Tax) by using the accounting tax difference that eliminates the effect of accrued profits. Thus, the formula is as follows:

5.Conclusion

This paper analyzes whether there are significant differences in the relationship between the capital structure and non-debt tax shield of listed companies in different industries in China, and finds that there are differences in the correlation between the capital structure and non-debt tax shield of listed companies in different industries in China, and there is a significant negative relationship between the debt ratio and non-debt tax shield in construction, wholesale and retail trade, real estate and other service industries. In construction, wholesale and retail trade, real estate and other service industries, there is a significant negative relationship between the debt ratio and the non-debt tax shield. The impact of the non-debt tax shield on the capital structure varies significantly for different industries, with the most influential industry being transportation, followed by construction and real estate.

As for this result, this paper suggests that this is due to the fact that China is in a transitional economic period and there is a general preference for equity financing among Chinese listed companies, and studies have found that there is a "reverse pecking order" among most Chinese listed companies. In other words, equity financing is preferred, followed by debt financing. In these industries, the size of fixed assets is relatively smaller than that of non-fixed assets, so the level of non-debt tax shield is relatively low and the level of business risk is also relatively not high, making it easy to obtain debt financing such as loans. Specifically, before China's equity split reform, some large SOEs with large fixed assets and a large proportion of state-owned shares, such as the transportation industry (especially the railway industry), had a large proportion of fixed assets and almost all of them were invested by the state, so their state-owned capital accounted for a large proportion and their debt ratio was low. Tax avoidance effect. In the construction and real estate industries, the proportion of fixed assets is small compared to non-fixed assets, but most of the funds required for their construction as well as large-scale inventories are obtained through debt financing, so the debt ratio is higher and the tax-avoidance effect of the debt shield is stronger.

6.Further study

However, there are still several important issues that have not been fully addressed in empirical research. Graham and Mills (2008) have suggested that factor analysis of corporate tax avoidance is an important issue at the third level of financial management, and that income tax factors are not delineated and measured. Most firms' capital structure decisions rely to some extent on using financial data as the empirical basis for calculating the marginal tax benefits of corporate income tax. However, there are some drawbacks to this model in that using financial statements alone as the basis for tax analysis may not fully reflect the tax factors that affect a firm's capital structure. For example, when firms prepare financial statements for a particular user, they structure the information appropriately and may omit some important measurement information. This is one of the issues that will be considered and attempted to be addressed in this paper.

Also, the empirical research process only examines 10 indicators such as the non-debt tax shield without also considering the possible impact of macro factors such as national laws and regulations, interest rates, inflation, and market competition on the capital structure of the companies. At the same time, we selected only 112 sample companies, which may not reflect the capital structure status of all listed companies, which is a further issue for the median value of the follow-up study.

Furthermore, we found that "Tax and agency conflict" is a new perspective on tax avoidance that has been proposed and studied by foreign scholars in recent years. Slemrod (2004) points out that principal-agent relationships can lead to non-tax costs that firms face in tax avoidance. One such scenario is that tax avoidance makes the tax burden lower and the firm's cash flow higher, and when ownership and control of the firm are separated, tax avoidance activities promote managerial opportunism, such as surplus manipulation and blatant transfers of resources. These opaque transactions provide opportunities for corporate management to make speculative management decisions, hence the loss of efficiency resulting from the agency problems generated by such tax avoidance. Since agency problems and corporate governance can have an important impact on corporate tax avoidance, which in turn may affect the capital structure of the firm, the subsequent study may consider introducing corporate governance as a factor to examine in depth its impact on the relationship between corporate tax avoidance and capital.

It is based on the following three hypotheses that are currently expected in the follow-up study, as mentioned in 19ECP311.

1. Management shareholding has a positive moderating effect on the effect of tax avoidance on the capital structure.

2. Larger independent boards of directors play a negative moderating role in the relationship between tax avoidance and capital structure.

3. The worse corporate governance in China negatively moderates the relationship between tax avoidance and firm value.

It is hoped that the results of the in-depth study will help Chinese firms to better choose their optimal capital structure.

At the end of the article, I would like to express my deepest gratitude to Dr. Simeon Coleman and Dr. Vitor Castro for their constant encouragement and guidance, who have accompanied me through all the stages of writing this thesis and have given me a lot of very helpful advice. Thank you to them for being there for me along the way.

Reference

[1]Allingham, M. G., & Sandmo, A. (1972). Income tax evasion: A theoretical analysis. Journal of public economics, 1(3-4), 323-338.

[2]Bradley, M., Jarrell, G. A., & Kim, E. H. (1984). On the existence of an optimal capital structure: Theory and evidence. The journal of Finance, 39(3), 857-878.

[3]Crocker, K. J., & Slemrod, J. (2005). Corporate tax evasion with agency costs. Journal of Public Economics, 89(9-10), 1593-1610.

[4]DeANGELO, H., & Masulis, R. W. (1980). Optimal Capital Structure under Corporate and Person Taxation. Journal of Financial Economics, 2, 38-53.

[5]De Jong, A., Kabir, R., & Nguyen, T. T. (2008). Capital structure around the world: The roles of firm-and country-specific determinants. Journal of Banking & Finance, 32(9), 1954-1969.

[6]Givoly, D., Hayn, C., Ofer, A. R., & Sarig, O. (1992). Taxes and capital structure: Evidence from firms response to the Tax Reform Act of 1986. The Review of Financial Studies, 5(2), 331-355.

[7]Graham, J. R., & Mills, L. F. (2008). Using tax return data to simulate corporate marginal tax rates. Journal of Accounting and Economics, 46(2-3), 366-388.

[8]Harris, M., & Raviv, A. (1990). Capital structure and the informational role of debt. The Journal of Finance, 45(2), 321-349.

[9]Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of financial economics, 3(4), 305-360.

[10]Jensen, M. C. (1986). Agency costs of free cash flow, corporate finance, and takeovers. The American economic review, 76(2), 323-329.

[11]Kim, J. B., Li, O. Z., & Li, Y. (2010). Corporate tax avoidance and bank loan contracting. Available at SSRN 1596209.

[12]Kim, J. B., Li, Y., & Zhang, L. (2011). Corporate tax avoidance and stock price crash risk: Firm-level analysis. Journal of Financial Economics, 100(3), 639-662.

[13]Kraus, A., & Litzenberger, R. H. (1973). A state-preference model of optimal financial leverage. The journal of finance, 28(4), 911-922.

[14]Krishnaswamy, C. R., Mangla, I., & Rathinasamy, R. S. (1992). An empirical analysis of the relationship between financial structure and market structure. Journal of Financial and Strategic Decisions, 5(3), 75-88.

[15]Lindenberg, E. B., & Ross, S. A. (1981). Tobin's q ratio and industrial organization. Journal of business, 1-32.

[16]Modigliani, F., & Miller, M. (1958). The cost of capital, corporation finance and the theory of finance. American Economic Review, 48(3), 291-297.

[17]Modigliani, F., & Miller, M. H. (1963). Corporate income taxes and the cost of capital: a correction. The American economic review, 433-443.

[18]Myers, S. C. (1984). The capital structure puzzle. The journal of finance, 39(3), 574-592.

[19]Rajan, R. G., & Zingales, L. (1995). What do we know about capital structure? Some evidence from international data. The journal of Finance, 50(5), 1421-1460.

[20]Robichek, A. A., & Myers, S. C. (1966). Problems in the theory of optimal capital structure. Journal of Financial and Quantitative Analysis, 1(2), 1-35.

[21]Rubinstein, M. E. (1973). A mean-variance synthesis of corporate financial theory. The Journal of Finance, 28(1), 167-181.

[22]Rubinstein, M. E. (1973). A comparative statics analysis of risk premiums. The Journal of Business, 46(4), 605-615.

[23]Scott, J. H. (1977). Bankruptcy, secured debt, and optimal capital structure. The journal of finance, 32(1), 1-19.

[24]Slemrod, J. (2004). The economics of corporate tax selfishness (No. w10858). National bureau of economic research.

[25]Titman, S., & Wessels, R. (1988). The determinants of capital structure choice. The Journal of finance, 43(1), 1-19.

[26]Wald, J. K. (1999). How firm characteristics affect capital structure: an international comparison. Journal of Financial research, 22(2), 161-187.

[27]Wernerfelt, B., & Montgomery, C. A. (1988). Tobin's q and the importance of focus in firm performance. The American Economic Review, 246-250.

[28]陳冬, & 羅祎. (2015). 公司避稅影響審計定價嗎?. 經(jīng)濟管理, (3), 98-109.

[29]郭鵬飛, & 孫培源. (2003). 資本結構的行業(yè)特征:基于中國上市公司的實證研究. 經(jīng)濟研究(5), 66-73.

[30]黃輝, & 王志華. (2006). 資本結構行業(yè)差異及其影響因素的實證分析——來自我國上市公司的經(jīng)驗數(shù)據(jù). 財經(jīng)理論與實踐, 27(1), 67-72.

[31]黃少安, & 張崗. (2001). 中國上市公司股權融資偏好分析. 經(jīng)濟研究(11), 12-20+27.

[32]陸正飛, & 辛宇. (1998). 上市公司資本結構主要影響因素之實證研究. 會計研究(08), 34-37.

[33]李新春, 楊學儒, 姜岳新, & 胡曉紅. (1994). 內(nèi)部人所有權與企業(yè)價值 3.

[34]肖作平, 吳世農(nóng). 我國上市公司資本結構影響因素實證研究[J]. 證券市場導報, 2002(08):39-44.

[35]肖作平. (2004). 資本結構影響因素和雙向效應動態(tài)模型——來自中國上市公司面板數(shù)據(jù)的證據(jù). 會計研究, 000(002), 98-103.

[36]周軍. (2004). 我國上市公司資本結構行業(yè)特征的實證研究. (Doctoral dissertation, 復旦大學).